Inflation, deflation, gold and currencies

Re: Inflation, deflation, gold and currencies

An interesting what if - regarding gold confiscation.

"Guest Post: Don’t Dismiss The Possibility Of Gold Confiscation"

http://www.zerohedge.com/news/2013-06-0 ... nfiscation

Hmmmm --Owning precious metals may not be wise.

"Guest Post: Don’t Dismiss The Possibility Of Gold Confiscation"

http://www.zerohedge.com/news/2013-06-0 ... nfiscation

Hmmmm --Owning precious metals may not be wise.

Re: Inflation, deflation, gold and currencies

Going from 2.3% increase in 10 days to 4.1% increase in 10 days really looks like they are losing control. At some point I expect a snowball/panic/rush/crash/positive-feedback loop as people get out of bonds and the central bank monetizes faster and faster. This could be the start of it. So this could be the real start of the hyperinflation feedback loops. After studying hyperinflation for years it is fascinating to be watching this unfold in Japan in real time. Can hardly wait for the next report. It is scheduled for Wed June 12th.vincecate wrote:From May 10 to May 20 the Bank of Japan increased the base money supply by 2.3%. From Apr 10 to May 20 they have increased by about 9%. My guess is that it is at a faster rate since then as the have been fighting hard to "reduce the volatility". Even without any help from increased velocity of money or reducing GNP this is fast enough to get hyperinflation in the Yen. But these other things will help too. Also, this is headed for a panic/avalanche/death-spiral, so you should expect it to speed up, not slow down.

http://www.bloomberg.com/quote/BJACTOTL:IND

Update: I ended up making a blog post from this post. http://howfiatdies.blogspot.com/2013/05 ... ng-at.html

http://www.boj.or.jp/en/announcements/c ... index.htm/

Re: Inflation, deflation, gold and currencies

a clever move --

ISIS Unveils Its New Gold-Backed Currency To Remove Itself From "The Oppressors' Money System"

http://www.zerohedge.com/news/2014-11-1 ... ney-system

"It seems Alan Greenspan may have been on to something after all...

"Remember

what we're looking at. Gold is a currency. It is still, by all

evidence, a premier currency. No fiat currency, including the dollar,

can match it."

--------------------------------------

So as fiat currencies lose value a terrorist currency does not?

Implying that a terrorist money has intrinsic value and the fiat of legitimate governments do not? -- Oh nice --- sarcasm

It looks like bankers and governments better start rethinking what they are doing. For they are helping to legitimize the terrorists.

------------------------------------------

from the comment section ---

Greenskeeper_Carl

great. how long do we have to wait for statements like "only terrorists buy or use gold and silver coins" or "only terrorists question the validity of the US dollar"

its only a matter of time, mark my words

------

LetThemEatRand

Or even more devious, "we must stamp out the use of gold and silver as currency in order to stamp out terrorists.

ISIS Unveils Its New Gold-Backed Currency To Remove Itself From "The Oppressors' Money System"

http://www.zerohedge.com/news/2014-11-1 ... ney-system

"It seems Alan Greenspan may have been on to something after all...

"Remember

what we're looking at. Gold is a currency. It is still, by all

evidence, a premier currency. No fiat currency, including the dollar,

can match it."

--------------------------------------

So as fiat currencies lose value a terrorist currency does not?

Implying that a terrorist money has intrinsic value and the fiat of legitimate governments do not? -- Oh nice --- sarcasm

It looks like bankers and governments better start rethinking what they are doing. For they are helping to legitimize the terrorists.

------------------------------------------

from the comment section ---

Greenskeeper_Carl

great. how long do we have to wait for statements like "only terrorists buy or use gold and silver coins" or "only terrorists question the validity of the US dollar"

its only a matter of time, mark my words

------

LetThemEatRand

Or even more devious, "we must stamp out the use of gold and silver as currency in order to stamp out terrorists.

Re: Inflation, deflation, gold and currencies

One of the interesting gold price forecasts suggesting bullish outlook on gold ahead. http://www.profitconfidential.com/gold/ ... -for-2015/

Re: Inflation, deflation, gold and currencies

Well i am turning 20 over these weekend and i am looking forward to invest in stock market and commodities and by saying commodities i mean gold and silver. I am huge fan of gold and would love to invest in gold. But actually when i did a bit of research i didn't find any ways how to invest in gold and after continuing my research for a while i came around a wonderful article which completely defines the ways to invest in gold but the content of that article was to difficult to handle for me and it hardly helped me!! ??? ??? ???

All that content was GOLD ETF , Physical Gold and some thing!!!!

Please help me out???

All that content was GOLD ETF , Physical Gold and some thing!!!!

Please help me out???

Re: Inflation, deflation, gold and currencies

Friends and family of moral agency is your issue. The best truth is spot price and the local pawn shop since colors talk only. Human habitation in the area now known as Venezuela from about 15,000 years ago points out if you plan to stay and survive what store of value lingers? That region has influences which in truth is a ancient evil upon them. Truly it evil past your ability to fathom for now we have seen before. Buy some intrinsic value. Mine is silver if I must move. Never surrender your weapon, it is death if you do.

https://www.youtube.com/watch?v=9Ll3TaVmIfk

Government forces (i.e. death squads) in Venezuela are summarily executing its citizens from motorcycles. Authorities are also breaking down doors of apartment buildings and murdering “suspected” protesters. Protesters are being murdered by the Venezuelan government without trial all across the country.

Some citizens, who are luckier than most are simply being arrested for “suspicion” of protest. In a classic case, government opposition leader, Leopoldo Lopez, surrendered to authorities. He is charged with inciting violence and opposition to the government. His arrest led to even more protesting. Venezuelan citizen, Gauber Venot, stated “It’s important we have foreign media here. Our media is censored; we learn about our own country from outside sources.” So is ours Mr. Venot, so is ours.

Of course, this is Venezuela and this could never happen in America. Of course, these same people who deny that this could ever happen here, have never heard of the NDAA. Also, one might want to revise their skepticism that this could ever happen here in light of released American military documents.

Name 10 people you know who seen this coming in Venezuela.

Venezuela's most significant natural resources are petroleum and natural gas, iron ore, gold, and other minerals. It also has large areas of arable land and water.

https://www.youtube.com/watch?v=9Ll3TaVmIfk

Government forces (i.e. death squads) in Venezuela are summarily executing its citizens from motorcycles. Authorities are also breaking down doors of apartment buildings and murdering “suspected” protesters. Protesters are being murdered by the Venezuelan government without trial all across the country.

Some citizens, who are luckier than most are simply being arrested for “suspicion” of protest. In a classic case, government opposition leader, Leopoldo Lopez, surrendered to authorities. He is charged with inciting violence and opposition to the government. His arrest led to even more protesting. Venezuelan citizen, Gauber Venot, stated “It’s important we have foreign media here. Our media is censored; we learn about our own country from outside sources.” So is ours Mr. Venot, so is ours.

Of course, this is Venezuela and this could never happen in America. Of course, these same people who deny that this could ever happen here, have never heard of the NDAA. Also, one might want to revise their skepticism that this could ever happen here in light of released American military documents.

Name 10 people you know who seen this coming in Venezuela.

Venezuela's most significant natural resources are petroleum and natural gas, iron ore, gold, and other minerals. It also has large areas of arable land and water.

Re: Inflation, deflation, gold and currencies

As I've written many times in the past (though not recently),Centaura wrote: > Well i am turning 20 over these weekend and i am looking forward

> to invest in stock market and commodities and by saying

> commodities i mean gold and silver. I am huge fan of gold and

> would love to invest in gold. But actually when i did a bit of

> research i didn't find any ways how to invest in gold and after

> continuing my research for a while i came around a wonderful

> article which completely defines the

> ways

> to invest in gold but the content of that article was to

> difficult to handle for me and it hardly helped me!! ??? ??? ???

> All that content was GOLD ETF , Physical Gold and some thing!!!!

> Please help me out???

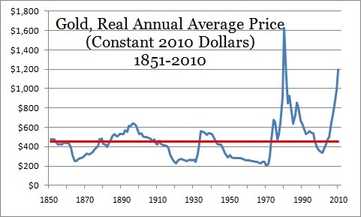

gold is in a bubble, just like the stock market. The long-term

trend value of gold is around $500 per oz. When the bubble

bursts, the price will overshoot and fall to the $200-300 range,

which is where it was around 2000.

Here's an article I wrote in 2011:

** 28-Jul-11 News -- Washington follows Brussels in fraud and extortion

** http://www.generationaldynamics.com/pg/ ... m#e110728b

Happy birthday!

Re: Inflation, deflation, gold and currencies

For a couple hundred years gold was about $20/oz, so that is the real long term trend line. However, it will not go back to that and probably not even $500. The reason is they keep printing more and more dollars out of thin air and nobody can print gold out of thin air.John wrote: The long-term trend value of gold is around $500 per oz.

The biggest bubble right now is in government bonds. When 20 years from now we talk to our grand kids they will say, "but there were negative interest rates on bonds, how could people not see that bond prices were a bubble?". Or maybe, "central banks printed trillions of dollars to buy up bonds and drive the prices up, why was it not obvious they were a bubble?". As people start to realize bond prices are too high and get out the central banks will print money even faster to buy up the bonds. When currencies start to go there will be a real panic out of bonds and central banks will print crazy fast. This will make people rush to sell their bonds even faster and so central banks will print even faster, etc. There will be a death spiral or positive feedback loop. Paper money will go down. Can't say when and how far but gold has a safety that no paper money has. Gold is very different from Monopoly money and the various paper money really is not so different.

- Tom Mazanec

- Posts: 4181

- Joined: Sun Sep 21, 2008 12:13 pm

Re: Inflation, deflation, gold and currencies

Inflation 160% since 2001 on "Burrito Index" http://www.zerohedge.com/news/2016-08-0 ... d-160-2001

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.”

― G. Michael Hopf, Those Who Remain

― G. Michael Hopf, Those Who Remain

Who is online

Users browsing this forum: Majestic-12 [Bot] and 128 guests