Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

The Dow Industrials are 47% below their peak, in a new six-year low.

According to an article scheduled for Friday's Wall Street Journal:

|

The Dow Jones Industrial Average broke to a new six-year low Thursday, dashing hopes of a quick market recovery and reawakening fears that the stock declines aren't over.

The Dow industrials now have lost nearly half their value, or 47%, since their record close 16 months ago. They fell 89.68 points to 7465.95 on Thursday, dropping past the Nov. 20 low of 7552.29.

With other indexes down similarly large amounts, investors are wondering how much longer the pain will continue.

If past experience is any indication, it can continue for a while. Money managers and analysts who have studied past bear markets are warning clients that they aren't yet seeing the signals they would expect to see at a true market bottom.

The Dow's 47% decline in the current 16-month bear market already is one of the biggest in the index's 113-year history. The only time it fell significantly harder was 1929-32, when it lost almost 90% of its value, and almost no one believes a similar calamity awaits this time.

The classic sign of a bottom that many analysts and money managers are looking for is a period of frantic selling, followed by a sudden onset of heavy buying. They have seen the selling, but so far, they haven't seen the buying. The fear is that this means more selling is ahead."

The "frantic selling" followed by "heavy buying" is what I described last year in "The origins of the hare-brained "capitulation" fallacy."

The latest fall comes amidst sharply increasing concern about the viability of east European banks, so much so that Moody's Investors Service warned of a "rapidly deteriorating global macroeconomic environment."

According to Moody's, "East European countries -- the region includes Central and Eastern Europe (CEE), South-Eastern Europe (SEE) and the Commonwealth of Independent States (CIS) -- have now entered a deep and long economic downturn." In worst shape are the Baltic countries, Hungary, Croatia, Romania and Bulgaria, because of their high fiscal deficits. However, Ukraine, Kazakhstan and Russia are all under pressure as well.

That's not all though. These East European countries are deeply in debt -- and they're in debt to West European countries, especially Austria, Italy, France, Belgium, Germany and Sweden. Thus, if one of the East European countries goes into default, it would begin a chain reaction that would cause major banking crises in one of those six West European countries.

The result is that the interest rate spreads on credit default swaps (CDSs) for several European countries have widened considerably, indicating that investors are "betting on" a default in one of those countries.

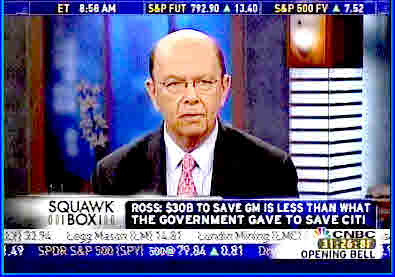

On Thursday morning on CNBC, billionaire investor Wilbur Ross made an interesting statement of a kind that I haven't heard before. The following is my transcript:

|

There's too much consumer debt out there, and you can argue that the anomaly was not so much the present recession. The anomaly may very well be the boom time that we had before.

One economist did a calculation - if you X'ed out the economy the home equity that was liberated through remortgaging, you know what you would have had in the six years from '00 to '06? Three down years, and three years of less than 1% growth. Total economy.

Basically, it all came from the consumer, and it wasn't the consumer income; it was consumer leveraging. Median income in this country actually went down in this country from 2000 to 2006, and so basically did net worth.

[CNBC anchor Joe Kernen: And you factor out the tech bubble, and it's positive effect in the late 90s, and you have that we haven't done anything for 15 years.]

That's right. We hid it pretty well, but in a sense that's a giant Ponzi scheme itself. It makes Madoff and everybody else look pretty small."

Regular readers of this web site will not be surprised at the characterization of the entire market the last few years as a "giant Ponzi scheme." I've been describing the global economy as a "pyramid scheme" and a "Ponzi scheme" since 2004.

What's remarkable is to hear such a remark on the normally Pollyannaish CNBC.

Even more remarkable is that CNBC anchor Joe Kernen, who has always been wildly optimistic, is actually making a connection between the 1990s dot-com bubble and the 2000s Ponzi scheme. Wow! Next thing you know, it'll occur to him that all this happened at exactly the time the Great Depression survivors all retired. Naaahhh. That's way too deep.

I'd like to warn web site readers that this may be a time of maximum danger, and that the current situation may indeed be a "crisis low," as the WSJ headline says. As you know, generational theory predicts that there MUST be a generational stock market panic and crash, the first since 1929. It's impossible to predict the exact date, but with the market now falling to a new six-year low, the mood may be right for a major panic.

If the market begins to recover again in a "bear market rally," then the immediate danger may be over. But if the market continues to fall, as the above Wall Street Journal article says that many analysts expect, a full-scale panic may occur right away, rather than later.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(20-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004