Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

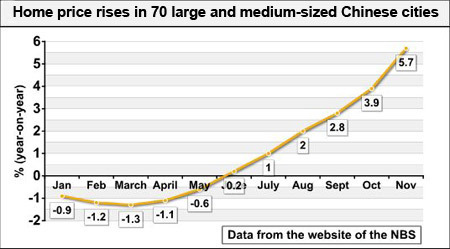

Chinese home prices rose 5.7% in November from a year earlier, according to China's National Bureau of Statistics (NBS).

Having just posted a new article, "'Shadow inventory' of unsold homes continues to grow," indicating that the housing crisis in America is far from over, it's worthwhile taking a look at the even worse real estate crisis in China.

|

China's growth rate in home prices was 2.2 percentage points higher than that of October, according to the NBS report.

Alarmed Beijing officials are imposing new regulations in an attempt to slow down the rapid bubble growth. "We’re at the start of an all-out crackdown on the property market," according to one Shanghai analyst. "The current speed of gains in property prices cannot be sustained. Local governments may also work out their own policies targeting house prices."

Announcement of this crackdown panicked investors this week in the Shanghai stock market, especially in stocks related to real estate.

According to former Morgan Stanley Chief Asia Economist Andy Xie, Chinese stocks and properties are 50-100% overvalued, fueled by bank lending and inflation fear:

The asset bubble is being caused by China's massive stimulus program. The stimulus program was intended to create jobs and increase consumption, but instead, state-run banks have channeled the money into real estate projects for their own benefit. The new landowners are being called "Land Kings," and they have little respect among the Chinese people.

|

As stimulus money pours into real estate properties, the property bubble gets larger and larger, making home prices too expensive for ordinary citizens, even as many homes and apartment buildings lay empty.

This is one of the most incredible features of China's real estate bubble, and something that's different from America's recent real estate bubble.

There's no property tax in China, and so there's no cost to buying real estate and holding it indefinitely, according to Patrick Chovanec, an associate professor at Tsinghua University’s School of Economics and Management in Beijing.

So "land kings" have been able to use stimulus money or cheap bank loans to purchase properties and hold them, expecting to sell them later at big profits. According to Chovanec,

This has led to remarkable situations. The following video describes "China's empty city - Ordos." The entire city was built by real estate developers using other people's money, and there are no people living there:

In America, the real estate bubble took the form of financial institutions creating and selling mortgage-backed securities that later turned out to be worthless "toxic assets."

In China, the real estate bubble takes the form of financial institutions building and buying unwanted real estate with other people's money.

The details are different, but the core patterns are the same: Financial institutions defrauding the public and paying themselves huge salaries, fees, commissions, bonuses and bribes.

China's residential real estate problem is bad, but if anything, the commercial real estate problems are even worse.

According to a lengthy Xinhua analysis, China's commercial real estate boom occurred in 2003-2007:

But when the financial crisis hit, many multinationals pulled their offices and employees out of China or moved to less expensive spaces, while the hordes of shoppers that retailers were expecting to flood the malls tightened their purse strings. Now, major cities throughout the country are home to empty skyscrapers and shopping malls that are virtually empty, apart from store clerks and security guards. Meanwhile, construction continues."

The result is that the vacancy rate in big cities like Beijing and Shanghai is approaching 50%. Even when the buildings and shopping centers are occupied, owners are forced to give special deals, such as one year free rent on a five-year contract. Thus, effective rents have crashed by 40-50% in the last year, even though nominal rents have remained almost the same.

According to international real estate executive Jack Rodman, there are two reasons that explain why developers have been keeping leasing prices at the old rates:

Moreover, the commercial real estate building craze has not ended, as new stimulus money and near-zero interest rates continue to fuel additional development projects that are not needed.

This has led to an absolutely incredible scam where farmers have started "growing houses" instead of growing food.

The scam works as follows: When there are rumors of a new development project, the farmers in the region quickly get together and build numerous houses on their farm land. These are not real houses, in the sense that anyone could live in them, but they're houses nonetheless. For example, they may be nothing more than bricks held together by glue.

Then, if and when the development project begins, the houses have to be torn town to make way for the development. Beijing's policy is to reimburse owners when a new real estate project causes people to loses their homes. So the farmers make back double their money. Of course, if the rumored development project never actually occurs, then the farmers lose their money.

I seem to keep using the word "dysfunctional" these days, whenever I talk about almost anything having to do with finance or politics, whether in the US or Europe. But it's going to be hard for any other country to beat the dysfunction that's apparent today in China's real estate market.

It's not uncommon for observers to compare China's real estate market today to Japan's real estate market just before its huge stock market crash in 1990. At the height of Japan's real estate bubble, the nominal value of the real estate in Tokyo alone was greater than the value of all the real estate in the United States. Once the crash began, Japan's real estate prices continued falling for almost two decades. (See "Japan's real estate crash may finally end after 16 years.")

China is showing the same signs, according to the NY Times:

China has been building factories and production capacity in virtually every sector of its economy, but it’s not clear that the latest round of investments will be profitable anytime soon. Automobiles, steel, semiconductors, cement, aluminum and real estate all show signs of too much capacity. In Shanghai, the central business district appears to have high vacancy rates, yet building continues."

In America, the public is becoming increasingly furious with Citibank, Bank of America, and other bankers, who have defrauded the public with "toxic assets," and who are now raising interest rates to 30% and imposing phony fees on credit card customers in order to have the money to pay themselves million dollar bonuses.

In China, this discontent goes far deeper. I started reporting on this phenomenon in 2004. (See "Up to 50,000 workers riot and clash with police in southeast China.")

If there were even one incident of this type in the United States, it would be international news. But there are tens of thousands of these "mass incidents" in China each year. And this doesn't count the recent unrest in Tibet and among the Uighurs in Xinjiang province.

These incidents represent an extremely high level of social unrest, and according to an analysis by a Chinese think-tank, the level of social unrest is higher than ever. According to the report, deep resentment has been accumulating over the past few decades against unfairness and power abuses by government officials at various levels.

From the point of view of Generational Dynamics, a Chinese civil war is certain. As I wrote in 2005 in "China approaches Civil War," China has a long history of massive internal rebellions and civil wars, creating bloodbaths that have slaughtered tens of millions of people in a short period of time. These include the White Lotus rebellion that began in 1795, the Taiping rebellion that began in 1852, and the Communist Revolution that began with Mao Zedong's genocidal Long March in 1934.

The current real estate bubble and "asset Ponzi scheme" is a financial crisis waiting to happen. China is desperately trying to use stimulus money to prevent a panic. These attempts have postponed the panic, but the development of the "Land Kings" shows that the stimulus money is only making things worse. And the size of the bubble is so huge that a panic will be a catastrophe for China's social fabric.

From the point of view of Generational Dynamics, China is now about due for its next massive internal rebellion and civil war, and is headed for civil war with absolute certainty.

(Comments: For reader comments, questions and discussion,

see the China thread of the Generational Dynamics forum.)

(22-Dec-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004