Dynamics

|

Generational Dynamics |

| Modern Generational Theory | |

| HOME WEB LOG COUNTRY STUDIES COMMENT FORUM | |

| DOWNLOADS FOURTH TURNING ARCHIVE ABOUT | |

The Modern Monetary Theory (MMT) hoax

by

John J. Xenakis

This morning's key headlines from GenerationalDynamics.com

|

In the past week, president Donald Trump has announced on Thursday a plan for "opening up" the American economy on a rolling basis, starting in May and continuing until a vaccine is found.

In the past week, several pharmaceutical companies have announced development of Covid-19 vaccines and treatments, raising hopes that the virus will be defeated by the fall, even though every medical expert I've heard says that 12-18 months will be required to perform all the testing phases before a new vaccine can be deployed.

In the past week, the stock market has swung upward, giving investors the hope that "the bottom has been reached," after a period where investors have been whiplashed by wild swings.

In the past week, several ongoing conflicts in the Mideast, Africa and Asia have become frozen because of fear of a "coronavirus tsunami," leading some people to hope that the Covid-19 crisis will end wars for a while. However, China and other countries have taken advantage of international pandemic distraction to launch military actions.

Each of these changes gives hope that the end of the Covid-19 crisis is sight, at least in the distance.

However, if you want to understand what's going on today, you have to understand that we don't have three or four different sets of problems (virus, stock market, real economy, global tensions) that can be solved independently.

The situation is almost infinitely more complex than that, but what we're seeing is the three major Western crises of the 20th century all merging into a single interlocking crisis today.

The three major cataclysmic Western crises of the 20th century are as follows:

In the 20th century, these crises occurred ten years apart, giving the world a chance to recover from one before having to deal with another.

But today, all three of these cataclysmic crises are occurring simultaneously. In addition, the WW I and WW II fault lines and timelines have been combined. Whether one of the currently "frozen" conflicts will eventually spiral into WW III is a matter of speculation.

The world is a complex system, where everything interlocks with everything else. So if two or more crises occur simultaneously, they interact with one another. When government officials try to deal with one crisis, they're hindered by problems with the other crises. So today's economic crisis will be much worse than the Great Depression, and World War III will be much worse than WW I and WW II combined.

On Thursday, president Trump announced a framework for opening up the US economy and returning to work. The framework is "data driven," and since the data can differ from state to state or region to region, the timeline will differ from region to region.

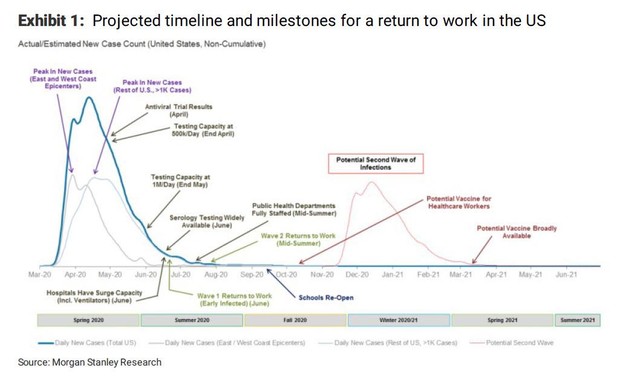

The chart at the beginning of this article was created by Morgan Stanley several days ago, so it doesn't precisely align with Trump's Thursday announcement. But it's close enough to serve as a reference model for discussion.

One issue highlighted by this chart is the date when a vaccine is broadly available. The chart assumes March 2021, which is a bit on the optimistic side, in view of what I've heard from experts.

Another issue highlighted by this chart is the "Potential Second Wave of Infections," starting in the fall, though it's not reflected "Daily New Cases" dark blue line. Scientists have already identified several minor mutations, with America's west coast dealing with the "Chinese virus," while the east coast dealing with the "European mutation."

The chart ignores the consequences of a significant mutation. In the 1918 Spanish Flu pandemic, the flu virus mutated over the summer into something much more virulent, resulting in far more deaths in the fall.

So the chart, like Trump's announced plan, might be called the "base scenario." It assumes that a lot of things will go right, but it's fragile, in that if one the assumptions is even partially wrong, then it could result in major changes to the plan.

So this chart, and Trump's plan, assume that a vaccine will be available in a year or a little later, which corresponds to the statements by experts. They also assume that any "second wave" can be controlled quickly, as Dr. Anthony Fauci on Trump's coronavirus team has promised, using experience gathered from the the first wave.

However, the biggest omissions in this chart, and in Trump's announced plan, is that there is no recognition of the other major crises that I've listed above -- a stock market crisis and a war crisis.

As regular Generational Dynamics readers are well aware, the stock market is in a huge bubble, with stocks far overpriced. By contrast, stocks were far underpriced in 1918 at the time of the Spanish Flu pandemic.

The S&P 500 price earnings ratio can tell us whether stocks are overpriced or underpriced. The historic average of the P/E ratio is 14. Here are the three values relevant to the current discussion:

This is an illustration of what I mean by simultaneous crises today.

There was no stock market bubble in 1918, the time of the Spanish Flu, and it was literally almost impossible to have a stock market panic at that time. The bubble grew during the 1920s, and burst ten years later, in the 1929 stock market crash. So the Spanish Flu crisis and the stock market crisis were ten years apart.

But today, the Covid-19 pandemic crisis is occurring SIMULTANEOUSLY with a huge stock market bubble. With the market far overpriced in a bubble, a panic could occur at any time.

This doesn't mean that a stock market panic must necessarily occur, but it means that the probability is high that it will occur. This is in contrast to 1918, when a stock market panic was almost impossible.

The timelines in the Morgan Stanley chart above, as in Trump's announced plan, assume that there will be no stock market panic. This means that the plans assume that funds will be available to pay for all the testing and bailouts and loans and unemployment benefits. Any sane person reading news must be as shocked as I am these days to see the government distribute trillions of dollars in newly "printed" money, as if they were distributing marbles. This is tied into the current economic fad, "Modern Monetary Theory (MMT)" that I'll describe below.

As regular Generational Dynamics readers are well aware, most of the world is in a generational Crisis era, with high levels of xenophobia and nationalism in almost every nation. This means that most countries, including China, Japan, Turkey, Russia, the EU, the United States, and many others have no fear of war, have no hesitation to set "red lines" or to cross other countries' "red lines," without understanding that such actions can quickly spiral into major wars.

This was not the case for Western nations in 1918, since World War I was just finishing up, and everyone was war-weary. This is an enormous difference between 1918 and today.

As regular readers know, Generational Dynamics predicts that there is an approaching Clash of Civilizations world war, pitting the "axis" of China, Pakistan and the Sunni Muslim countries against the "allies," the US, India, Russia and Iran. Part of it will be a major new war between Jews and Arabs, re-fighting the bloody the war of 1948-49 that followed the partitioning of Palestine and the creation of the state of Israel. The war between Jews and Arabs will be part of a major regional war, pitting Sunnis versus Shias, Jews versus Arabs, and various ethnic groups against each other.

Furthermore, as I've written in the past, China does not want a war with the US. However, China is planning a war of extermination against Japan, in revenge for Japan's atrocities in World War II, and also a war of annexation against Taiwan. China is developing a huge arsenal of missiles and ships to attack the United States because the Chinese know that the US will defend Japan and Taiwan when they're attacked by China.

Those interested in understanding the dynamics of China's plans should read my book, "World View: War Between China and Japan: Why America Must Be Prepared" (Generational Theory Book Series, Book 2), June 2019 Paperback: 331 pages, over 200 source references, $13.99 https://www.amazon.com/World-View-Between-Prepared-Generational/dp/1732738637/

So we have war tensions growing in many places in the world, during this generational Crisis era. It's impossible to predict how the Covid-19 pandemic is affecting whatever war plans might be in progress in any of these countries. In the Mideast, we're seeing some ongoing conflicts in Syria and Yemen frozen in place because of the Covid-19 pandemic threat. On the other hand, there are reports that China is taking belligerent actions in the South China Sea and East China Sea in order to take advantage of how the Covid-19 pandemic has distracted the United States.

A decision to go to war during a generational Crisis era is a "chaotic event" (in the sense of Chaos Theory), which means something trivial (like a butterfly flapping its wings) could affect the nature or the time of the decision to go to war. The Covid-19 pandemic is not a trivial event, of course, but the same principle can apply. So if we apply that reasoning to China, then the pandemic may cause the CCP thugs to say, "We'd better wait a while longer to make sure the army is OK," or it may cause the CCP thugs to say, "Since Japan is flat on its back from the pandemic, now is the time to strike." It could go either way.

This is a brief summary of the accusations being directed against China as the source of the pandemic. These are important because they may play a role in the anger and xenophobia directed against China, and in the defensiveness and xenophobia directed by China against other countries.

It's now widely accepted that China could have used standard containment measures (contact tracing and isolation) to stamp out Covid-19 fairly quickly in December. Instead, the CCP censored all news and social media reports of the growing danger, and forced the doctor, Dr. Li Wenlian, who had identified and reported about the virus, to sign a phony confession. Dr. Li died of the disease himself, and other doctors were "disappeared."

China repeatedly censored any reports of the virus, and denied that there was any human-to-human transmission for weeks. China's claims would not have been believed, since China lies about everything, but Tedros Adhanom Ghebreyesus, director of the World Health Organization (WHO), vouched for China's lies.

These lies lulled many countries, in Europe, Asia and the United States, into a sense of complacency. If it hadn't been for those lies, the pandemic would have been far less severe, because the US and other countries would have started reacting much sooner.

There are some additional issues:

As things stand, many nations are facing the pandemic because China censored the facts and lied about them. If it turns out that China did so on purpose, in order to infect other nations, then some of those nations might consider it an act of war.

All the actual facts will be coming out over the next few weeks.

I listen all the time to economists and financial analysts on CNBC, Bloomberg TV, Wall St Journal and elsewhere, often described as "reknowned" or "legendary." These people are idiots. They have no particular skills at explaining or forecasting the economy than any random seven-year-old child. Their only skill is to dress up their own political biases or their firm's sales pitches into words that will get them on TV.

There are so many examples. One was the housing bubble in the mid-2000s decade. That there was a housing bubble was obvious, to me and to others, as early as 2004, when Alan Greenspan said there was a housing bubble. But for years the "experts" on CNBC and in the Wall Street Journal kept saying that "Housing prices can't go down -- people have to live somewhere," and "Banks won't foreclose -- it's not in their interest to do so" and "These housing construction firms know what they're doing, and they wouldn't be building houses if it were just a bubble."

It wasn't until 2009 that I heard a tv analyst talk about a housing bubble -- they said that it had occurred several years earlier. These "reknowned" or "legendary" experts only recognized the housing bubble long after it had burst. That's why I call them idiots -- they can't even see the most obvious things.

Economists are no different from politicians, and I see this all the time. SAT scores have been plummeting since the Boomers were in school. Since then, it became fashionable to major in idiotic subjects like sociology or women's studies, and then call yourself an "expert." You can see this in politicans, in computer programmers, and in economists.

Another example, which I've written about many times, is that economists are unable to explain the tech bubble that occurred in the late 1990s -- why it occurred at all and why it didn't occur ten years earlier or later. The economist idiots just say, "Oh, it's because of the internet," which is no explanation at all, especially since it doesn't explain why it didn't happen in the 1980s, when millions of programmers were developing PC software in the basements.

As Generational Dynamics readers are well aware, the 1990s tech bubble occurred at exactly the time the survivors of the 1929 stock market crash and Great Depression all disappeared (retired or died). As long as they were in charge, as they were in the 1980s, PC software investments were made with care. But when their children were in charge, starting in the 1990s, internet software investments were made with reckless abandon.

Those concepts are beyond the grasp of economists and analysts, because understanding it requires more knowledge than you get in fourth grade. So they're simply incapable of understanding this.

Economists and analysts may not have any knowledge beyond the fourth grade, but that doesn't stop them from becoming drug addicts. And for today's economists, the cocaine-like addiction drug is known as "The Modern Monetary Theory" (MMT).

In centuries past, when Kings wanted to "print money," they actually had to run some sort of printing press. But not today. Today, anyone can "print money" simply by creating and issuing bonds. The US government "prints money" by selling Treasury bonds.

When Barack Obama took office, the national debt was $10.6 trillion. When Donald Trump took office, the national debt was $19.9 trillion. But this year, the government is going on a massive spending spree. There was a $2.1 trillion bailout bill, and there are more bailouts and infrastructure programs planned. The total national debt will go to around $27 trillion.

So doesn't that debt have to be repaid? The magic of MMT says that it doesn't.

Here are the elements of MMT:

You read this, and you might think it's something out of a comic book, but it's considered serious economic theory today (though controversial).

The first fallacy is that the government would raise taxes to control the hyperinflation. That's ridiculous. Neither Democrats nor Republicans would ever agree to such a tax increase, and decades of history prove that's true.

The biggest fallacy of all in MMT is that it causes inflation or hyperinflation. That's not what happens in a generational Crisis era, like today, when almost everyone is in debt. Today the country and the world are in a classic deflationary spiral, and anyone counting on inflation is going to be badly hurt.

MMT is the ultimate form of drug addiction.

It's like a drug addict who has already lost his home, his family and his job, and who needs to take more and more drugs to feel ok. Taking more and more drugs only postpones and worsens the problems he has to face, but it may be the best choice for the time being because it postpones the problems he has to face. In the meantime, he keeps hope alive. Maybe he'll win a $10 million lottery, so he'll be able to use the money to get off drugs, and get his home and family back. Keep taking drugs, and keep hope alive as long as possible. If something can't go on forever, then it won't.

So that's why so many economists and politicians hope for and predict inflation. Just as a drug addict might hope for winning the lottery, economists and politicians hope for hyperinflation, which is their version of winning the lottery, since hyperinflation wipes out debt. It's a dream fantasy.

When people have tons of money, then they buy lots of things, creating inflation.

But people have NO money today. They have the opposite. Instead of tons of money, they have tons of debt, which is the opposite. They have tons of interlocking debt.

They do not have the money to spend or the desire to spend, so there won't be hyperinflation. You have a clue what's going on when the federal government is tying its bailouts to requirements to spend. If the government has to force people to spend there won't be inflation. If people won't spend, then there'll be deflation, the opposite of inflation.

The way the economy will fail is when somebody's margin call or somebody's bankruptcy triggers a chain reaction of debt payment failure. That's what a deflationary spiral is, as one bankruptcy triggers another one. This is what I used to refer to as the Principle of Maximum Ruin: The maximum number of people are ruined to the maximum extent possible. Inflation is a fantasy.

From the point of view of Generational Dynamics theory, hyperinflation can only occur in generational Awakening and Unraveling eras, as in the case of Germany's Weimar Republic or Zimbabwe. In a generational Crisis era, when all the bills come due, it's not inflation but it's a massive deflationary spiral that occurs. If I have enough time left, then at a future date I'll write about the theory of how all this works. I can't get into it now, because this article is long enough as it is.

At the beginning of this article, I referenced Donald Trump's plan for "opening up" the economy, and I referenced the Morgan Stanley plan, as illustrated by the diagram at the beginning of the article.

Those two plans differ in details, but from a high level, they're pretty much the same plan. They portray the most optimistic scenario for ending the Covid-19 pandemic crisis in America. However, these plans overlook the consequences of several real possibilities.

At the beginning of this article, I listed three major 20th century crises:

In the 20th century, these crises occurred ten years apart. But from the point of view of Generational Dynamics, they are likely to merge in the 21st century.

Generational Dynamics predicts that all of the items in this list of events will occur, though not necessarily in the two year time frame contemplated by the "opening up" scenarios. However, bear in mind that the IMF has predicted the worst global recession since the 1930s Great Depression. So with debt around the world increasing almost exponentially, and with ethnic and racial tensions growing around the world because of Covid-18, the probability that they'll occur in the next year is substantially higher than at any time since the end of World War II.

John Xenakis is author of: "World View: War Between China and Japan: Why America Must Be Prepared" (Generational Theory Book Series, Book 2), June 2019, Paperback: 331 pages, with over 200 source references, $13.99 https://www.amazon.com/World-View-Between-Prepared-Generational/dp/1732738637/

John Xenakis is author of: "World View: Iran's Struggle for Supremacy -- Tehran's Obsession to Redraw the Map of the Middle East" (Generational Theory Book Series, Book 1), September 2018, Paperback: 153 pages, over 100 source references, $7.00, https://www.amazon.com/World-View-Supremacy-Obsession-Generational/dp/1732738610/

John Xenakis is author of: "Generational Dynamics Anniversary Edition - Forecasting America's Destiny", (Generational Theory Book Series, Book 3), January 2020, Paperback: 359 pages, $14.99, https://www.amazon.com/Generational-Dynamics-Anniversary-Forecasting-Americas/dp/1732738629/

Sources:

Related Articles:

(Comments: For reader comments, questions and discussion,

see the Generational Dynamics World View News thread of the Generational

Dynamics forum. Comments may be posted anonymously.)

(19-Apr-2020)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2020

Web Log Summary - 2019

Web Log Summary - 2018

Web Log Summary - 2017

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2020

Web Log - November, 2020

Web Log - October, 2020

Web Log - September, 2020

Web Log - August, 2020

Web Log - July, 2020

Web Log - June, 2020

Web Log - May, 2020

Web Log - April, 2020

Web Log - March, 2020

Web Log - February, 2020

Web Log - January, 2020

Web Log - December, 2019

Web Log - November, 2019

Web Log - October, 2019

Web Log - September, 2019

Web Log - August, 2019

Web Log - July, 2019

Web Log - June, 2019

Web Log - May, 2019

Web Log - April, 2019

Web Log - March, 2019

Web Log - February, 2019

Web Log - January, 2019

Web Log - December, 2018

Web Log - November, 2018

Web Log - October, 2018

Web Log - September, 2018

Web Log - August, 2018

Web Log - July, 2018

Web Log - June, 2018

Web Log - May, 2018

Web Log - April, 2018

Web Log - March, 2018

Web Log - February, 2018

Web Log - January, 2018

Web Log - December, 2017

Web Log - November, 2017

Web Log - October, 2017

Web Log - September, 2017

Web Log - August, 2017

Web Log - July, 2017

Web Log - June, 2017

Web Log - May, 2017

Web Log - April, 2017

Web Log - March, 2017

Web Log - February, 2017

Web Log - January, 2017

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004