|

|

|

Bubbles and Global Financial Crisis - 1995-Present

|

Tech bubble |

|

Real estate and credit bubbles |

|

Financial crisis |

|

Eurozone deterioration |

|

Price/Earnings ratios |

|

|

|

|

The Tech Bubble of the late 1990s

|

Tech bubble began in 1995 |

|

- |

Why did it occur at all? |

|

- |

Why did it occur then - vs. 1985 or 2005? |

|

- |

International real estate bubble also began in 1995 |

|

- |

Economists have no explanation |

|

- |

Blaming Greenspan/2003 is not credible |

|

Mainstream economists can't explain anything since 1995 |

|

- |

Can't explain tech bubble |

|

- |

Can't explain real estate bubble |

|

- |

Can't explain credit bubble |

|

- |

Didn't foresee the financial crisis |

|

- |

Didn't foresee where we are today |

|

- |

Have no idea what's going to happen next |

|

Pending crises |

|

- |

Europe: Greece, Ireland, Portugal, Spain, Italy, Belgium |

|

- |

China: Massive real estate bubble about to pop |

|

- |

U.S.: Federal, state debt. Pensions bankrupt. |

|

|

|

|

Price/Earnings ratios

|

|

S&P 500 Price/Earnings Ratio (P/E1) 1871 to August 2010

|

|

Price/Earnings ratios |

|

- |

Stock price / last 12 months' reported earnings |

|

- |

Well above average (13.91) since 1995 |

|

- |

WSJ: Current (5/20/2001) S&P 500 P/E ratio: 16.58 |

|

- |

Apply the Law of Mean Reversion |

|

Continuing fraud |

|

- |

Fraud: 'Operating earnings' or 'forward earnings' |

|

- |

Became common after the 1990s tech bubble |

|

- |

Named names on my web site |

|

|

|

|

Generational credit bubbles

|

How money is 'created': Securitization of debt |

|

- |

Tulipomania - 1637 - Tulip future share |

|

- |

South Sea Bubble - 1621 - South Sea shares |

|

- |

Bankruptcy of French Monarchy - 1789 - 'assignats' |

|

- |

Panic of 1857 - Railway Shares |

|

- |

1929 - Foreign bonds and stock shares |

|

- |

2000s - Synthetic securities (CDSs, CDOs, IRSs) |

|

Collapse of bubble |

|

- |

Huge deflationary spiral |

|

|

|

|

Generational pervasiveness of bubble fraud

|

Pervasiveness of fraud |

|

- |

Homeowners lied on their applications |

|

- |

Construction firms colluded with appraisers, got kickbacks |

|

- |

Construction firms colluded with brokers, got kickbacks |

|

- |

Lenders resold mortgages without verifying claims |

|

- |

Lenders adopted predatory lending practices |

|

- |

Lenders gave loans to people with no hope of repaying |

|

- |

'Financial Engineers' created synthetic securities |

|

- |

Synthetic securities were mathematically fraudulent |

|

- |

Investment models assumed real estate would rise forever |

|

- |

Ratings firms took fat fees to lie about AAA ratings on securities |

|

- |

Monoline firms took fat fees to insure fraudulent securities |

|

Only explanation is generational |

|

- |

Incompetent, greedy Boomer bosses, cooperating with |

|

- |

Nihilistic, greedy Gen-X perpetrators |

|

|

|

|

DJIA - 1900 to 2010

|

|

Dow Jones Industrial Average -- 1900 - present

|

|

|

|

|

DJIA - 1900 to 2010 + exponential growth

|

|

Dow Jones Industrial Average -- 1900 - present - with exponential growth trend curve

|

|

|

|

|

DJIA - 1900 to 2010 + exponential growth on log scale

|

|

Dow Jones Industrial Average -- 1900 - 1950 - with exponential growth trend curve / log scale

|

|

|

|

|

Generational euphoria / denial

|

|

Generational 'moods' overlaying Dow Industrials since 1950

|

|

1970s models, 1990s models are irrelevant today |

|

- |

Economics of the Maginot Line |

|

Boomers and Generation-Xers |

|

- |

'Financial engineering' programs - 1990s |

|

- |

Greed+Incompetence with Greed+Nihilism |

|

|

|

|

Global Real Estate Bubble

|

|

Housing price index in various countries, 1970-2008

|

|

|

|

|

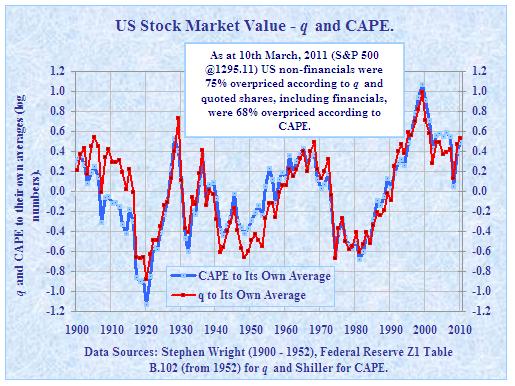

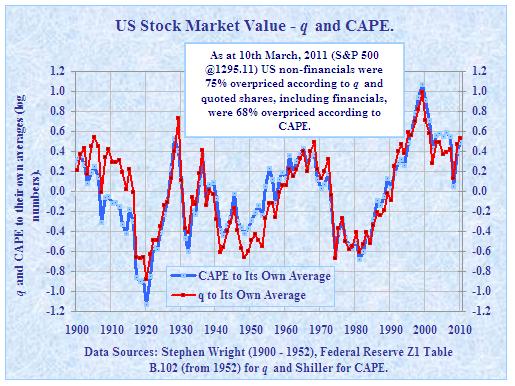

Tobin's q and Shiller's CAPE

|

|

Tobin's q and Shiller's CAPE indexes (Smithers & Co.)

|

|