Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Shadow inventory indicates there'll be another leg down in housing prices

Last week I wrote that there was full-fledged panic in progress, as Greek bond prices were crashing, with a "contagion" effect on Portugal and the euro.

Sunday's non-bailout bailout of Greece was supposed to stop the panic, but it didn't.

Then on Monday, the European Central Bank (ECB) took the first step to invoking the "nuclear option" ("quantitative easing" through aggressive purchasing of countries' bonds) by allowing Greek junk bonds to be used as collateral in credit operations, according to an ECB press release.

One important measure of the level of panic is the prices of credit default swaps (CDSs) for Greek debt. Recall that a CDS is a kind of insurance policy that pays off if the underlying debt defaults. In "normal" times, a typical CDS price is $10-25,000 to insure $10 million of debt.

CDS prices on Greek debt dipped slightly on Monday, because of the aid package, but by Tuesday they were back up to the astronomical level of 725bp, according to FT Alphaville, meaning that it will cost $725,000 to insure $10 million of Greek debt.

More worrisome is that the panic is spreading to other euroland countries. The following graph shows what's happening to CDS prices for Portugal and Spain:

|

This graph shows dramatically how CDS prices are spiraling out of control for Portugal and Spain, as they follow Greece's path.

Markets around the world fell 2-3% on Tuesday. Financial pundits that I heard give various reasons:

These are plenty of negatives weighing on the world's markets.

Balancing all of those negatives there's only one potential "positive," and that's the "nuclear option," a form of massive quantitative easing.

If the ECB exercises this option, it will "print money," and use the money it creates to aggressively purchase bonds from several euro countries. An FT Alphaville analysis indicates that the ECB is indeed considering this option. ECB president Jean Claude Trichet was quoted as saying, "At this stage, we have absolutely no decision on the purchase of government bonds," and his use of the phrase "at this stage" in the past has meant that a change of policy was being considered.

According to the article, an increasing number of analysts believe that the nuclear option is the only way to keep the Greek contagion from spreading.

"Oh dear. Whilst one day’s trading does not necessarily indicate a trend, I would bet that there are a lot of very worried EU officials this afternoon," says Gary Jenkins of Evolution Securities. "In the poker game between the markets and the EU the former has consistently asked to see the latter's hand, and with the €110bn 3 year package the EU was no doubt hoping that it was game over. But maybe not."

Jenkins also points out that "About the only thing the EU has left up its sleeve is to ask that the ECB buy bonds in the market. However this would have to be in significant size to have any real impact."

Commentary from the Royal Bank of Scotland argues that the ECB should take this step right away, rather than wait for the situation to get worse.

Back in August, 2007, I posted the article, "The nightmare is finally beginning."

That was when the global credit crisis began, and it appeared that the crisis would spiral out of control. That's when Fed chairman Ben Bernanke announced a small reduction in the Fed funds rate, and that's all it took to allow the stock market bubble to continue growing for another month, going above Dow 14,000.

Those were the good old days, because the solution was so simple. But as we've gone from one crisis to another, each significantly more serious than the previous one, it's been necessary to do a lot more than just make an interest rate reduction. Particularly after the Lehman Brothers bankruptcy in September, 2008, governments around the world implemented huge stimulus and quantitative easing programs, resulting in a renewed stock market bubble throughout the last year.

But as the current Greek crisis worsens, more and more people seem to agree that central banks have almost run out of ammunition. There's really only one weapon left, and that's a huge purchase of government bonds by the ECB.

The problem is that, once again, Generational Dynamics predicts that this cannot end the crisis, but can only postpone the crisis a little bit longer. Let me make a point that I've made several times before.

On Tuesday, the Dow Industrials fell over 200 points to just above 10,900. Everybody believes that this is a bad thing.

But it was just a little over a month ago that the the Dow ROSE to a price just above 10,900, and that was a cause for celebration. How could the same price be bad news today, when it was very good news a month ago?

The point I'm making is that there's no one that I hear on television or read in the financial papers ever addresses the question of what the Dow SHOULD be. Is 10,900 too high or too low? Should it be 11,000? 14,000? If so, then why not 20,000 or 100,000 or a million? Is there any reason why a million is any better or worse than 10,900? And would Dow 1 million be good news or bad news? What if it had been 1.1 million the week before?

And once you've accepted that a million is just as fair a price as 10,900, then you'd also have to agree that 9,000 is also a fair price. So is 8,000 or 5,000, or 1,000.

If you were investing in an apartment building, you could answer that question by estimating the rental income and expenses over time, and perform a present value computation to get the real value of the apartment building.

You can do the same thing with stocks by using price/earnings ratios. That's what I did in the article, "How to compute the 'real value' of the stock market." As that article shows, the stock market has been in a bubble since 1995, and is still overpriced today by a factor of almost 200%, so by the Law of Mean Reversion, there will be a stock market crash to a range below Dow 3000.

That's the reality of the situation. Stimulus and quantitative easing programs have postponed the inevitable, and they may or may not do so one more time in Europe, but it is mathematically certain that a major stock market crash is still to come.

|

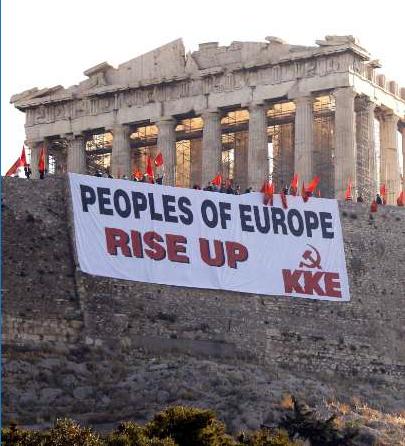

Demonstrators from Greece's communist party, KKE, took over the Parthenon on Tuesday, and hung the huge banner shown in the adjacent photo. Their apparent intention was to encourage all the people of the different countries in Europe to rise up with them in protest to the austerity measures imposed on Greece.

This is one of the reasons that many Europeans don't trust the Greeks, and why many analysts doubt that Greece will stick to the austerity measures that they've already agreed to.

In fact, there's been a lot of discussion on the BBC about why the Greeks aren't more grateful that they've been bailed out. Many people outside of Greece feel that they're going to suffer because of Greece's profligacy, and that they should at least receive a "thank you" for their sacrifices.

As FT Alphaville put it, referring to the Parthenon demonstration, "That, of course, follows Europe’s €110bn bailout pledge for Greece this weekend. Charming."

That article also referred us to the video of the song "Do You Hear the People Sing?" from the musical show Les Misérables.

This is a great song, and serves as our musical entertainment for today. Once you've heard it, then you too will be motivated to go out and start a revolution:

A web site reader asks:

The issue with the Greek armed forces is Turkey. Greece is one of Europe's biggest arms purchasers, according to an analysis by the French news agency AFP, out of concern over a war with Turkey. However, the IMF has warned Greece that military spending must be "clearly reduced."

Orthodox Christian Greece and Muslim Turkey have been at war several times for centuries, most recently in the Mediterranean island of Cyprus in the 1970s. Even today, the island is split into two fortresses, one with Greek citizens and one with Turkish citizens.

Turkish Prime Minister Recep Tayyip Erdogan will visit Greece next week, with the goal of improving relations between the two countries. After all these centuries, it's doubtful that one meeting will make much difference.

According to the WSJ, there's plenty of reason to believe so.

|

As the above graph shows, it would now take 103 months (8 1/2 years) to sell off all the foreclosed properties in banks' possession.

As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20% from a year earlier, according to the article. Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That “shadow inventory” was up 30% from a year earlier.

That means that housing prices are certain to continue to fall. My own estimate, as I've stated before, is that they'll fall to 1990 prices.

South Korea appears to be inching closer to blaming North Korea for the sinking of the warship Cheonan. On Tuesday, president Lee Myung-bak convened an unsual meeting of top military commanders, and vowed "clear and resolute measures" against those responsible. NY Times

For techies: How to stay anonymous online. PC Magazine

Al Gore has purchased a $9 million mansion in Montecito, Calif., with an "almost comical carbon footprint," indicating that he's probably giving up on the global warming movement. Pajamas Media

There are now numerous examples of how YouTube.com has become the internet's primary and rapidly expanding jihadi base. Jihadist groups are using it to take responsibility for terrorist attacks, and for training and propaganda. MEMRI

The "Red Shirt" demonstrators that have taken over Bangkok's retail district are willing to negotiate with Thailand's government officials over a proposed reconciliation plan involving early elections. However, the demonstrators want a much earlier date than the November date being offered. Xinhua

"Cash recycling machine" and "Slip and fall down carefully" are examples of signs in Shanghai in Chinglish, a Chinese version of English that results from poor translations of Chinese into English. A campaign in Shanghai seeks to eliminate these signs. NY Times

A U.S. military base on the Japanese island of Okinawa has become increasingly unpopular with the island's people. When Prime Minister Yukio Hatoyama was running for election last year, he promised to move the military base off the island. But now he's backtracking on that promise, and looking for a compromise plan. Nikkei.com

Faisal Shahzad, the attempted Times Square car bomber, was born and trained in Pakistan, before he became a naturalized U.S. citizen. On Tuesday, Pakistan law enforcement agencies arrested Shahzad's family members living in Karachi. Dawn

Fallen arches are not a problem for most people, but in severe cases can be very painful, and require surgery. NY Times

Beautiful women are bad for your health. Telegraph

(Comments: For reader comments, questions and discussion,

see the 5-May-10 News -- Financial markets volatile as Europe considers the 'nuclear option' thread of the Generational Dynamics forum.

Comments may be posted anonymously.)

(5-May-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004