Dynamics

|

Generational Dynamics |

| Modern Generational Theory | |

| HOME WEB LOG COUNTRY STUDIES COMMENT FORUM | |

| DOWNLOADS FOURTH TURNING ARCHIVE ABOUT | |

Understanding inflation, deflation and the CPI

by

John J. Xenakis

This morning's key headlines from GenerationalDynamics.com

|

In mid-May, the Bureau of Labor Statistics (BLS) published its monthly computation of the change in the Consumer Price Index (CPI) of 4.2%, the highest rate since September 2008. This means that consumer prices had risen 4.2% in the preceding 12 months.

The media went hysterical and started predicting hyperinflation. A typical media statement by so-called "experts" was some variation of the following:

"Inflation exploded in April at an annual rate of 4.2%, the highest rate since Sept 2008, so inflation is already occurring, and we can expect much higher inflation or hyperinflation in the next few months!"

Long-time readers are aware that I have a low opinion of economists, and the above statement is one more example. If the inflation rate was even higher in September 2008, then why wasn't there hyperinflation in 2009? These "experts" are too dumb to even ask that question. As it turned out, there was mild deflation in 2009, so the Law of Reversion of the Mean took hold.

Then in mid-June, the BLS reported a CPI increase of 4.99%. Here's how CNBC reported it:

"The consumer price index, which represents a basket including food, energy, groceries, housing costs and sales across a spectrum of goods, rose 5% from a year ago. Economists surveyed by Dow Jones had been expecting a gain of 4.7%.The reading represented the biggest CPI gain since the 5.3% increase in August 2008, just before the worst of the financial crisis sent the U.S. spiraling into the worst recession it had seen since the Great Depression."

This was actually a pretty good report, since it balanced the inflation hysteria with a sober report about what happened in 2009.

However, it didn't stop the hysteria from the so-called "experts" on TV, who have been predicting hyperinflationary doom, because they just can't seem to grasp that this CPI change is a temporary spike.

The following page contains a table of historical changes in the CPI month by month for the preceding 12 months, from 1913 to the present:

Historical Consumer Price Index Change

If you'd like, you can copy and paste the table on that page into a text file or into a spreadsheet, or you can just read the table on the web page.

You should spend a few minutes studying that table. It shows how the current spike in inflation is not unusual in the last three decades, and that there were previous larger spikes that didn't lead to sustained inflation.

As I've written many times, the "experts" have been consistently wrong about inflation since 2003, when I started keeping track, and predicted a deflationary era. For the last 70 quarters, the "experts" predicted that there would be inflation or super-inflation in the following quarter, and for 70 quarters they've been wrong every quarter and I've been right every quarter. And now it's the same thing all over again.

It would be VERY nice if even one of these "experts" at least acknowledged that they've been wrong for the last 70 quarters, and explained why "this time it's different" this quarter. But they never do.

When I first wrote about deflation in 2003, I really didn't understand what was going on, and in fact I said that inflation is "very mysterious." But I knew we were in a stock market bubble, and I knew that public debt was very high, and I knew that we were in a generational Crisis era, so I assumed that we would be following the deflationary path of the 1930s, and that we were in a "deflationary era."

That turned out to be correct. But now, having seen what happened in the last almost 20 years, I now have a much better idea about what a "deflationary era" or "disinflationary era" means. It means two things:

There are two economic measures that define a deflationary era:

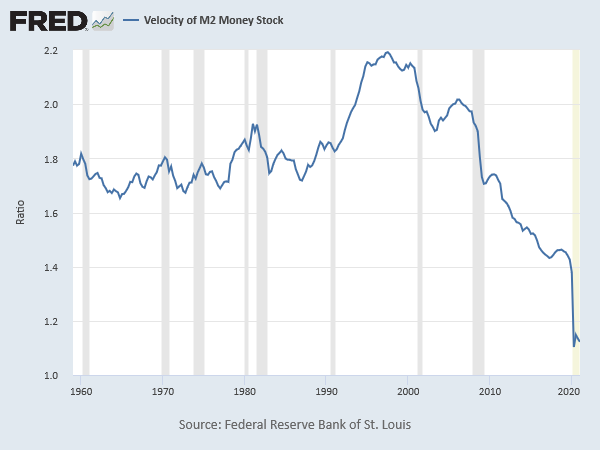

Both of these economic measures are generational, in the sense that they occur during generational Crisis eras, and are the opposite of what occurred in the generational Awakening era of the 1970s. During the 1970s, people were still recovering from the Great Depression and public debt was extremely low, so people were willing to incur debt and spend money, resulting in a high velocity of money in the 1970s, and inflation.

The global financial crisis of 2007-2008 caused many people to go bankrupt or to lose their homes, and that made people extremely averse to spending. This reluctance to spend was measured by the velocity of money, which has been falling sharply since then. You can see that clearly by the graph at the beginning of this article.

This doesn't cause deflation, but it does put a lid on inflation during this deflationary era. It also means that when there's a burst of inflation caused by scarcity, like today, it will not encourage people to spend more, but instead will cause people to become more cautious and pull back even further, often resulting in a brief period of deflation as the scarcity unwinds. This happened in 2009, following an inflationary spike in 2008.

The second factor, besides velocity of money, is increasing public debt.

But today, public debt is extremely high and growing. This feeds into the velocity of money, since people in debt are very reluctant to spend and pay high prices, which would only increase their debt.

Furthermore, the high public debt leads to the second outcome of a deflationary era, namely that it ends with a sharp deflationary crash. This is because of the chain reaction that starts at the beginning of a financial crisis. As debts come due, people are no longer able to borrow money to roll debts over, so they have to sell assets and collect money owed through other people's interlocking debts, and that forces other people to sell their assets, resulting in a chain reaction and a full-fledged deflationary spiral.

I was actually expecting this to happen in 2008, with the collapse of Lehman and other banks. But something happened that I didn't expect -- that the Fed would flood the markets with "quantitative easing" (printed money), which provided banks with plenty of liquidity so that they could lend money to roll debts over. The problem is that this exacerbated the problem of interlocking debt and extended it around the world, so that the next crisis won't be resolved by quantitative easing, especially if it happens in the context of war.

Here's a final ironic point. When the US government "prints money," knee-jerk economists say that this will result in "too many dollars chasing too few goods" and inflation. This was true in the 1970s, but the opposite is true in a generational Crisis era, which the knee-jerk economists don't grasp at all. Printing money today does not generate inflation today. Printing money today increases public debt, which makes people more cautious and lowers the velocity of money. So printing money today does not cause inflation. It creates disinflationary pressure, and eventually will make the deflationary crash much larger. So printing money today actually causes more deflation.

You know, I used to think that the amount of money in the economy (M2) at least had some effect on the inflation rate, but as time has gone on, I increasingly believe that the amount of money has absolutely nothing to do with the inflation rate, at least in the American economy.

The inflation rate is not a monetary phenomenon. It's a generational phenomenon. It's not the Fed that affects the inflation rate. It's the people and the mood of the people that affect the inflation rate.

Sources:

Related Articles:

(Comments: For reader comments, questions and discussion,

see the Generational Dynamics World View News thread of the Generational

Dynamics forum. Comments may be posted anonymously.)

(15-Jun-2021)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2021

Web Log Summary - 2020

Web Log Summary - 2019

Web Log Summary - 2018

Web Log Summary - 2017

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2021

Web Log - November, 2021

Web Log - October, 2021

Web Log - September, 2021

Web Log - August, 2021

Web Log - July, 2021

Web Log - June, 2021

Web Log - May, 2021

Web Log - April, 2021

Web Log - March, 2021

Web Log - February, 2021

Web Log - January, 2021

Web Log - December, 2020

Web Log - November, 2020

Web Log - October, 2020

Web Log - September, 2020

Web Log - August, 2020

Web Log - July, 2020

Web Log - June, 2020

Web Log - May, 2020

Web Log - April, 2020

Web Log - March, 2020

Web Log - February, 2020

Web Log - January, 2020

Web Log - December, 2019

Web Log - November, 2019

Web Log - October, 2019

Web Log - September, 2019

Web Log - August, 2019

Web Log - July, 2019

Web Log - June, 2019

Web Log - May, 2019

Web Log - April, 2019

Web Log - March, 2019

Web Log - February, 2019

Web Log - January, 2019

Web Log - December, 2018

Web Log - November, 2018

Web Log - October, 2018

Web Log - September, 2018

Web Log - August, 2018

Web Log - July, 2018

Web Log - June, 2018

Web Log - May, 2018

Web Log - April, 2018

Web Log - March, 2018

Web Log - February, 2018

Web Log - January, 2018

Web Log - December, 2017

Web Log - November, 2017

Web Log - October, 2017

Web Log - September, 2017

Web Log - August, 2017

Web Log - July, 2017

Web Log - June, 2017

Web Log - May, 2017

Web Log - April, 2017

Web Log - March, 2017

Web Log - February, 2017

Web Log - January, 2017

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004