Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

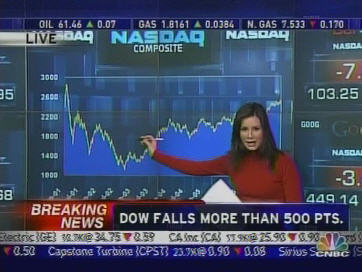

The Dow fell 200 points in four minutes around 3 pm.

I don't take very many risks on the web site, because of my concern for credibility. I reference only the most credible sources. I make predictions only when I'm absolutely certain, which is why all of my predictions have been right.

And I very rarely talk about what I "feel" is going to happen, and when I do, I clearly label that as my "opinion" or "feelings," subject to change.

So I will say this: It's very hard not to "feel" that something significant happened on Tuesday. And it's not what the analysts and pundits were talking about.

Investors panicked at little, but not much. But an experience like this cuts into the Boomer investors' giddy overconfidence. Whereas investors were "looking for reasons to buy" in past years, now they're "looking for reasons to sell."

Things looked really bad all day. The analysts were saying, "There's a flight to safety ... There's a low appetite for risk. ... This is a good thing because investors have been too complacent. ... People I've called on Wall Street say that this is a buying opportunity."

But then at 2:58 pm something happened:

|

At 2:55 pm, when the Dow was down 260, I heard: "If you put this little dip in context, it isn't that significant."

At 3:01 pm, when the Dow was down 470, I heard things like: "There's a lot of noise and shouting on the floor. At first we thought it was an error, but it's holding. ... We're moving to 500 point decline."

|

Soon thereafter, we heard CNBC's anchor Rebecca Jarvis say, "I'm shaking my head because this is just shocking. You have to all the way back to 2001, one of the worst years for this exchange, to even find a down day like this."

For the rest of the afternoon, the comments went something like this: "Huh? What happened? ... I've never seen anything like this. ... There's no reason for this much of a selloff. ... The economy is strong, the fundamentals are good. ... This isn't time to panic. ... The market was overdue for a correction. ... I've never seen anything like this before - it reminds me of 1987."

The fact is that no one had any idea what was going on. They took guesses.

As I explained at length in my comprehensive analysis of macroeconomic theory that I wrote last year, "System Dynamics and the Failure of Macroeconomics Theory," economists have been wrong about everything, at least since the start of the bubble in 1995. They didn't explain or predict the bubble or its timing. They failed to predict low inflation or high unemployment in the early 2000s. They didn't predict or explain productivity increases. They didn't predict or explain the low interest rate "conundrum." They didn't predict or explain the housing bubble. They've been consistently wrong about almost everything.

I must have heard dozens of analysts, economists, pundits and journalists today. Not a single one mentioned the price/earnings ratio index. NOT A SINGLE ONE. The P/E ratio has been at 19 or above since 1995, and so a fall is overdue. The P/E ratios fall to the 5-10 range every decade or two. They did so six times in the last century, most recently in 1982. You have to be a total moron to think it won't happen again, and yet, there they all were, arguing over whether it would be a one-day or one week phenomenon before the market started going up again.

So let's make this clear: a major 1930s style Great Depression is coming, because the stock market is overpriced by a factor of about 250%, same as in 1929. (In 1987, when a brief panic occurred, the stock market was underpriced.)

For reasons that I've repeatedly discussed on this web site since 2002, we're headed for a new 1930s style Great Depression, complete with massive unemployment, bankruptcies and homelessness. There is nothing can be done to stop this. If you listen to the airheads on TV, including the airheads that I've been quoting, you will be screwed.

If you go back through history, there are of course many small or regional recessions. But since the 1600s there have been only five major international financial crises: Tulipomania bubble (1637), South Sea Bubble (1721), French Monarchy bankruptcy (1789), Hamburg Crisis of 1857, and 1929 Wall Street crash.

Each of these major international crises occurred roughly 70-80 years after the previous one. What you find is that each new "debt bubble" occurs at exactly the time that the generation of people who grew up during the previous financial crisis all disappear (retire or die), all at once. Thus, the length of time between these "generational" financial crises is approximately equal to the length of a maximum human lifetime.

Our 70-80 year interval is pretty much over. The next major 1930s style Great Depression is just around the corner, with 100% certainty. Nothing can be done to stop it. All we can do is prepare for it.

Perhaps the market will work its way out of the current crisis, as it has in the past. Perhaps things will settle down again. It's possible, but it doesn't fix the real problem. The market will still be overpriced by about 250%, and a collapse cannot be avoided.

A panic must occur before too much longer, because of all the huge and growing imbalances in the global economy. There's a significantly high probability that we're seeing the beginning of it right now, right today, but if not, then we'll see it soon.

One more thing.

Wall Street IT systems became overwhelmed today around 3:45 pm ET (15 minutes before the market closed) because of the high volume of sell orders. There are "tons" (one analyst's word) of sell orders left over that haven't been processed, and won't be until Wednesday morning.

This means that if you're planning to get out of the market "just before" the final crash, you may find yourself stuck for a couple of days. That's because there will be so many sell orders that the computers systems will be overwhelmed, and the market will shut down. You'll have to sit there watching TV as your positions are frozen and the market falls.

I strongly urge my readers to get out of the market now, before you

get caught. Keep your money in cash, or in 6-month Treasury bills.

Don't reenter the market until its clear that things have settled

down.

(27-Feb-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004