Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

As Kyrgyzstan violence slows, officials worry about humanitarian 'catastrophe'

As long-time web site readers know, I've complained endlessly that mainstream journalists, bloggers and analysts who claim to be experts simply ignored the Law of Mean Reversion, which says that stocks are 150-200% overpriced, and have been overpriced since 1995, and that therefore a stock market crash is a mathematical certainty. And it's not as if I invented the Law of Mean Reversion. I'm simply applying it in an obvious way that anyone who's taken an economics course should easily understand. (See "How to compute the 'real value' of the stock market.")

Well, imagine my shock and surprise to read Friday's posting at Yves Smith's Naked Capitalism blog, and find that one of the links points to an article entitled "Now Stocks Are 48% Overvalued, Says Smithers," by Henry Blodget; and then to find that this article says that stocks are 50% overpriced, and the S&P 500 index must "revert" to about 700.

Blodget's article describes some work by "Andrew Smithers, an excellent economist based in London," who's done an analysis very similar to mine.

A quick search reveals that an article by Tyler Durden on the Zero Hedge blog also references Smithers' article. Durden says that Smithers' article shows that the stock market is "disconnected from reality," although he blames the bubble prices on HFT (high frequency trading, or computer trading). He concludes, "Shut down HFT, and next thing you know the market will drop to its fair value: somewhere 50% lower."

Now, I know that Yves Smith is aware of this web site, and it's possible that Durden does as well, so you'd think that one of them might have given me some credit for saying all this for several years, but it's typical of today's nasty world that such a thing is impossible.

However, it would certainly be a remarkable breakthough if people like Smith and Durden actually tried to understand the Law of Mean Reversion and its consequences. It would be a sign that people in the mainstream are finally beginning to think.

The referenced article by Andrew Smithers can be found on the Smithers & Co. web site.

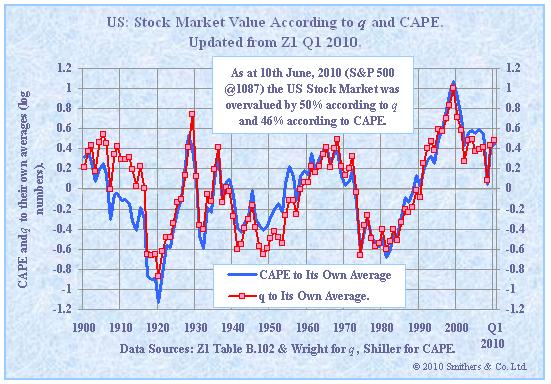

I'd like to discuss Smithers' work, and indicate some differences between what he's done and what I've done. The following chart is from Smithers' web site:

|

This chart is a little confusing, because it displays deviations from the historic average.

This chart displays two different values from 1900 to the present. But the values shown on the left and right axes are indicators of whether the value was above or below average.

The red line is the "Tobin-Q" value, which I won't discuss further today.

The blue line is the CAPE or the "cyclically adjusted P/E ratio." This is the current stock price divided by the average earnings per year for the previous ten years, something that I've called "P/E10" in previous articles.

The long term average for P/E10 is around 16, and that corresponds to a value of 0 on the above graph. As you can see, the value at present is shown on the graph is 0.5, which (it turns out) corresponds to a price/earnings ratio of about 20.

Now, Smithers' reasoning is as follows:

Now, this conclusion alone should be enough to be enough to shock the hell out of any investor who owns stock today, especially because it comes from a "mainstream economist," as opposed to me (a nobody).

But actually Smithers doesn't go far enough. A trend value will not just return to its historical average; it will actually overshoot and fall substantially below average, to compensate for having been above average.

Smithers is actually using an economic law call "Regression to the Mean." According to this law, a trend value that's well above or below its historical average will return to its historical average. That's certainly true.

But we've been using a stronger law, the Law of Mean Reversion. In the case we're talking about, the value of P/E10 has been far above average since at least 1995, or 15 years. This means that the value has to fall far below average for a comparable amount of time.

Here's another way to look at it: If the S&P 500 index today is around 1100, which is 400 points above the long-term trend value, then it shouldn't surprise you if the index falls to 300, which is 400 points BELOW the long-term trend value. This corresponds roughly to Dow 3000, and that's where we're headed with mathematical certainty.

Now that you have a mainstream economist substantiating most of this, you should take appropriate action if you haven't already.

|

The latest estimates are that 2000 people have been killed and 400,000 are refugees who were displaced from their homes in last week's violence in the Fergana Valley region of Kyrgyzstan. Almost all victims are ethnic Uzbeks. According to Rferl, many refugees are afraid to return to their homes for fear of renewed violence. Wounded refugees have little chance of getting medical attention.

U.N. Secretary-General Ban Ki-moon announced on Friday that the U.N. is requesting $71 million in donations to provide emergency assistance in the form of food, water and tents to the refugees, to prevent a humanitarian disaster, according to VOA. The BBC World Service reports that the United States envoy Robert Blake has called the humanitarian situation "catastrophic," and says that the U.S. will contribute $31 million.

Evidence is growing that the violence was "instigated" by supporters of deposed former president Kurmanbek Bakiyev. Reuters quotes American Secretary of State Hillary Clinton as saying that Bakiyev may be to blame. "Certainly, the ouster of President Bakiyev some months ago left behind those who were still his loyalists and very much against the provisional government. There certainly have been allegations of instigation that have to be taken seriously."

From the point of view of Generational Dynamics, it's clear that, once started, the violence was viral and self-sustaining, indicating that the violence would have occurred sooner or later anyway, with the right trigger.

The situation has settled down for now, but there is fear that the crisis is far from over. The government is on the brink of collapse, according to an analysis in Spiegel. There are fears that Islamist groups from Pakistan and Afghanistan will move into the area to foment a wider regional conflict around the Fergana Valley.

Free checking will be disappearing, as banks increasingly charge $10-15 per month for checking accounts. WSJ

The Baltic Dry Index (BDI) is a measure of shipping costs for cargoes in "capesize" vessels -- vessels that are too large to fit through the Suez or Panama canals, and so must go around the Cape of Good Hope or Cape Horn. These vessels transport the huge cargoes of copper, iron ore and other commodities. The BDI surged to bubble levels in early 2008, thanks to enormous Chinese demand for commodities prior to the Beijing Olympics in August. Once the Olympics games ended, Chinese demand plummeted, creating a chain reaction that brought world wide trade and transportation almost to a standstill. The Baltic Dry Index plummeted an astounding 95% by April 8, 2009, and then recovered part of its losses. Now the BDI is falling sharply again -- 7% last week, and 34% in June. Bloomberg

(Comments: For reader comments, questions and discussion,

see the 19-Jun-10 News -- Omigod! NakedCapitalism and ZeroHedge discover mean regression! thread of the Generational Dynamics forum. Comments may

be posted anonymously.)

(19-Jun-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004