Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Startled analysts are debating whether the market is close to a crash.

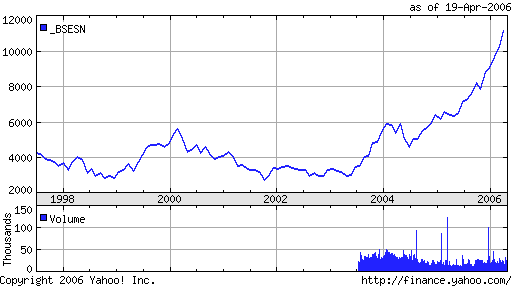

The Bombay Sensex (BSE) stock market index shot past 11,000 on March 21, and then picked up speed and raced past 12,000 yesterday, to land at 12,053.74. That was the fastest 1,000 point rally in history.

Is this a bubble? Not according to Indian government officials. “I don't think there is any bubble (in the stock market),” a top finance ministry official said.

Others aren't so sanguine. Saying that the Sensex resembles the American stock market of 1929, an editorial in India Daily says, "The fundamentals of India's real fiscal situation is bleak. The trade deficit, 75% of imported oil and gas bill with oil at $75 and pseudo buying of stocks by foreign financial institutions and hedge funds all point to an imminent crash of Indian stock market that may follow a protracted long term severe slow down in Indian economy."

|

That's what it looks like to me from the adjoining chart. For whatever reason, investors have frantically poured money into the BSE, pushing prices sky high.

(Remember how a bubble works: If I pay $100 for a share of stock, sell it to you for $200, and you sell it back to me for $300, then we've both somehow made $100 each, even though the underlying value of the share of stock is still only $100.)

But we don't have to go all the way to India to see a stock market bubble.

The Dow Jones Industrial Average (DJIA) closed today at 11342.89, just above the 2001-May-21 index of 11337, the highest it's been since January 2000.

And the DJIA is now within striking distance of 11723, the all-time high, that it reached on January 14, 2000.

What a glorious day it will be when the DJIA tops 11723! Oh, how the champagne corks will be popping!

There is absolutely no rational explanation for what's going on. Oil prices have more than doubled in the last few years, and keep on rising. Interest rates are rising, so credit is becoming less available. This is happening at a time when investors are becoming increasingly risk-averse. The real estate bubble appears to have burst last October. the stock market is increasingly overpriced; the the trade deficit keeps increasing exponentially; and Japan's plans to raise interest rates are threatening the "carry trade" bubble.

It's like the world has gone crazy, just like the world went crazy in 1929.

This is what I've been calling The Principle of Maximum Ruin. Government officials, journalists, pundits and high-priced analysts tell everyone that the market can only continue to go up. This draws more and more people into the market, and each person invests more and more of his money. When the bubble bursts and the crash occurs, then the maximum number of people are ruined.

But that's not all. The crash doesn't occur all at once. In 1929 the stock market kept falling for four full years. During that four years, more and more people were ruined.

The following paragraph from John Kenneth Galbraith's book, The Great Crash - 1929 explains how it worked:

So even after the initial crash occurs, the same government officials, pundits, journalists and high-priced analysts keep predicting that the worst is over. "The fundamentals are solid" is a commonly held statement put forth by analysts during these times. These statements draw more and more people and more of their money into a falling market, thus causing continuing and increasing ruin for a long time to come.

Even Alan Greenspan, now freed from the restrictions imposed by being Federal Reserve Chairman, is warning of sharp falls in financial asset values.

As I've been saying since 2002, Generational Dynamics predicts that

America is entering a new 1930s style Great Depression, with a stock

market crash to the Dow 3000-4000 range by the 2007 time frame. I

certainly have no reason to change this prediction now.

(21-Apr-06)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004