Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

European economic growth is much smaller than previously reported.

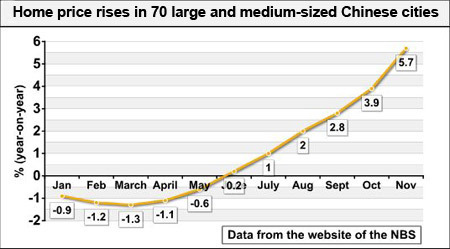

The People's Bank of China surprised the world's financial markets on Friday by announcing new regulations raising reserve requirements for lending. These new regulations effectively curb the lending that's been a central part of China's stimulus package in the last year.

A report by the LA Times said that the move was meant to stem "growing fears of a real estate bubble" and to "put a lid on incipient inflation."

|

An analyst, Jing Ulrich from J.P. Morgan, is quoted as saying, "The message coming out of China in recent weeks has been quite clear: Policymakers are becoming more concerned about containing inflationary expectations and managing the risk of asset price bubbles as a result of last year's aggressive expansion of credit."

There's little doubt that there's a housing bubble. As I wrote in December in "Skyrocketing real estate prices in China alarm officials," the housing bubble is almost astronomical in nature.

But in my opinion the situation is much more complicated then that. Recall that early in 2008, prior to the Beijing Olympics games in August, China's economy was roaring. Once the games ended, China's economic boom ended, but a lot more happened as well.

As I wrote at the time, there was a worldwide collapse in transportation and trade. (See, for example, "World wide transportation and trade sink farther into deep freeze.") I made a comparison to the old science fiction movie, "The Day the Earth Stood Still," except that it wasn't science fiction.

I believe that the Chinese are afraid that if they allow the current bubble to continue, then they'll suffer another crash, similar to the one at the end of 2008. Thus, they're trying to cool down the economy now, in the hope of having more steady growth into the future.

Early in 2009, China implemented a major new stimulus package -- as did the United States, Britain, Europe, and other countries. It's believed that it was the combined effects of these stimulus packages that created the new stock market bubble in 2009.

Now all of those stimulus packages are beginning to go in reverse. Friday's announcement was actually the second one this year from the People's Bank of China. The Bank of England's Mervyn King has hinted that the quantitative easing program may slow down. The Fed is ending its program of buying mortgage-backed securities.

And then we have euroland, which is coming close to total chaos.

Reports continued on Friday that there are deep divisions among the European finance ministers about bailing out Greece.

And worse, there was a new economic report on Friday that indicates that last year's economic growth was a lot smaller than expected.

As The Independent reports:

Ominously, that spurt of growth seems to have petered out, with the expiry of special measures such as those scrappage schemes, and the gradual reversal of monetary and fiscal boosts across the world. As one of the great trading nations and manufacturers, Germany is particularly sensitive to such trends. Job subsidies have so far helped to protect the labour market from more serious damage, but the programme of fiscal retrenchment being undertaken by Chancellor Angela Merkel's Christian Democrat/Free Democrat alliance may bring those to an end as well."

This explains why German chancellor Angela Merkel will almost certainly NOT agree to any bailout of Greece. Germany's own economy is faltering, and the German people are not going to be willing spend a lot of money to bail out the Greeks, who they believe are profligate spendthrifts who should be forced to bail themselves out.

It also explains why the Greek crisis is worse than expected, as well. If the euroland's growth is lower than expected, then Greece's budget deficit is going to be higher than predicted. And budget deficits will also be higher than expected in other borderline economies, such as those in Portugal and Spain.

As I've been saying recently, there's very much a feeling that the eurozone is spinning out of control. Friday's report adds to that feeling.

I'm not the only one with that feeling. According to Bloomberg, Société Générale's top-ranked strategist Albert Edwards is saying that "southern European countries are trapped in an overvalued currency and suffocated by low competitiveness, a situation that will lead to the break-up of the euro bloc."

From the point of view of Generational Dynamics, the global financial system is in a deflationary spiral, as I've been saying for years. (See, for example, "What's coming next: Understanding the deflationary spiral.")

The massive stimulus injections by countries around the world have slowed the deflationary spiral, and frankly have succeeded better than I had expected them to -- although even with all that stimulus, we can still see euroland approaching collapse.

But now, the stimulus is being withdrawn. The "experts" that you hear on CNBC say that the worst is over, and there isn't even any need for more stimulus.

From the point of view of Generational Dynamics, nothing has changed, except that last year's stimulus bubble has only made things worse. As explained in "How to compute the 'real value' of the stock market," the stock market has been substantially overpriced since 1995, by historical standards. Applying the Law of Mean Reversion, the stock market will have to fall well below the Dow 4000 level, and stay there for a roughly equivalent period of time (15 years). That's exactly what happened after the 1929 crash, and the "natural laws of finance" have not changed at all since then, despite the fantasies of the "experts."

And just to be clear, I'm not the only person who thinks so. As I wrote in "Report from TARP Inspector: We're driving off a cliff in a faster car," the Obama administration's Special Inspector General finds that all the abusive practices that led to the financial crisis that began in August 2007 are still being used, and the abuses are much worse. The inevitable logic is that a much larger financial crisis is yet to come.

One thing that we can be sure of is that the "experts" that we see on CNBC or read in the Wall Street Journal are going to protect themselves. Right now, they're investing other people's money, and earning fat fees and commissions by declaring (again) that the stock market will only go up.

For example, we saw this with the real estate bubble.

Long-time readers of this web site knew that there was a real estate bubble as early as 2004. I even quoted Alan Greenspan in 2004 saying that credit card debt was at historically high levels, and that there had been an "exceptional run-up" in housing prices.

One thing that surprises me these days is that pundits and experts freely use the phrase "real estate bubble" in reference to the last few years. When did that become the common wisdom? I must have missed the memo. Early in 2008, Ben Bernanke was still saying the "subprime crisis" was "contained," so it couldn't have been the common wisdom then. Brokers and financial analysts were telling their clients in 2008 that the stock market would only go up, and that they should invest their money in more stocks, and pay more fees and commissions. That's why the subprime crisis was "contained."

Since then, the financial advisers have changed their tunes. "Oh, you lost money following my advice? Well, who knew that we were in a real estate bubble? Even Ben Bernanke was wrong about that. But all that's over now, and you can start buying stocks again, because the stock market can only go up."

They will ignore the generational deflationary spiral that's still ongoing, with the worst effects postponed by massive worldwide stimulus that's now ending. And they'll ignore the massive abuses of credit that are still occurring, and in fact they'll participate in those abuses.

So the rule followed by financial analysts and brokers is as follows: Make up any story you want to maximize your fees and commissions. You have no fiduciary duty to your clients. Your only duty is to maximize your income at the expense of your clients.

So you have people who used to say, "Of course housing prices can't go down - everyone has to live somewhere," and who are now freely saying that there used to be a "housing bubble." Those same people are ignoring the budget crisis in Greece and Portugal, and the massive real estate collapse in Spain, and saying, "Of course those countries won't go into default - the European Commission won't let them because it's bad for business."

After their clients lose a lot of money, you should expect to hear the new common wisdom in a couple of years: "It's not my fault. How was I to know that Spain would default on its debt?"

(Comments: For reader comments, questions and discussion,

see the 13-Feb-10 News - China restrains lending, as euro crisis continues

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(13-Feb-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004