So why can't things just stay about the same, in a "trading range," as they say?Higgenbotham wrote:"You have trillions of dollars on the sidelines," This means there are trillions of dollars in cash such as CDs, money market funds, etc., that are theoretically available to invest in stocks.

"and money managers only have a couple hundred million dollars left," This means mutual fund money managers only have about $200 billion (I think he means, not million) in cash available to put into stocks. This is a very small amount.

"so something has to break soon." This means if the money doesn't start moving off the sidelines and into stocks...

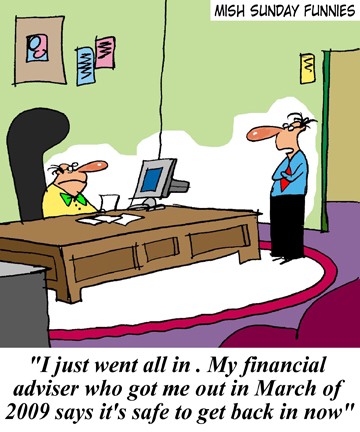

Same thing we've been talking about for 2 weeks here. Wall Street is trying to suck the public back in (Barton Biggs, etc.) so they can dump their stocks off on them, but the public is not in any mood to get screwed for a third time. If the public is smart enough this time to leave Wall Street holding the bag, the thieves will look to the left and look to the right and then they will panic.

And like you said, the shorts that are left aren't budging.

Why does anything have to break at all?

John