Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

A Greek default could have serious consequences.

Talk of restructuring Greece's debt (a form of default) has been increasing since two days ago when, as we reported, German Finance Minister Wolfgang Schaeuble broke the politicians' code of silence and said that debt restructuring would probably be necessary.

|

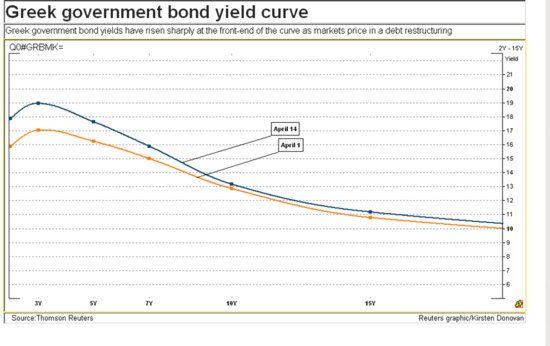

The yield (interest rates) on Greece's 10 year bonds rose to a euro lifetime high of 13.61% on Thursday and, surprisingly, the yield on Greece's 2-year bond hit 18.4%, up almost a full percentage point on the day, according to Reuters. These interest rates are displayed on the graph above.

The reason that this is surprising is because normally short-term bonds yield lower interest rates than longer-term bonds. If I'm going to lend you money for 10 years, I'll usually want to charge you a higher interest rate than if I'm only going to lend you money for 2 years.

However, the situation with Greece is, shall we say, all screwed up.

The talk is that Greece is going to give bond investors a 50% "haircut," meaning that if they invested $100,000 in bonds, then they'll lose $50,000. The reason that yields for 2-5 year bonds are much higher than the yields for 10 year bonds is because the rumors are that the greatest part of the haircut will be focused on the 2-5 year bonds, according to the article.

Since last year's bailout of Greece, it's been obvious to anyone who could count that the bailout would only be enough to make a few debt payments, after which Greece would be in as much trouble as before. Politicians have a practice of lying about problems until an actual crisis forces them to admit the truth, and then they say, "Who saw that coming?"

Thus, Olli Rehn, Europe's Economic and Monetary Affairs Commissioner, said the following on Thursday, according to Reuters:

"I am aware of the public debate and recent public statements as regards debt sustainability in Greece. We do not see debt restructuring as an option. Instead we are engaged in a revised and updated debt sustainabilty analysis, which we will do with the IMF and present in due course."

Ooooooooooooooooooooooh. He's going to do a revised and updated debt sustainabilty analysis. Gosh, I didn't know that he was going to do a new debt sustainabilty analysis. Well, that changes everything, doesn't it.

Meanwhile, back in Washington, everything you hear coming from Washington is bullshit. I mean total crap. They're arguing over nothing.

It's as if you had $100,000 in credit card debt, with $20,000 per year interest payments, and you argued with your wife whether next year you were only going to charge an extra $49,000 on your credit card, rather than $50,000 more. Nobody in Washington is saying anything about the existing debt and interest payments; all they're talking about is a tiny bit more or less ADDED ON to the existing debt. It's bad enough that it's happening, but we have to listen to politicians in Washington posture with one another and give us lectures that are total crap.

One of the most bizarre stories that we hear all the time is that there was a federal budget surplus in the last 1990s because of clever agreements by Bill Clinton and the Republican Congress, and that the big federal deficit in the last decade was from the Afghan/Iraq wars and the Bush tax cuts. (See, for example, my 2007 article, "Alan Greenspan blames the Republicans for the financial crisis.")

That makes absolutely no sense whatsoever. Everyone seems to believe this, even though it couldn't possibly be true, since the deficit began to increase in 2000, but the wars didn't begin until 2002, and the tax cuts didn't begin until 2003.

Here's a graph that appeared on the Calculated Risk blog in 2005, showing government income and outlays, but not including Social Security:

|

This graph shows that the huge deficit, which was supposedly caused by the Iraq war, actually began in 2000, the last year of the Clinton administration, with the Nasdaq crash. The outlays caused by the Iraq war were not particularly large by the standards of the preceding three decades. What mattered was the collapse of tax revenues, starting in 2000.

In fact, tax revenues depend on the state of the economy, and have almost nothing to do with anything else. Tax revenues went up in 2006 because of the credit bubble, and in 2009 they crashed dramatically. (See "US tax revenues fall sharply, the most since 1932.")

And there have been some news stories recently hinting that tax revenues are again falling. If that's true, then deficits this year will be much higher than politicians are predicting.

And then there's the health care bill.

As I've written several times, most recently in "1-Oct-10 News -- McDonald's threatens end to worker health benefits," until last year, by far the dumbest and most destructive economic policy enacted in Washington in my lifetime was the imposition, by President Richard Nixon's administration, of wage-price controls, to counter the national "emergency" represented by an inflation rate of about 4.5%. The controls program was an utter disaster. The inflation rate spiked up during the period of wage-price controls. It caused numerous shortages and mini-calamities, and did enormous damage until it was ended three years later.

The health care bill, which is wage-price controls for doctors, hospitals and health services, is in the process of doing even greater damage to the American economy. I've heard one commentator after another complain that businesses, especially small businesses, don't understand the health care bill, don't know how to comply with it, are afraid to hire people because it might obligate them to enormous health care costs. Many commentators have pointed out that it was to the benefit of many small businesses to drop health care coverage altogether, and pay a fine of $2000 per employee, rather than pay the ill-defined cost of health care. None of this matters, though, to the politicians in Washington, in this case the Democrats.

It's the same on Wall Street. They literally ALWAYS lie on CNBC and Bloomberg TV when they talk about price/earnings ratios (also called valuations). I've written about this before, even naming names in "5-Oct-10 News -- Goldman Sachs's Cohen gives price/earnings fantasy" and "24-Aug-10 News -- Ariel's Bobrinskoy gives price/earnings fantasy." Are these people crooks or simply incompetent? I report, you decide.

So what happens now? Maybe the Republicans and Democrats can get together and do a revised and updated debt sustainabilty analysis. That should fix everything.

Jerks.

And over in Europe, the situation in Greece has the potential of being a major crisis, even bigger than the crisis that followed the Lehman Brothers bank collapse in 2008. If Greece imposes a 50% "haircut," then banks around Europe will lose a great deal of money, and investors will assume that Ireland, Portugal and Spain will default as well. Things are moving more quickly now.

(Comments: For reader comments, questions and discussion,

see the 15-Apr-11 News -- Euro crisis grows as Greece approaches debt restructuring

thread of the Generational Dynamics forum. Comments may be

posted anonymously.)

(15-Apr-2011)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004