Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

There's been a 'quiet freeze' on new Jewish settlements in east Jerusalem.

I heard a BBC reporter today describe this situation as "embarassing." Well, wearing non-matching socks is embarassing, but having your debt reduced to junk status requires slightly stronger words, don't you think? Apparently investors think so.

There's the smell of panic in the air today.

Markets fell 1.5-3% in Europe, North America and Asia, after the Standard & Poor's Ratings Services announced that it was lowering the rating on Greece's debt to "junk bond" status, and yields on 2-year bonds went to 15%.

But the junk bond rating is not the worst of it, according to FT Alphaville. In its announcement, S&P said that if a default occurs, bondholders will lose 50-70% of their investment.

However, in the spirit of "all talk, no action," officials from the European Union and the International Monetary Fund (IMF) talked about things that they might do to calm the situation.

The NY Times reports that the EU governments may hold a summit meeting on May 10, "in an effort to show unity." Well, what does that mean? They're already the European "Union," so what unity are they going to show?

The May 10 date was undoubtedly chosen because it's the day after the German elections. The hope is that the Germans will be more generous with aid money then. However, according to the Independent, polls indicate a roughly 50-50 chance that Angela Merkel's governing coalition will lose, since the German people so strongly oppose a Greek bailout. This would undermine the stability of the German government, and put the aid package into further doubt.

And Reuters reports that the IMF is in talks to increase its share of the planned aid to Greece to 25 billion euros from 15 billion euros.

The intent would be to increase the size of the total package from 45 billion euros to 55 billion euros. But I wouldn't be surprised if this IMF offer is used as a reason by some IMF countries to reduce their own contributions.

Reuters is providing a summary of the status of the aid package on a country by country basis. If you read through the article, you can see that in most cases, the aid is dependent on approval by the nation's parliament, and there is no committed date. One gets the feeling that the entire aid package is a house of cards.

The Greek financial crisis is gathering momentum. It's already gathered enough momentum that I don't believe that anything can stop it now, even if the will existed to stop it.

S&P also lowered Portugal's credit rating on Tuesday, though not to junk status. Bloomberg reports that the amount of debt as a proportion of GDP that Portugal has to refinance this year is one of the highest in the euro region, leaving the country "vulnerable to changes in investor sentiment," according to S&P.

I've heard several financial pundits claim that because Greece is such a small country, a default by Greece would not have much effect on anyone else. This is the height of wishful thinking.

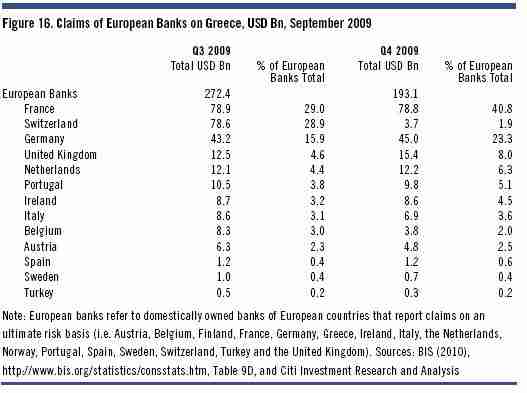

FT Alphaville has provided the following chart of the exposure of European banks to Greek debt:

|

Recall that we stated above that S&P expects holders of Greek bonds to lose 50-75% of their investments if Greece defaults. Thus, European banks will lose hundreds of billions of dollars in assets, in case of a Greek default. Contrast that with the "paltry" 45 billion euro aid package that may or may not get approved.

A lot of people are now thinking about the financial collapse of central Europe in 1931. Here's what I wrote in 2007 in "The bubble that broke the world:" On May 11, 1931, the Credit-Anstalt bank of Austria failed. This triggered mass panic and bank failures throughout Central Europe, and generated a worldwide banking crisis. On July 13, the German Danatbank failed. Foreign investors in Germany quickly withdrew their capital from Germany, heightening the crisis, leading to the complete collapse of the German economy. By the end of the year, there were over 6 million unemployed, and the resulting social tension gave rise to Communism and Naziism.

A lot of people now are worried that this will happen again.

From the point of view of Generational Dynamics, we're headed for a global financial crisis, with 100% certainty. With Greece in almost total meltdown, with Portugal to follow, this may be the trigger that causes the financial crisis.

Israel's Prime Minister Benjamin Netanyahu has stated that there would be no halt to the building of Jewish settlements in Jerusalem, but there's apparently been a "quiet" freeze put into place for new contruction. CS Monitor

Germany has made the Greek crisis worse, through hesitation and patronizing advice. While the Greeks have produced "one false [financial] report after another," the Germans "delight in hindering a rapid and unambiguous European response to the Greek crisis." Der Spiegel

Although US stocks fell on the Greek news, stocks were set to fall anyway, because of deepening unemployment, according to Mitsubishi UFJ Securities Co. Bloomberg

Tired of investing in sinful stocks? Consider the Stoxx Europe Christian Index, which lets you invest in companies that are compliant with Christian moral and social doctrines. Christian Today

Cities in Italy and around the world are being crushed by debt, as the financial crisis continues to worsen. Washington Post

Like China and Japan, South Korea is stealthily building up its armed forces. The need for stealth is one reason why they haven't directly accused North Korea of sinking their warship on March 26. Diplomat

Powerpoint presentations have become an obsession among the military officials responsible for the war in Afghanistan. NY Times

Food prices in India have risen by as much as 20% over the past year, giving rise to nationwide protests and the rise of communist parties. BBC

Posters advertising a small Citroen C3 hatchback car contain the slogan, "Be like Madame Bruni, take a small French model". The ad mocks French president Nicolas Sarkozy, who is shorter than his supermodel wife Carla Bruni, and is causing a scandal. Telegraph

(Comments: For reader comments, questions and discussion,

see the 28-Apr-10 News -- Greece melts down, as bond rating lowered to 'junk' status

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(28-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004