Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

And the Democrats refuse to commit to end Iraq war even by 2013.

Al-Qaeda expert Lawrence Wright provided a kind of "screenplay" scenario for the capture of Osama bin Laden.

One of the most widely asked questions today is: Why haven't we yet caught Osama bin Laden?

Lawrence Wright, author of the Pulitzer Prize winning book, The Looming Tower: Al-Qaeda and the Road to 9/11, provided an answer to that question and another one: What would we do if we captured him? The answers were provided on Face the Nation on Sunday:

|

Lawrence Wright: It may very well be, Bob, that we more or less HAVE found him. We know that he's in the tribal areas, probably. And yet, we decided not to get him, because going into the tribal areas to actually find him might destabilize Pakistan. At least this is the view of a lot of American policy makers. So in a general way, we have found him. In a specific way, we don't know exactly where he is, probably, but the hunt for bin Laden has essentially stopped at the borders.

Bob Schieffer: If we caught bin laden, what would we do with him?

Lawrence Wright: The CIA asked me that question, because I'm a screenwriter.

They appealed to me for a scenario, and I said I can't write a screenplay for the CIA because I'm a reporter, but I'll tell you what I think, in the form of an op-ed.

First of all, he's the most famous man in the world - he's going to be one of the most famous men in history. So you don't just deal with bin Laden the man. You have to deal with "bin-Laden-ism" and the legacy that he's going to leave for untold generations.

So if you find him, don't kill him, because that's what he wants, and his martyrdom will seal that legacy in amber for all eternity.

But don't bring him to America - not right away. Take him first of all to Kenya where, on August 7, 1998, he set off a bomb in front of the American embassy and killed over 200 people. More than 150 were blinded by the flying glass. Let Osama bin Laden sit in a courtroom in Nairobi and tell 150 blind Africans that he was just striking at a symbol of American power.

Then, after that, take him to Tanzania where, on the same day, he set off another bomb in front of another American embassy killing 11 people, all of the Muslims.

Al-Qaeda excuses that because it was Friday, and "good Muslims" would be in a mosque. It would be a wonderful venue to ask, "What is a good Muslim?"

Then you can have him answer for the Cole bombing, and the 3000 people who died on 9/11, and you could take him so many other places. Just take him one last place. Just take him home to Saudi Arabia, where hundreds of Saudis and ex-pats have died, and try him under Sharia law. And if he's convicted, he'll be taken to a square, a "chop-chop square" in downtown Riyadh. And the Saudi custom is that the executioner goes out and beseeches the crowd, who are composed of the families of the victims of the condemned man to forgive him. And if they can't do that, then the executioner will do his job and bin Laden will be taken and buried in an unmarked Wahhabi graveyard. I think in that way you can begin to roll back some of his legacies."

Wright later added that bin Laden's al-Qaeda has suffered many defeats and is weakened, but worldwide al-Qaeda has been strengthened because of alliances among many terrorist groups.

I would add the following to this, from a Generational Dynamics point of view.

Suicide bombings and other terrorist acts committed by groups loosely related to al-Qaeda are explained by generational factors, as I described in a series of articles following the July 7, 2005, London subway bombings. This was summarized in last December's article on the MI5 chief's speech, saying that the U.K. population contains thousands of Islamic terrorists and sympathizers.

We're seeing that suicide bombers only come from societies that have entered generational Crisis periods, and not before. This indicates that when a society enters a generational Crisis period, the society becomes fundamentally changed, so that the creation of suicide bombers becomes possible. (And as I showed in my analysis on Iraqi Sunnis turning against al-Qaeda in Iraq, there are virtually NO Iraqi suicide bombers, since Iraq is in a generational Awakening era; they all have to be imported from Jordan or Saudi Arabia.)

Further findings, obtained by combining Generational Dynamics research with Robert Pape's study of suicide bombers, published in the book Dying to Win, we find that suicide bombers justify their terrorist acts as "altruistic suicide." Pape found that suicide bombers most likely come from countries occupied by another country, and his research shows that they come overwhelming from countries that have passed through a generational crisis era without having a crisis war. In these countries, the parents have accepted the occupation, albeit bitterly and reluctantly. But their impatient children take it upon themselves to free their parents' generation from this occupation by this unique form of altruistic suicide.

In the case of the London subway bombers, the perpetrators had backgrounds in Pakistan and were bitter about the Kashmir region, disputed between Pakistan and India. They were England-born citizens, but had developed a generational "Hero - Prophet" relationship with radical clerics in Pakistan; that is, the suicide bombers become "heroes" through their altruistic suicide, and they're guided by the Pakistani clerics who assume a kind of spiritual "prophet" role toward the "heroes."

From the point of view of Generational Dynamics, this Prophet/Hero relationship is extremely powerful. This is how crisis wars begin. During generational Crisis eras, young people are confused by the lack of direction in society as a whole, and they turn to these "Prophets," based on the appeal that they can become "Heroes."

So Lawrence Wright is correct when he says that al-Qaeda linked groups are becoming stronger in many countries around the world, as they're fed by foreign fighters linked to countries in generational Crisis eras.

And Wright is TECHNICALLY correct when he said that Osama bin Laden's al-Qaeda has been weakened militarily.

But what I've shown is that the bin Laden's al-Qaeda has been getting increasingly STRONGER in this spiritual "Prophet" sense. Al-Qaeda linked terrorists in many countries may not be working under bin Laden's direct orders, but they're working under the powerful influence of bin Laden's "teachings," as adopted by clerics in Pakistan.

Lawrence Wright's warning not to turn bin Laden into a martyr is certainly correct. A dead, martyred bin Laden would become an even more powerful symbol to these Pakistani "Prophet" clerics.

--------------

Another issue touched on at various times in the Sunday news talk shows is that the leading Democratic candidates for President have refused to commit to end the Iraq war even by 2013.

Brookings Institution does a full reversal on Iraq war:

As Americans withdraw from cities, Brookings admits there's no civil war....

(1-Jul-2009)

Stock markets in Iraq and Iran are surging.:

Iran's President Mahmoud Ahmadinejad says "it is the end of capitalism."...

(17-Oct-2008)

On "60 Minutes," Bob Woodward makes ridiculous claims about Iraq.:

He says the surge succeeded because of some magic new military technique....

(7-Sep-2008)

Iraq's Shiite cleric Moqtada al-Sadr turns from arms to "culture":

This follows several Sunni "Tribal Awakenings" to expel al-Qaeda....

(10-Aug-2008)

Obama continues to damage his candidacy with his Iraq policy.:

Obama is hurting himself by bobbing and weaving on the success of the "surge."...

(27-Jul-2008)

The new Iraqi "civil war" fizzles out, as expected:

Radical Shia cleric Moqtada al-Sadr called for a cease-fire on Sunday,...

(1-Apr-08)

The Iraq war may be related to the bombing of Hiroshima and Nagasaki.:

On the first anniversary of the successful "surge" strategy,...

(17-Feb-08)

Casualties are down sharply in Iraq.:

This issue has been a spectacular validation of Generational Dynamics theory....

(31-Oct-07)

As Turkey prepares to invade northern Iraq, it's isolating itself internationally:

A new "Young Turks revolution" is reestablishing strong Turkish nationalism....

(29-Oct-07)

Washington Post says that al-Qaeda in Iraq is "crippled":

Meanwhile, Iraqi citizens' political opposition to America is growing....

(16-Oct-07)

Antiwar Democrats are freaking out over Bush's Vietnam - Iraq war comparison.:

The same people who have been comparing Iraq to Vietnam for years...

(24-Aug-07)

Iraq: Suicide bombers interrupt celebrations in Baghdad over soccer win:

Iraq's stunning 4-3 soccer victory over South Korea in the Asia Cup semi-final...

(26-Jul-07)

The al-Askariya Shrine in Samarra, Iraq, is bombed again:

Last year's bombing triggered months of vicious sectarian violence in Baghdad,...

(14-Jun-07)

Congress votes to fund Iraq war without deadlines:

The result shows conflicting anxieties during America's Crisis era....

(24-May-07)

Senator Joe Biden wants to move troops from Iraq to Darfur civil war:

Saying on Meet the Press that we should remove troops from Iraqi "civil war,"...

(29-Apr-07)

NY Times columnist Thomas Friedman shows ignorance and evasiveness about al-Qaeda in Iraq:

In an interview that appeared on CNN on Sunday,...

(24-Apr-07)

BBC kills an Iraqi war story because it's "too positive":

But a drama showing British troops brutalizing civilians is perfectly fine....

(11-Apr-07)

Tens of thousands of Shi'ites protest against American "occupiers":

In what appeared to be a grand, party-like atmosphere,...

(10-Apr-07)

Iraq's Moqtada al-Sadr tells followers to attack Americans, not each other:

This could be good news....

(9-Apr-07)

Iraqi Sunnis are turning against al-Qaeda in Iraq :

This is exactly the kind of thing that generational theory predicts.

(1-Apr-2007)

New optimistic poll of Iraqi people barely mentioned on Sunday TV news shows:

And Bob Shieffer on CBS's "Face the Nation" asked really dumb questions of Secretary of Defense Robert Gates....

(19-Mar-07)

Robert Gates on "civil war" in Iraq.:

Following the release of the Iraq National Intelligence Estimate on Friday,...

(2-Feb-07)

News as theatre: NBC announces it will call Iraq war a "civil war":

On Monday morning on the "Today Show,"...

(29-Nov-06)

President Bush's reference to Vietnam War "Tet Offensive" has journalists in a tizzy:

Airhead journalists have completely missed the point, and the real danger....

(20-Oct-06)

Learning-disabled journalists and politicians continue to predict Iraq civil war:

Occasionally journalists take a break from their heavy-breathing over Congressional pages,...

(8-Oct-06)

General John Abizaid says there'll be no troop cutbacks in Iraq:

This is hardly a surprise to me, though not for the reasons most people give....

(19-Sep-06)

Debate over civil war in Iraq rages over semantics:

An actual crisis civil war in Iraq is impossible, but it's now embroiled in the November elections,...

(23-Aug-06)

Washington becomes hysterical again over an Iraqi 'civil war' :

A civil war in Iraq is impossible, as I've said many times, because only one generation has passed since the Iran/Iraq war of the 1980s. Here's some additional historical information.

(7-Aug-2006)

Israel's war against Hizbollah and Lebanon forces Muslims to choose sides : The war is part of a larger Shi'ite-Sunni struggle, and a stopgap ceasefire will create a worsening environment leading to a much more chaotic situation within a few months (25-Jul-2006) Speculations about a stock market panic and crash : Will there be a stock market panic next week, next month, or next year, and will it lead to a crash? We speculate on some possibilities. (31-May-2006) Journalists have a 'civil war in Iraq' orgy over the weekend:

It's hard to remember when news shows had so much sheer non-stop nonsense...

(21-Mar-06)

I just heard on CNN International: "The threat of civil war in Iraq is over.":

Surprise! Surprise! The press corps was 100% wrong, and I was right....

(28-Feb-06)

Fear of Iraqi civil war nears hysteria:

But there is NO CHANCE WHATSOEVER of a civil war....

(24-Feb-06)

Bombing of 1200 year old Shi'ite mosque inflames Iraq to the verge of massive civil war rhetoric:

Shi'ites conducted over 90 revenge attacks on Sunni shrines on Wednesday,...

(23-Feb-06)

Vitriolic Iraq war politics erupts in Washington:

But the basics of the Iraq war haven't changed a bit....

(21-Nov-05)

After President Bush's speech: What next for Iraq?:

With growing insurgency violence and flagging public support, what's America's "end strategy" in Iraq?...

(1-Jul-05)

Iraqi Sunni and Shi'ite clerics call for restraint:

Analysts, pundits and journalists are still predicting civil war, and they're still getting it wrong....

(23-May-05)

The chaotic Iraq election is only two days away:

The election is on Sunday, January 30, and no one has a clue what's going to happen....

(28-Jan-05)

Brent Scowcroft predicts an "incipient civil war" for Iraq:

Pundits are returning to wishful thinking as the January 30 election approaches...

(09-Jan-05)

Can we withdraw from Iraq in 2005?:

Suddenly the Washington buzz is that whoever wins - Bush or Kerry - will begin to withdraw American troops from Iraq. We look at two historical examples to predict scenarios.

(16-Oct-2004)

Fallujans are getting angry with insurgents:

Just a few hours after my posting that al-Zarqawi's most formidable enemy may be the 40-50 year old mothers of Fallujah,...

(13-Oct-04)

Al-Sadr's Shi'ite militia fighters turn in their weapons:

The war in Iraq took a significant turn this week when the Shi'ite militias agreed to disarm,...

(13-Oct-04)

The press is talking about another "uprising" in Iraq. Yawn.:

Nothing shows more how clueless the press is about what's going on in Iraq than this constant talk about civil war and uprisings....

(7-Aug-04)

Iraq Today vs 1960s America (Revised):

They have much in common: Bombings, assassinations, student demonstrations, violent riots, calls for insurrection and civil war and harsh rhetoric. That's much more than a coincidence.

(8-May-2004)

What Iraqi Civil War?: Early in 2003, I predicted that there would be no popular uprising against the Americans, and that there would be no civil war. After the overthrow of Saddam, I said that an Iraqi civil war was impossible. Despite the constant near-hysteria of the politicians, journalists and high-priced analysts, I've been right so far. Here's why. (09-Apr-04) Anti-Shi'ite Terror Attacks in Iraq, Pakistan: So far, Sunni and Shi'ite leaders in Iraq aren't taking the bait. (2-Mar-04) Terrorist suicide bombings in Iraq may backfire against terrorists: During an awakening period, terrorist acts cause masses of people to shrink from more violence. (19-Aug-03) | ||

Here's an AP news story on this subject:

"I think it's hard to project four years from now," said Sen. Barack Obama of Illinois in the opening moments of a campaign debate in the nation's first primary state.

"It is very difficult to know what we're going to be inheriting," added Sen. Hillary Rodham Clinton of New York.

"I cannot make that commitment," said former Sen. John Edwards of North Carolina."

This doesn't surprise me in the least. Here are some of the points that I've been making about Iraq on this web site since 2003:

As I've said many times on this web site in the last few years, my

expectation is that we'll still be in Iraq when the Clash of

Civilizations world war begins, and we'll withdraw at that time

because our forces will be needed elsewhere.

(30-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Saying that it's no better today than it was 50 years ago, former Fed chairman Alan Greenspan told Jon Stewart of Comedy Central's Daily Show that forecasting hasn't improved because human nature can't be changed.

|

Here's my transcript of the final portion of the interview:

And the one thing that all human beings do when they're confronted with uncertainty is pull back, withdraw, disengage. And that means that economic activity, which is really dealing with people, just goes straight down.

And so the key problem is ...

Stewart: It's about perception then. It's about making people believe that the system is sound. ... if the stock market is high, people feel confident and spending, and if it lowers, they feel less confident

Greenspan: I think you have to realize that there are certain aspects of human nature which move exactly the way that you've defined it.

The problem is periodically we all go a little bit euphoric until we get to the point where we are assuming with confidence that everything is terrific, there will be no problems, nothing will ever happen. and then it dawns on us ... no. And we go the other way. [Stewart: Huge fear.]

I was telling my colleagues the other day, I've been dealing with these big mathematical models, forecasting the economy -- and I'm looking at what's going on in the last few weeks and you know if I could figure out a way to determine if people are more fearful, or changing to euphoric, and I had a third way of figuring out which of the two things are working, I don't need any of this other stuff. I could forecast the economy better than any way that I know. The trouble is that we can't figure that out. The same meeting I was talking at, I said that I've been in the forecasting business for 50 years ... more than that actually ... I'll have to think about that ... but in any event, I'm no better than I was, and nobody else is.

Forecasting 50 years ago was as good or as bad as it is today. And the reason is that human nature hasn't changed. We can't improve ourselves.

Stewart: You just bummed the [bleep] out of me."

This is actually quite a remarkable admission, because it makes exactly the point I've been making over and over: Mainstream macroeconomics is a total failure at predicting or explaining anything about the economy.

In my article, "System Dynamics and the Failure of Macroeconomics Theory," I claimed that mainstream macroeconomics hasn't predicted or explained anything that's happened since the dot-com bubble of the 1990s, including the bubble itself. Why did the bubble occur? Why did it happen at exactly that time, instead of ten years earlier or later?

Greenspan is saying a lot more -- that mainstream macroeconomics has been useless for forecasting for his entire 50-year career.

This is no surprise, since nothing that the Fed has done has really made much difference at all, except in the short term. That's pretty obvious, but no one ever says so -- until Alan Greenspan's statement.

So, next time you hear a financial pundit on CNBC, or read one in a newspaper, either praising Ben Bernanke for doing the right thing, or criticizing Bernanke for causing the current crisis, remember that he had nothing to do with it.

Actually, the Fed's ½% interest rate reduction last week evidently continues to have a powerful effect in reducing general investor anxiety and panic. I wouldn't have expected it to be so effective, but investor anxiety appears to have dropped to almost nothing. I don't know anyone who believes that the interest rate reduction has any significant REAL effect on the global economy, but it is having, for the time being, a significant EMOTIONAL effect.

And this brings us to Greenspan's next point: "if I could figure out a way to determine if people are more fearful, or changing to euphoric," then that would be more useful than all the data models and forecasting techniques.

Once again, I can only agree.

From the point of view of Generational Dynamics, the emotions that Greenspan describes -- euphoria and fear -- are exactly the causes of the ups and downs of the stock market that we've been seeing. The dot-com bubble, the credit bubble, the housing bubble, and other bubbles were caused by the generational euphoria among the Boomers and Generation-Xers that occurred when the survivors of the 1930s Great Depression all disappeared. The panic that's been setting in in recent months is when these same Boomers and Xers come to realize that all their assumptions are wrong.

Greenspan's remarks resonate with things that I've been writing on

this web site for years. It's a shame that no one will believe him.

(27-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

At the UN, President Bush announced new sanctions on Burma (Myanmar), as signs grow that the military is preparing to use force.

The last major nationwide demonstrations occurred 19 years ago, starting on August 8, 1988 (8/8/88). Student-led pro-democracy demonstrations at that time were joined by Buddhist monks and many civilians. The demonstrations were crushed when the Burmese army fired on students with machine guns, killing thousands.

|

New demonstrations by the "88 Generation" began last week, triggered by an abrupt government decision to double the price of gasoline.

The new demonstrations have been led by over 100,000 Buddhist monks, in demonstrations across the country, especially in Rangoon (Yangon) and Mandalay. The army has not interfered with them yet, but there are signs that the army is preparing for a confrontation. Many people fear a new mass slaughter, like the one in 1988.

Here's what President Bush said in his UN speech on Tuesday:

American aid ships are ordered to leave Burma's (Myanmar's) waters:

Military junta is using cyclone devastation as cover for violent campaign against Karen minority....

(5-Jun-2008)

China requests foreign assistance for earthquake relief - cash only:

It's likely that tens of thousands of people were killed on Monday...

(12-May-2008)

Burma (Myanmar) junta is turning a natural disaster into a criminal catastrophe:

Could it affect the Beijing summer Olympics?...

(11-May-2008)

Cyclone Nargis could trigger violence in Burma (Myanmar):

Burmese generals are placing obstacles in the way of international aid....

(8-May-2008)

China crushes protests by Buddhist monks in Tibet:

The Dalai Lama, exiled in India since 1959, called for calm....

(16-Mar-08)

Burma (Myanmar) demonstrations fizzle after violent government response:

Thousands of troops are exerting a massive stranglehold on the streets of Rangoon...

(2-Oct-07)

Burma: Growing demonstrations by the "88 Generation" raise fears of new slaughter:

At the UN, President Bush announced new sanctions on Burma (Myanmar),...

(26-Sep-07)

| ||

The ruling junta remains unyielding, yet the people's desire for freedom is unmistakable. This morning, I'm announcing a series of steps to help bring peaceful change to Burma. The United States will tighten economic sanctions on the leaders of the regime and their financial backers. We will impose an expanded visa ban on those responsible for the most egregious violations of human rights, as well as their family members. We'll continue to support the efforts of humanitarian groups working to alleviate suffering in Burma. And I urge the United Nations and all nations to use their diplomatic and economic leverage to help the Burmese people reclaim their freedom."

The speech references Aung San Suu Kyi, who is a heroine of the 88 Generation, having been a leader in 1988. Suu Kyi has been under house arrest since 1990, and late news stories indicate that the government on Tuesday transferred her from her home to a notorious prison.

From the point of view of Generational Dynamics, Burma is in an Unraveling Era. Large demonstrations of this type are typical in Unraveling Eras, but they fizzle out quickly. For example, think of the "Million Man March" in 1990s America, or the massive demonstrations against Venezuelan President Hugo Chávez in May of this year. Both of these are examples of large Unraveling era demonstrations -- begun enthusiastically, but fizzling out quickly.

The new Burma demonstrations will undoubtedly fizzle out quickly as well, even if the army overreacts. But an overreaction now would set the stage for increasing conflict that would lead to a full scale civil war within 10-15 years.

The following is a brief Generational Dynamics history of Burma (Myanmar):

|

Crisis war: 1727-1752: Various rebellions against the Toungoo throne at Ava. The crisis war climax occurred when the Ava throne fell in in 1752, after a siege by a combined army of different ethnic groups, ending the Toungoo dynasty.

Crisis war: First Burmese War, 1824-26. British victory. Britain annexes the southern portion of Burma, which becomes part of British India.

Awakening Era war: Second Burmese War, 1852-53. Britain annexed additional territory.

Crisis war: Third Burmese War + civil war, 1886-1891. The war with Britain itself ended with a quick Burmese surrender to Britain, but violent civil war among various ethnic groups continued until 1891.

Awakening: 1920 - A generational split between old and young (presumably between generational "Artists" and "Prophets") members of the Young Men's Buddhist Association. Younger members rename the organization the General Council of Burmese Associations, dedicated to anti-colonialism.

Unraveling war: World War II, 1940-45. Occupation by Japan.

1948: Independence, formation of the Union of Burma.

Note: Aung San, commander of the Burma Independence Army, is considered to be the founding father of Burma. He was assassinated six months before final independence.

Crisis war: 1948-1958: Civil war among ethnic groups, with intervention by Chinese. Climax in 1958 when the army took over power, and turned power over to a civilian government.

The army overthrew the civilian government in 1962, and has remained in power since then.

|

Awakening Era climax: On 8/8/88, hundreds of thousands of students in the "88 generation," joined by monks and civilians, marched against the military government. Soldiers opened fire on demonstrators with machine guns, resulting in thousands of casualties.

Note: Aung San Suu Kyi, daughter of Aung San, participated in the 1988 demonstrations, calling for democratic government. In 1989, she was placed under house arrest without charge or trial. In 1991, she won the Nobel Peace prize.

Today: As the 20th anniversary of 1988 massacre approaches, there are massive new demonstrations in Burma, led by monks and nuns, but now joined by many ordinary citizens. The tension in Rangoon is great, and the military government is evidently trying to decide whether to let things be, hoping the demonstrations will fizzle, or repeat the violent reprisals of 1988. Since this is an unraveling era, it would seem that the demonstrations will indeed fizzle, unless the army overreacts.

Note: Aung San Suu Kyi is still under house arrest, and is

considered a goddess by today's demonstrators. However, late news

indicates that she was apparently transferred to a prison on Tuesday.

(26-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

After a year of governmental near-paralysis under 53 year old Prime Minister Shinzo Abe, the ruling Liberal Democratic Party has selected 71 year old Yasuo Fukuda as the party's new leader. The Parliament is expected to elect Fukuda as Japan's new Prime minister on Tuesday.

The selection of Fukuda follows the resignation of 53 year old Shinzo Abe, who took office a year earlier as Japan's first Prime Minister born after World War II, in Japan's "Baby Boomer" generation.

Abe had taken office with ambitious plans for economic reform and to increase Japan's role in worldwide diplomatic and military affairs, including plans to beef up Japan's military defense. However, the administration was riddled with scandal, and popularity plummeted.

In other words, Abe's administration followed the typical paradigm, very apparent in the U.S. Congress, of saying a lot of stuff, arguing with a lot of people, but getting nothing done in the end.

By contrast, Fukuda is already exhibiting the qualities of compromise that mark the typical behavior of someone who grew up during the previous crisis war (WW II). The generation of children that grow up during a crisis war, when they're constantly surrounded by the death, destruction and other horrors of a genocidal war, suffer a kind of "generational child abuse." Like any child abuse victim, they grow up to be sensitive and indecisive, which is why William Strauss and Neil Howe, the founding fathers of generational theory, call them "Artists." In America, the Artist generation that grew up during WW II was named the "Silent Generation" during the 1950s, because they never complained about anything.

Recall that on a number of occasions I've contrasted today's U.S. Congress, which is incapable of doing anything except whine and complain, with the 1980s Congress, where the Republicans and the Democrats cooperated with each other to change the Social Security system to make it a sounder system, and then cooperated again to specify new rules to control the budget deficit. That kind of cooperation is completely impossible with the Boomers and Generation-Xers running Congress today.

|

Fukuda is following the "Artist" archetype pattern. He has vowed to work for compromise with other party leaders, something that Abe didn't do.

In fact, Fukuda has even replaced younger people in top leadership position in Abe's administration with older generation people (former Minister of Finance Sadakazu Tanigaki, 62, Education Minister Bunmei Ibuki, 69, and former Trade Minister Toshihiro Nikai, 68).

Fukuda has not yet announced specific policies of his new administration, except that he's going to be seeking compromise and reconciliation with other politicians and other nations, including North Korea and China.

However, a nation's policies are not determined by just one man, but by the actions and behaviors of large masses of people. For that reason, Fukuda's more conciliatory approach may accomplish no more than Abe's confrontational approach.

Here's how a Japan Times commentary described the situation:

Political analysts, however, are doubtful there will be much of a drastic change now that Fukuda has been elected head of the LDP and is set to become prime minister on Tuesday.

"What one prime minister wants to do personally and whether or not he will be able to move forward with his policies are two different things," said Takeshi Sasaki, a political science professor at Gakushuin University. "A perfect example of this is Abe himself."

Abe pushed forward his conservative ideas by ramming a controversial bill through the Diet to revise the Fundamental Law of Education to instill patriotism in the classroom, and he stressed his vague but conservative ideology for a "beautiful country." But at the same time, Sasaki pointed out, Abe suppressed much of his hawkish tendencies. ...

Political observers say Fukuda will have difficulty pushing his dovish policies because he is likely to face strong opposition from conservative forces within his own party.

"Fukuda has the motivation (to push dovish policies) . . . but whether he will actually be able to act on his convictions is the issue," Sasaki said. "As long as Abe was able to (control) the LDP's hawks, it was all right — but that is not possible anymore. So Fukuda will be faced with raw" demands from hawkish LDP lawmakers."

So, in terms of results, Fukuda may fare no better than Abe did.

Nonetheless, his exceptionally conciliatory attitude, when contrasted

with the much more confrontational approach of Shinzo Abe, marks both

men as being typical of their respective generations, one growing up

during World War II, and one born after the end of the war.

(24-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

I've received some criticism for being a bit too negative.

Several readers and correspondents have expressed some scorn, now that the market seems to be "back on track" (as one person put it), headed for new highs.

Let's start by quoting web site reader Bob:

Well actually I've been predicting a crash since 2002, based on the fact that the market is way overpriced by historical standards, and that hasn't changed at all. In 2002 I said it would probably happen in the 2006-2007 time frame, and that's still a pretty good prediction.

One of the standards is price/earnings ratios, and here's the current graph, from my recent article "How to compute the 'real value' of the stock market":

|

Now, the thing that I don't understand, and have never understood, is how anyone can look at the above graph and not realize instantly that the stock market is going to crash. This graph isn't rocket science; it simply depicts a standard way of measuring the "real" value of the stock market.

The graph doesn't tell you on which day this will occur; it might happen next week, next month or next year. But it does tell you that it will happen soon.

There are a lot of people who used to call me nuts but don't anymore, as the economy has continued to worsen. But one thing I've noticed over the years is that people who do so never address things like the above graph. Does anyone seriously believe that P/E ratios are going to stay well above average forever? No one, including people who call me nuts, has ever made that argument, because it can't be made. The above graph alone is actually very close to a mathematical proof that a crash is coming.

So let's step back now, and see where things stand today.

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Alan Greenspan predicts the panic and crash of 2007:

He's said this kind of thing before, but this time it's resonating....

(08-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

How to compute the "real value" of the stock market. :

And some additional speculations about stock market crashes.

(20-Aug-2007)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Redemptions of money market funds now fully in doubt:

Wednesday is the deadline for 3Q redemption of many hedge fund shares....

(15-Aug-07)

Alan Greenspan defends his Fed policies, as people blame him for the subprime crisis:

Greenspan never ceases to amaze, and he did so again on Monday....

(8-Aug-07)

Nouriel Roubini says: "Worry about systemic risk." Whoo hoo!:

His arguments show what's wrong with mainstream macroeconomics....

(6-Aug-07)

Robert Shiller compares stock market to 1929:

He says the recent fall was caused by "market psychology," but is puzzled why....

(20-Mar-07)

A conundrum: How increases in 'risk aversion' lead to higher stock prices:

Maybe because the global financial markets are increasingly "accident-prone."...

(12-Mar-07)

Pundits are suddenly talking about (gasp!) "risk aversion":

Fearing full-scale panic in the mortgage loan marketplace,...

(6-Mar-07)

Alan Greenspan blames the housing bubble on the fall of the Berlin Wall:

Meanwhile, the stock market keeps skyrocketing and appears unstoppable to many investors....

(25-Oct-06)

System Dynamics and the Failure of Macroeconomics Theory :

Mainstream macroeconomic theory, invented by Maynard Keynes in the 1930s, has failed to predict or explain anything that's happened since the bubble started, including the bubble itself. We need a new "Dynamic Macroeconomics" theory.

(25-Oct-2006)

Alan Greenspan gives another harsh doom and gloom speech:

Saying that "the consequences for the U.S. economy of doing nothing could be severe,"...

(4-Dec-05)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Fed Chairman Alan Greenspan says that the deficit is out of control:

France's Finance Minister Thierry Breton quoted Greenspan...

(25-Sep-05)

Fed Governor Ben Bernanke blames America's sky-high public debt on other nations:

I'm normally wary of applying specific generational archetypes to individuals, but Bernanke is acting like a Baby Boomer....

(14-Mar-05)

Greenspan's testimony further repudiates his earlier stock bubble reasoning:

The Fed Chairman has now completely reversed his previous position on the stock market bubble...

(17-Feb-05)

Alan Greenspan warns that global economic dangers are without historical precedent :

In a speech on Friday, Greenspan buried a major change of position in a speech admitting that his assumptions about the economy for the last decade were wrong.

(6-Feb-2005)

| ||

It's hard to overestimate the impact of this week's monetary loosening by the Fed and Bank of England.

Before Tuesday, the public debate was whether the interest rate cut would be none or 25 basis points (¼%). The 50 basis point (½%) interest rate reduction was much larger than was expected, and represented a sudden and substantial loosening of Fed policy.

The same was true when the UK government agreed to guarantee all Northern Rock bank deposits. The Bank of England then followed up by substantially and unexpectedly loosening the standards for borrowing money from the Bank of England.

Among investors, the euphoria was instantaneous, and lasted through the end of the week. The commercial paper market, which had become frozen, unfroze, partially relieving the credit crunch.

The 50 bp interest rate cut did inject some liquidity into the market and make some additional lending possible, but no one that I've read seriously believes that the 50 bp interest rate reduction is large enough to substantially change the underlying fundamentals that caused the credit crunch, and made other things worse, as we'll discuss in the following paragraphs.

What's going to happen when there's another bout of bad news? There'll be demands for a further Fed rate cut, and this time, any cut, even a 50 bp cut, will not have anything like the same psychological effect.

Just as stock market investors received a psychological boost to push the stock market up higher, currency traders received a psychological boost to push the value of the dollar down.

Here's how one news article described the situation:

The level of the dollar - often regarded as a barometer of the U.S. economy's health - dropped to $1.4120 against the euro during business hours in Asia, reaching an all-time low for a second consecutive day.

It also slipped against a number of other major currencies on speculation that the U.S. Federal Reserve would keep cutting interest rates as the world's largest economy weakens.

Sentiment soured for the dollar after Ben Bernanke, chairman of the Federal Reserve, stoked speculation that he might continue to lower rates following this week's aggressive trim of half a percentage point. Bernanke said Thursday that the sell-off in credit markets could make the housing recession more severe."

This makes several things clear: The dollar was weakened by the Fed move, and the world now expects further weakening.

Here's how another news article describes the Saudi view:

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.

Ben Bernanke has placed the dollar in a dangerous situation, say analysts. "This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

"Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said.

The Saudi central bank said today that it would take "appropriate measures" to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg."

Finally, it's worth noting that Canadians are brimming with pride this week because, for the first time in decades, a Canadian dollar is worth just as much as an American dollar.

That's the headline in a Financial Times news story about the effects of American's financial turmoil on Europe.

The eurozone "purchasing managers' index," which measures economic activity among both manufacturers and service provides, fell steeply in September, the biggest drop since October 2001.

These problems are being exacerbated now by the fall of the dollar against the euro, which means rise in value of the euro against the dollar, following the Fed's interest rate reduction.

If the "super euro" remains high against the dollar, it means that European exports become a lot more expensive to Americans. This is bad for business in Europe, and there are now concerns that Europe will fall into recession because of the Fed rate cut.

If you've been reading this web site for the last six months, then you know that you know that the economic turmoil has been caused by "collateralized debt obligations" (CDOs) and other credit derivatives.

Without attempting to repeat previous detailed explanations, CDOs and other credit derivatives allow you to make various "bets" related to credit, especially whether certain classes of debt will be repaid or go into default. These got into particular trouble because many CDOs are based on sub-prime mortgage loans.

If you're a very "sophisticated" investor, you might have purchased a CDO that will pay you a regular income provided that the underlying mortgages are not foreclosed. You may have thought it was a "sure bet," because the major ratings agencies told you that these CDOs were AAA investments. But with foreclosures surging in the last few months, these investments have performed badly.

For months, we were told that the "subprime mortgage problem" was completely "contained." But in fact, it's now turning out that CDOs are in the portfolios of all kinds of financial institutions around the world, including banks, pension funds, and so forth.

Here's what Fed Chairman Ben Bernanke said to Congress, just last week:

Notice the phrase: "the resulting global financial losses have far exceeded even the most pessimistic estimates of the credit losses on these loans."

Now you may wonder if perhaps the crisis is over. In fact, it's only just beginning.

Many mortgage loan foreclosures are from ARMs (adjustable rate mortgages), where the homeowner signs up for the mortgage with a low monthly payment, based on a low "teaser" interest rate. That teaser rate expires after 1, 2 or 3 years, depending on the terms, and then the interest rate "resets" to a much higher value, and the homeowner's monthly payment can double or even quadruple.

Here's a chart showing ARM reset schedules from the Calculated Risk blog:

|

As you can see, the great bulk of ARM resets occurs in the next 10 months. So the worst is yet to come.

How bad can it be?

First, you have to remember what's really going on here. There have been global financial crises at regular intervals throughout history. The details have been different each time, but they always have one thing in common: A debauched and perverted use of credit, occurring at exactly the time that the survivors of the previous financial crisis have all died or retired.

If you go back through history, there are of course many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash.

I've quoted this paragraph a couple of times before, but it such a powerful paragraph that I want to repeat it. It describes the the last days of the Tulipomania bubble of the 1630s, as described in Edward Chancellor's 1999 book, Devil Take the Hindmost, a history of financial speculation:

This last sentence tells you exactly what CDOs and other credit derivatives have become. They're based on leveraged mortgage-based investments that no longer exist in viable form, and were paid for with other credit derivatives that could never be honored because they too were worthless.

So how bad can it be?

Nobody knows for sure, because large financial institutions are now doing everything in their power to cover up the size of their exposure. But here are some figures you should be aware of:

Now, in the case of Bear Stears and other financial institutions, we've seen that some of the credit derivative instruments lost something like 90% of their value when an attempt was made to actually sell them, and they were "marked to market."

But let's suppose that, on the average, when all those credit derivatives are finally "marked to market," the average loss is only 10%. That's an optimistic assumption, but 10% of $750 trillion is $75 trillion!

In other words, even in this optimistic scenario, the amount of money to be pulled out of the world's economies is 1½ times the GDP of the entire world!

Now, for those of you who think that can't happen, remember what Bernanke himself said this week:"the resulting global financial losses have far exceeded even the most pessimistic estimates of the credit losses on these loans."

There is absolutely no evidence to support the belief that the worst has past. In fact, the trends are clearly pointing in the direction that the worst is yet to come.

Let me return to an analogy that I've used before.

Imagine the world economy as a huge mansion, blown up into a huge bubble. For several months now, pieces of that huge mansion have been breaking off and falling into the ravine. Examples of "implosions" are: Bear Stearns' hedge funds, Countrywide Bank, Sentinel Management, and Northern Rock bank in the UK. According to the mortgage lender Implode-o-Meter, the count of major U.S. lending operations that have "imploded" since December is now up to 159.

Maybe the stock market crash would have occurred by now, as it had at this point in the 1929 cycle, but there's something very different today that wasn't true in 1929.

The Fed and other central banks are running around the mansion with hammer and nails, patching things up as fast as they can, trying to keep ahead of things -- and they're being pretty successful at that. Last week's interest rate reduction by the Fed was a particularly big wad of glue and nails.

But it can't work for much longer. The price/earnings graphic near the beginning of this article tells you so. The stock market is overpriced by a factor of 250% or so. Wads of glue can't fix that.

This is the Principle of Maximum Ruin that I've discussed many times in the past. The longer the crash is delayed, the worse it will be. In time, the world's financial officials will see to it that the maximum number of people are ruined to the maximum extent possible.

All the advances in economics and macroeconomics that we've learned since 1929 really haven't done anything useful except provide for new and clever ways of applying glue and nails. But sooner or later, the entire mansion has to collapse and fall into the ravine.

So, to Bob and others, I say to you, take another look at that price/earnings graphic at the beginning of this article, and think about what it's telling you. Is it telling you that "nothing can kill this market," as you claim? Is it telling you that "it's different this time"? If so, then just keep pouring your money into the bubble.

But if it's telling you, as it's telling me, that the P/E index is soon going to start plummeting down below 10, as it has several times in the last century, most recently in 1982, then you'd better take your money and run for the hills.

From the point of view of Generational Dynamics, there's no doubt

whatsoever: We're headed for a generational stock market panic and

crash. Really, we have different names for things today, but the

underlying basics today are no different than they were in 1929.

(23-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

France, Pakistan and Israel in the news

I've been focusing on the global economic situation, and have been neglecting a number of important international stories. For the record, here's a summary of some of these stories:

Ever since Nicolas Sarkozy became President, he's become increasingly vocal about Iran's nuclear program, and has indicated (through his foreign minister) that the world should begin to prepare for war with Iran.

Europe as a whole is very schizophrenic about Iran. On the one hand, they don't want to do anything that might be interpreted as supporting United States policy. On the other hand, nuclear missiles launched from Iran won't reach the U.S., but they will reach Europe.

As I wrote in a lengthy analysis of Iran, this kind of bellicose reaction is welcomed by Iranian president Mahmoud Ahmadinejad and by the hardline mullahs. Iran is in a generational Awakening era, and the Iranian people identify with western values, even American values, much to the horror of the hardliners. They see a military conflict, or the threat of one, as the way to unify the nation against the West, as happened during their last generational Crisis era, leading to the Iran/Iraq war of the 1980s.

This is a highly volatile situation, and it's impossible to predict whether, in fact, any military action will take place.

I've always expressed admiration for Pakistan's President Pervez Musharraf and his Indian counterpart, India's Prime Minister Manmohan Singh. Both Pakistan and India are nuclear powers, but these two leaders have engineered a remarkable détente that has prevented a conflict.

Musharraf, born 1943, and Singh, born 1932, are both survivors of World War II and the subsequent genocidal war between Pakistan and India over Kashmir and Jammu, a dispute that still seethes today, even though the United Nations partitioned the region into Indian and Pakistani regions in 1947.

The disappearance of either Musharraf or Singh would change the situation dramatically, as either one would likely be replaced by someone much younger, and much more confrontational. This is the kind of generational change that leads to new crisis wars.

Musharraf is viewed by many Pakistanis as an American puppet, and now Osama bin Laden has issued a new video declaring war on Musharraf, and calling for his overthrow.

The Pakistanis will have have an election on October 6, and Musharraf's destiny is in doubt at this time.

French President Nicolas Sarkozy is in the news for another reason: he's headed for a major confrontation with the labor unions.

President Sarkozy went on television to announce his plan to end the Napoleonic era civil service laws. Infuriated union leaders are threatening crippling strikes.

When Sarkozy won the election in May, he said that he was "going to restore the status of work, authority, standards, respect, merit. I am going to give the place of honour back to the nation and national identity. I am going to give back to the French people pride in France."

He promised to end the 35-hour work week, solve the problem of illegal immigration, and make France a leader in the European Union.

He's been proceeding cautiously, but now he's ready for full-scale political warfare.

From the point of view of Generational Dynamics, he has little chance of succeeding. Think of what's happening in Washington, where the city is practically paralyzed by politicians who are incapable of doing accomplishing anything except arguing. This is because the survivors of the World War II are all gone, and the leaders in Washington are from the Boomer generation born after the war.

The same is happening in France, and in fact in every country that fought World War II as a crisis war. The postwar generation is in charge, and the country is paralyzed, with the leaders unable to do anything but argue.

So it's unlikely that Sarkozy will accomplish anything with his aggressive new initiative although, of course, it will generate a great deal of political furor.

Israel's cabinet has just voted to declare the Gaza strip a "hostile territory," because of the steady stream of Qassam rockets fired into Israel from Gaza.

This means that Israel will impose further restrictions on living conditions in Gaza, including limiting the supply of fuel and electricity, and the transfer of people and goods.

The intent is to make it harder for militants to smuggle weapons into Gaza, but the result will be a further degradation in the standard of living, in a place where the standard of living is already almost the worst in the world.

From the point of view of Generational Dynamics, Gaza and Israel are

headed for a new genocidal crisis war, refighting the genocidal war

between Palestinians and Israelis that followed the 1948 partitioning

of Palestine and the creation of the state of Israel. However, in

recent months it's become increasingly likely that a component of

this war will be a civil war between Gaza and West Bank Palestinians,

with the West Bank allied with Israel, at least for a while.

(21-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Wall Street markets surge 2.5-3%, the biggest increases since October 15, 2002, following an unexpectedly large lowering of the Fed Funds rate.

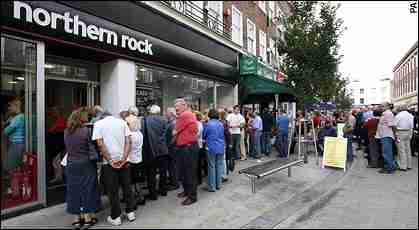

European markets spiked 1.5-2%, after the Bank of England changed policies and guaranteed the safety of ALL Northern Rock bank deposits. And as of this writing (evening in US, morning in Asia), Asian markets are up 3%.

Champagne corks are popping again! The party is in full swing! Euphoric investors are ready to go full steam ahead!

In the US, the Fed lowered interest rates by a full ½ point, when only ¼ point was expected. Furthermore, the ½ point reduction applies the both the Fed Funds rate (the rate that banks pay when they borrow money from another bank) and the Fed Discount rate (the rate that banks pay when they borrow money from the Fed).

Thus, the Funds rate went from 5¼% to 4¾%, and the Discount rate went from 5¾% to 5¼%. It is thought that this will reduce the "credit crunch," by providing cheaper money that can be offered for credit.

The size and rapidity of the rate cut was almost completely unexpected, and resulted in the market surge.

Also unexpected was the guarantee, by UK finance chancellor Alistair Darling, that all Northern Rock bank assets would be guaranteed by the government.

In normal times this would be considered a wildly inappropriate move by the government, since it shows such favoritism to one bank, and thereby puts other banks at a disadvantage. However, these are not normal times, as a panicky bank run was spreading throughout Britain.

From the point of view of Generational Dynamics, nothing has changed. This is because the stock market is STILL overpriced by a factor of around 250%.

Equally important, Tuesday's stock market surge is actually a sign of increased panic.

Let's take a look at what happened:

|

Take a look at what happened at 2:15 pm in the above graph, and then read the following message that I received from an online correspondent:

Luckily for me I was on the correct side of the trade and was not affected much by the outage. But this has scared me. My broker told me that there were multiple firms that all experienced the same problem."

I don't know how widespread this computer failure was, since it hasn't been a media story, but it doesn't surprise me at all.

The above graph shows that at 2:15 pm, when the Fed mades it's announcement, the Dow spiked by 150 points in something like a nanosecond.

It's obvious that large financial firms, with special access to the NY Stock Exchange computers, were able to place buy orders instantly, and get them filled.

But my friend, who is just an ordinary investor, didn't have a prayer. He was so far back in line, that it would have been many hours before he could have placed an order, if that had been necessary.

This is a point that I've made in the past.

There are many people today who are willing to agree that the stock market may be due for a correction, but many of those people believe that they can get out quickly, without losing too much money, if it becomes necessary. Such people have no idea of the dynamics of what's going on.

Here's the next sentence from my online correspondent's message:

What?? Why would anyone believe that there's any significant chance at all that what happened Tuesday means that the market will reach new highs?

What actually happened on Tuesday is what might be called "upward panic." Investor anxiety has been increasing steadily since February. This kind of anxiety leads to panicky decisions -- either in the downward direction (stock market crash) or upward (what happened on Tuesday).

And remember this: On Monday, October 7, 1929, anxious, panicky investors pushed the stock market up +6.32%. That was just two weeks before Black Thursday.

So I would very strongly challenge any assumption that the market is going to keep going up. What happened on Tuesday was not a sign that the party is on again. It's actually a sign of panic among investors, who, for that moment on Tuesday, believed that the Fed saved the world.

But will they still believe on Wednesday that the Fed has saved the world?

We'll have to see, of course, but the huge spike at 2:15 tells me that it's very unlikely. When you have a massive "upward panic" like that, so large that it crashes multiple computer systems, it's not a sign that things are returning to the good 'ol days.

If the Dow can spike up 150 points in a nanosecond on Tuesday, then

it can spike down 150 points in a nanosecond on Wednesday. And now,

thanks to the message from my online correspondent, we have someone's

personal experience to tell you what will happen -- you won't be able

to do anything, because the computers will crash. You'll have to

just sit there and watch your assets disappear, just as all the people

of Salt Lake City, Utah, did in 1929.

(19-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

By this measure, investor fear has clearly been growing since February.

When I wrote about this subject last week, I hadn't been able to find any historical data on the Marketpsych web site. Now I have.

|

This graph shows the value of the "fear index" (measured on the left scale) for the last year versus the Nasdaq market index (measured on the right scale). It shows that the market seems to vary inversely with the fear index.

This graph, showing a year's worth of data, clearly indicates that, by this measure, investor "fear" had been falling steadily until February 27, when a 9% collapse in the Shanghai stock market triggered a worldwide "mini-panic." Things settled down after that, but not to the way they were prior to February 27. Investor "fear" was never went back as low as it had been in December and January and, in fact, has been rising steadily since then.

As this graph shows, the "fear index" had fallen to about 4 in January, peaked at 22 in February, but fell back only as far as 10 in May. Since then, it peaked again at 51 in August, and is now hovering around 21, which is near the February peak value.

Before becoming aware of this index, I had previously thought that the August 16 "mini-panic" had been the turning point, and that's why I wrote the essay "The nightmare is finally beginning" at that time.

However, that's clearly not the case. It's now clear that the February 27 event was the triggering event for the rise in investor anxiety, even though the market peak didn't occur until July 19.

|

The Marketpsych web site does provide a graph that's updated daily, each morning (including Saturday and Sunday), showing the most recent values of the "fear index." The adjoining graph shows the value as of Tuesday morning, along with the preceding three months.

We can guess that the rise in the past few days was triggered by the spreading panic in Britain, as branch offices of Northern Rock continue to be mobbed by depositors wishing to withdraw their money.

And we can guess that the rise on Tuesday morning is related to the anticipation of an expected announcement on Tuesday afternoon of a reduction in the Fed Funds rate.

Incidentally, these two stories have become major international stories in the last few days. In fact, THE major international story on Tuesday appears to be the anticipated Fed announcement, which investors apparently believe will save the world. That alone is a sign of worldwide investor anxiety.

The day to day variations in the fear index really don't mean much, since any bit of news, major or minor, can trigger a small rise or fall. In fact, I suspect that the margin of error on the computation of this index is something like ±3.

What IS important is the long-term trend, and that's become quite clear -- that investor anxiety is continuously increasing.

This contradicts some of the latest remarks by Alan Greenspan, as he seems to have become a rock star in the last few days, and is willing to talk gibberish on almost any economic, political or personal subject.

On the interview on 60 Minutes, broadcast on Sunday, Greenspan said the following, in response to a question by interviewer Leslie Stahl:

Greenspan: "But there is an underlying strength in the United States. And, indeed, when you look around the world, even with this extraordinary credit problem, the economies seem to be holding up. But for the moment it does not look sufficiently severe that it will spiral into anything deeper.

"We’re going to get through this particular credit crunch. We always do. This is a human behavior phenomenon, and it will pass. The fever will break and euphoria will start to come back again."

This is a weird point of view. Everybody seems to agree now that there's a housing bubble. Even Greenspan has now admitted that he "didn't get it" about the housing bubble, until it was too late.

So what does it mean when he says, "The fever will break and euphoria will start to come back again"?

Is he abandoning his previous view that "history has not dealt kindly with the aftermath of protracted periods of low risk premiums"?

Who knows?

While I'm on Greenspan, I'd like to comment for a moment on "Fed speak." In his new book (which I haven't seen), Greenspan apparently brags about his use of "Fed speak" to make comments that nobody understands, so that he can get away with saying anything he wants.

What the hell is that all about? I understood everything he was saying, and I've commented on all his major speeches since 2004 on this web site. I showed how he went from self-congratulation to increasing alarm to a total repudiation of his previous reasoning, to dire warnings at the end of 2005. Maybe you have to go to the trouble to read a paragraph two or three times, but if you're willing to go to that trouble, then it's perfectly possible to understand what he's talking about.

This just goes to show how ignorant and sloppy journalists and politicians are. When a journalist or blogger says that he didn't understand Greenspan, what he's really saying is this: "I was too lazy and stupid to bother to figure out what was going on, and I didn't WANT to know what was going on." So you had people like Greg Ip at the Wall Street Journal and Steve Liesman at CNBC who were so stupid and so lazy that now they have to establish a framework of excuses so that they won't be blamed by other people. "Ohhhh, it's not my fault that I'm stupid and lazy; it's Greenspan's fault."

That's like Ben Bernanke's excuse that "It's not the US's fault that we're at astronomic levels of public debt; it's every other country's fault, for having a 'Global Savings Glut.'" Blecch.

|

Incidentally, I mentioned the February turbulence that caused a 9% drop in the Shanghai stock market bubble in February. There was more turbulence in June.

But nothing seems to stop this bubble (which is what I used to always say sarcastically about the Wall Street bubble, until it finally peaked on July 19.)

The Shanghai index seems to have absolutely no limit, and undoubtedly will keep on getting exponentially higher forever (which is what I used to say about Wall Street). I guess Alan Greenspan would be pleased to see that the "euphoria" hasn't ended in Shanghai.

|

From the point of view of Generational Dynamics, Wall Street has been in a bubble that began in 1995, as evidenced by the fact that price/earnings ratios have been astronomically since then. The bubble cannot continue forever, and the rapidly rising value of the "fear index" appears to indicate that it won't continue for much longer. |

US Treasury Secretary Hank Paulson arrives in London to meet with UK Chancellor Alistair Darling, to discuss the worsening global financial crisis and credit crunch, as spreading panic begins increasingly to threaten markets in Britain and around the world.

|

Thursday's bailout of Northern Rock Bank caused long lines on Friday of depositors wishing to withdraw their money.

On Saturday, the lines were even longer and slower at Northern Rock's 76 branch offices. Most customers were elderly, but even so, police had to be called to deal with some "boisterous customers." In one branch, the police dispersed the crowd after the bank promised those present would be assisted first on Monday.

An interesting twist to the Northern Rock story is that, prior to the Bank of England bailout, there were two larger suitors in talks to acquire Northern Rock, Lloyds TSB and Royal Bank of Scotland.

But the Bank of England blocked the potential acquisitions, because they might cause consternation in financial markets. Once that happened, Rock had no choice but to ask the BOE for the bailout, and that DID cause quite a bit of consternation in financial markets.

A month ago, California depositors mobbed Countrywide Bank branch offices to withdraw their deposits, but that event didn't generate anything like the media coverage or widespread concern that the Northern Rock situation has done, particularly in Britain.

From the point of view of Generational Dynamics, this is exactly the

kind of panic that we've been watching for. Investors have been

getting measurably more anxious and worried since the beginning of 2007, but the Northern Rock appears

to be pushing the level of panic up one more notch.

(16-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Saying that the Republicans drove the country into ever deeper deficits, former Fed chairman Alan Greenspan criticized "out of control" spending in the Republican Congress, and President Bush's failure to veto those bills.

The comments appear in his new 500 page book, "The Age of Turbulence: Adventures in a New World," to be published on Monday.

Greenspan reserves his highest praise for President Bill Clinton who, he said, maintained "a consistent, disciplined focus on long-term economic growth."

All of this will resonate with the Washington politicians, but I can't help but laugh at it because from the point of view of economics, Greenspan's remarks are total gibberish.

Here's a graph that appeared on the Calculated Risk blog in 2005, showing government income and outlays, but not including Social Security:

|

This graph shows that the deficit has absolutely nothing to do with the Bush administration. Note the following:

So Greenspan's remarks really are TOTAL GIBBERISH.

There's something that I remember very vividly, because I was so shocked by it when it happened in 1996.

In 1996, Clinton gave his "the era of big government is over" speech, and worked with the Republican Congress to end the welfare entitlement because it was too expensive. It was becoming clear that the government was going ever deeper into debt, and it had to stop.

Here's what President Clinton said in his 1996 State of the Union speech:

The era of big government is over. But we cannot go back to the time when our citizens were left to fend for themselves. Instead, we must go forward as one America, one nation working together to meet the challenges we face together. Self-reliance and teamwork are not opposing virtues; we must have both. ...

I say to those who are on welfare, and especially to those who have been trapped on welfare for a long time: For too long our welfare system has undermined the values of family and work, instead of supporting them. The Congress and I are near agreement on sweeping welfare reform. We agree on time limits, tough work requirements, and the toughest possible child support enforcement. But I believe we must also provide child care so that mothers who are required to go to work can do so without worrying about what is happening to their children.

I challenge this Congress to send me a bipartisan welfare reform bill that will really move people from welfare to work and do the right thing by our children. I will sign it immediately.

Let us be candid about this difficult problem. Passing a law, even the best possible law, is only a first step. The next step is to make it work. I challenge people on welfare to make the most of this opportunity for independence. I challenge American businesses to give people on welfare the chance to move into the work force. I applaud the work of religious groups and others who care for the poor. More than anyone else in our society, they know the true difficulty of the task before us, and they are in a position to help. Every one of us should join them. That is the only way we can make real welfare reform a reality in the lives of the American people."

None of that is the shocking part; it's just the usual politics. The shocking part is what happened afterwards.

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Alan Greenspan predicts the panic and crash of 2007:

He's said this kind of thing before, but this time it's resonating....

(08-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

How to compute the "real value" of the stock market. :

And some additional speculations about stock market crashes.

(20-Aug-2007)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Redemptions of money market funds now fully in doubt:

Wednesday is the deadline for 3Q redemption of many hedge fund shares....

(15-Aug-07)

Alan Greenspan defends his Fed policies, as people blame him for the subprime crisis:

Greenspan never ceases to amaze, and he did so again on Monday....

(8-Aug-07)

Nouriel Roubini says: "Worry about systemic risk." Whoo hoo!:

His arguments show what's wrong with mainstream macroeconomics....

(6-Aug-07)

Robert Shiller compares stock market to 1929:

He says the recent fall was caused by "market psychology," but is puzzled why....

(20-Mar-07)

A conundrum: How increases in 'risk aversion' lead to higher stock prices:

Maybe because the global financial markets are increasingly "accident-prone."...

(12-Mar-07)

Pundits are suddenly talking about (gasp!) "risk aversion":

Fearing full-scale panic in the mortgage loan marketplace,...

(6-Mar-07)

Alan Greenspan blames the housing bubble on the fall of the Berlin Wall:

Meanwhile, the stock market keeps skyrocketing and appears unstoppable to many investors....

(25-Oct-06)

System Dynamics and the Failure of Macroeconomics Theory :

Mainstream macroeconomic theory, invented by Maynard Keynes in the 1930s, has failed to predict or explain anything that's happened since the bubble started, including the bubble itself. We need a new "Dynamic Macroeconomics" theory.

(25-Oct-2006)

Alan Greenspan gives another harsh doom and gloom speech:

Saying that "the consequences for the U.S. economy of doing nothing could be severe,"...

(4-Dec-05)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Fed Chairman Alan Greenspan says that the deficit is out of control:

France's Finance Minister Thierry Breton quoted Greenspan...

(25-Sep-05)

Fed Governor Ben Bernanke blames America's sky-high public debt on other nations:

I'm normally wary of applying specific generational archetypes to individuals, but Bernanke is acting like a Baby Boomer....

(14-Mar-05)

Greenspan's testimony further repudiates his earlier stock bubble reasoning:

The Fed Chairman has now completely reversed his previous position on the stock market bubble...

(17-Feb-05)

Alan Greenspan warns that global economic dangers are without historical precedent :

In a speech on Friday, Greenspan buried a major change of position in a speech admitting that his assumptions about the economy for the last decade were wrong.

(6-Feb-2005)

| ||

Around April or May, news stories said that tax collections were unexpectedly high. Tax receipts kept getting higher and higher, and it was a COMPLETE SURPRISE to everyone, including the administration and Alan Greenspan's Fed. It was not until the END of 1996, when Greenspan gave his "irrational exuberance" speech, that officials became aware that the bubble was on.

So there was a government surplus when the dot-com bubble was on, and there was a deficit when the dot-com bubble burst. This all happened in the Clinton administration. So the Bush administration had absolutely nothing to do with it. That's why Greenspan's remarks are gibberish, although they'll resonate with the usual moronic debates going on in Washington.

Politics has nothing to do with the current financial crisis. As I've written on this web site many times, the current fiscal crisis is caused by the entire Boomer generation and Generation-X, working together to engineer every debauched misuse of credit imaginable. The debauchery is practiced by Republicans and Democrats and independents alike. It has nothing to do with politics. It's because they're in the generations with no personal memory of living through the 1930s Great Depression.

As I've said many times, and discussed at length in "System Dynamics and the Failure of Macroeconomics Theory," mainstream economics has neither explained nor predicted anything since the dot-com bubble began in 1995. In particular, no one has any explanation for why the bubble began in 1995, instead of 1985 or 2005.

The only possible explanation is a generational explanation: The dot-com bubble began when the generations of survivors of the 1930s Great Depression all disappeared in the early 1990s. Their leadership positions were then filled by Boomers and Xers with no personal memory of the 1930s and adopted abusive credit policies that their parents would NEVER have approved.

As I've said before, the survivors of World War II, the GI Generation and the Silent Generation, did great things -- they created the United Nations, World Bank, Green Revolution, World Health Organization, International Monetary Fund, and so forth. They created these organizations and managed them for decades with one purpose in mind: That their children and grandchildren would never have to go through anything so horrible as the Great Depression or World War II.

Throughout their lives, they worked together, even when they were on opposite political sides, to protect America and the world from the excesses that led to the Great Depression and World War II.

In the 1980s, the Republicans and the Democrats cooperated with each other to change the Social Security system to make it a sounder system. After that, they cooperated again to specify new rules to control the budget deficit. And in 1996, as we just discussed, Democratic President Bill Clinton, saying that "the era of big government is over," cooperated with the Republican congress to eliminate the welfare entitlement.

|

For the last few years, especially since 2004 or so, any kind of political agreement has become completely impossible.