Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

21st century issues are being totally ignored, so far.

I love irony, and so I'm absolutely thrilled about the choice of Alaska governor Sarah Palin as the Republican Vice Presidential candidate:

|

(The Vogue magazine cover with the photoshopped picture of Palin appeared on the Kodiak Konfidential blog, after Vogue announced last December that they were going to do a cover story on Palin. The blogger says that he "proudly supports Barack Obama.")

To me, as a person who dislikes politicians and was expecting to find the campaign increasingly boring, this is all hilarious and extremely enjoyable. I expect it to remain enjoyable until Palin gets boring or until she starts making gaffes and flames out.

All the issues being argued about in this election are from the 1960s generational Awakening era: feminism (women's lib), racism, generational change. Even the Iraq war as an issue is a reflection of the antiwar / Vietnam War debate.

(For information about generational Awakening eras, see "Basics of Generational Dynamics." For more information about the 1960s, see "Iraq Today vs 1960s America.")

There isn't a single bit of this that's at all relevant to what's coming. What's important today are things like the gathering storm in the Caucasus, the meltdown of the country of Pakistan, and the accelerating financial deflationary spiral. A crisis in any one of these areas would be enough to instantly remove feminism, racism, and Iraq from the public discussion, and there will be crises in all three areas.

Does it make any difference who's elected? It's hard to see how. It's true that Palin and Obama have little real experience. And it's true that I've called Biden the stupidest man in the Senate, with good reason: He wanted to stop the Iraq "surge," and send 2200 American troops into Darfur. And it's true that McCain has the most experience that's relevant to the first two of the three issues listed above.

But these potential crises are all completely new, and unlike anything that very few people alive today have ever seen before. There is nothing in past experience that could prepare any of the candidates for any of these crises, and so there's no predictable effect that the election of either candidate could have on the outcome of these crises.

Just as today's major political issues were leftovers from the 1960s Awakening era, the major political issues of the 1960s were leftovers from the WW II 1940s crisis era. The big issue in the 1960 election was over how the US should respond to a Chinese attack on the Taiwanese islands of Quemoy and Matsu. John Kennedy won in 1960, but got into trouble on 1940s-type Crisis era issues -- the Bay of Pigs disaster in Cuba, the Cuban missile crisis, the Vietnam war. The Administrations of Kennedy, Johnson and Nixon all foundered because they failed to recognize and deal with the new 1960s Awakening era issues -- women's lib, racism, antiwar, etc. It didn't matter which of Kennedy, Johnson or Nixon was elected -- they all made similar mistakes, because none of them had any experience with the new issues.

The same will be true today, no matter whether Obama, McCain, Palin

or Biden is President. They're all focused on the 1960s issues, and

none of them has a clue how to deal with the new Crisis era issues

that are right around the corner. Any one of them will make many

major mistakes, just as President Lincoln did in the Civil War, and

Franklin Roosevelt did in WW II. However, the good news is that our

enemies will also make many major mistakes, and at least we have the

hope that they'll make worse mistakes than we will.

(31-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

What could the Russians possibly have been thinking?

A couple of days ago I saw a news article with the title, "Medvedev Seeks Support From China, Allies on Georgia." My immediate reaction was that Medvedev will get support on the Georgia invasion from China when pigs fly.

The Chinese Communist Party (CCP) is the most paranoid group of politicians on earth. They're afraid of secessionist movements by the Tibetans in Tibet, by the Muslim Uighurs in Xinjiang, and by the Taiwanese. They're also afraid of rebellions by their own people.

There was never a snowflake's chance in hell that China would support the Russians in declaring the independence of the two Georgian provinces, of Abkhazia and South Ossetia.

|

The Russians had hoped that a meeting of leaders of several Asian countries of the Shanghai Cooperation Organisation (SCO) would side with Russians against the West. After all, it was to oppose Nato and the west that the SCO was formed.

After the meeting ended, Russian President Dmitry Medvedev claimed victory by saying, "We are sure that the position of SCO members will get an appropriate international response. I hope it will serve as a serious signal for those who try to turn black into white and justify the bloody adventure of the Georgian leadership."

Actually, the meeting was a significant political rebuff of Russia.

The statement issued by the SCO insisted on the need to preserve "the unity of a state and its territorial integrity," and that "placing the emphasis exclusively on the use of force has no prospects and hinders a comprehensive settlement of local conflicts.

A web site reader wrote to me:

The differences between Russia and the West have always been purely political. There is no visceral hatred or xenophobia between the West and Russians. The Russians particularly love the Europeans.

Here's a graphic that I created several years ago. It's a tiny bit out of date but it illustrates the points we want to make:

|

This graphic shows some of the major crisis wars of the last millennium. North America is the column on the left, Western Europe is the column in the middle, and Eastern Europe is the column on the right.

In the column on the right, you'll notice that I have three wars displayed in grey: "Great Northern War v Sweden," "Napoleon invades Russia," and "Hitler invades Russia." These are the three great wars where Europeans invaded Russia. All three of those wars were non-crisis wars for the Russians, but occurred during major crisis wars for the Europeans (the War of the Spanish Succession, the Napoleonic Wars, and World War II, respectively). And Russia won all three of those wars in pretty much the same way: Let the invading enemy go deep into Russia, where the frigid Russian defeated the invaders. There was never a genocidal Russian attack on Europe. As I said, Russians love Europeans.

Russians do not love the Chinese. Ever since Genghis Khan and the Mongols swept through Western Asia in the 1200's, the Russians and their Asian neighbors have not gotten along. The Mongols conquered Turkey, the Caucasus, and much of Russia before being driven back. Mongol descendants influenced or became part of the cultures of several Sunni Muslim populations in the Mideast, as well as in China itself. The Mongol invasions targeted the Russians and Hindus alike, and so the Russians and Indians are viscerally allies against the Mongol progeny in Pakistan and China.

Most people believe that China and Russia love each other because they both had Communist Revolutions. Actually, they had different kinds of Communist Revolutions and they didn't support one another. The only thing they had in common was that their leaders, Josef Stalin and Mao Zedong, join Adolf Hitler as the three most bloodthirsty, genocidal psychopaths of the 20th century.

In fact, take a look at the 1960s CIA intelligence report on the Sino-Soviet split. Many people in the intelligence field believed that China and Russia were close to thermonuclear war at that time.

Of course, generational theory tells us that couldn't really have happened, since neither country was in a generational Crisis era at that time.

But BOTH countries are in generational Crisis eras today. Either of

their populations would happily exterminate the other's. They get

along politically only because they both wish to oppose the United

States and the West politically, but when they're forced to choose,

they'll choose to fight each other.

(29-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Relations between Russia and the West became colder on Tuesday, when Russian President Dmitry Medvedev announced that he had signed a decree recognizing the breakaway Georgian regions of South Ossetia and Abkhazia as independent states.

|

Medvedev said that it was necessary to protect the indigenous Ossetians and Abkhazians from "genocide" by the Georgians. "This is not an easy decision, but this is the only chance to save people's lives," Medvedev said.

President George W. Bush demanded that Russia reverse its "irresponsible decision." Similar statements came from several European leaders.

It's startling how quickly relations between Russia and the West have deteriorated, in just three weeks.

What's become clear in these three weeks is that there isn't much visceral hatred between Georgians and Russians. The Georgians are furious that the Russians are occupying Georgian territory, but there's no genocidal fury between these two ethnic groups.

What's also become clear, however, is that there is plenty of genocidal fury between Georgians and Ossetians. These two ethnic groups really hate each other, and either of them would gladly exterminate the other.

The Russians see their role as keeping the Georgians and Ossetians from killing each other, causing a war that would ignite the entire Caucasus. The Russians still have a collective memory of the massive civil wars of the 1920 that slaughtered tens of millions of people. To the Russians, the Georgians and Ossetians are beginning to replay those events. Thus the Russians see the need to play peacekeeper, keeping their troops within Georgia proper, and now declaring South Ossetia (and Abkhazia) to be separate nations.

For the West, the collective memory is very different -- of Hitler, World War II, and Stalin. To the West, Russia is replaying those events.

These collective memories don't come from politicians. They come from hundreds of millions of people in the Russia and the West. It's these collective memories from hundreds of millions of people that are driving events in the Caucasus. That's why it makes no difference how much political pressure the Russians and the West put on each other; it's like trying to close a gate to stop a tsunami.

|

If you enjoy ridiculous political machinations, then you'll love the current debate of so-called "international law" on this issue.

In February, the West allowed Kosovo to secede from Serbia. The Russians were strongly opposed, citing "territorial integrity" of Serbia, while the West called it a "special case."

Now the positions are reversed. It's the West that's citing "territorial integrity" of Georgia, while the Russians are calling this a "special case." So-called "international law" is just about the silliest stuff around.

But this business of secessionist provinces is extremely serious stuff. Remember that the American Civil War, an extremely bloody and genocidal war, began when the South moved to secede from the United States in 1861.

There are several regions shown in the Caucasus map above that are secessionist problems. Chechnya, Ingushetia and Dagestan have Muslim separatist movements that would like to see those provinces secede from Russia. Nagorno-Karabakh in Azerbaijan is an Armenian enclave that the Armenians would like to see secede.

In India, you have Kashmir, where there is a strong independence movement among the Muslims. There's Tibet in China, there's Xinjiang in China, and let's not forget possibly the most explosive one of all -- Taiwan wants to secede from China.

Any of these situations could ignite a larger war, just as the secession of the South launched the American Civil War.

This is the stuff of generational Crisis wars. As long as there were

people around who remembered the horrors of WW II, the populations

were willing to live happily, and avoid making trouble by trying to

secede. But now, with most of the world entering a generational

Crisis era, and with few WW II survivors still around, it's time for

people to learn their lessons again, as the world lurches toward the

Clash of Civilizations world war.

(27-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

As fighting rages in Pakistan's tribal areas, the coalition formed by the two parties that forced the resignation of former President Pervez Musharraf has collapsed.

The collapse came after the government banned the Taliban group, Tehreek-e-Taleban Pakistan (TTP), that claimed responsibility for the massive suicide bombing attack last Thursday at a large munitions factory near Islamabad, the nation's capital.

It's not clear whether the "ban" will have any actual effect on TTP, or whether it's simply symbolic.

But, as expected, last Thursday's terrorist attack has had a powerful effect on Pakistani politicians and people, and is becoming a "regeneracy" event.

(For information about the term "regeneracy," see "Basics of Generational Dynamics.")

|

Parliamentary leader Asif Zardari, widowed husband of the assassinated Benazir Bhutto, and head of the Pakistan People's Party (PPP), has acted indecisively toward the Taliban until now. Pakistan's army, was entirely on its own in fighting a massive battle in the Bajaur region of the tribal areas. Now the army is gaining political support from Zardari, and this is a big change.

Nawaz Sharif, head of the Pakistan Muslim League-Nawaz (PML-N) party, split with Zardari shortly thereafter, blaming the split on "unkept promises" by Zardari. However, as I've pointed out in the past, Sharif is one of the group that tends to blame the terrorist violence on Musharraf's relationship with America, fighting the war on terror. Thus, it seems most likely to me that the differences in attitude toward the Taliban are the main cause of the split, after Thursday's terrorist attack.

Recall that Zardari is Shia Muslim, and that the father of his slain wife, Benazir Bhutto, was one of the leading Shia figures in the early days of Pakistan's independence. Sharif is Sunni Muslim, as are the Taliban.

The Pakistan government is disintegrating right before our eyes, at a

time of maximum danger, when a major war is going on in Bajaur, and

rioting is increasing in Kashmir. As the regeneracy advances, the

days of easy compromise have ended, and positions on all sides will

continue to harden.

(26-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Former IMF chief: Worst of global financial crisis is yet to come.

I'm grateful to several web site readers this week who sent me references to different articles and blog entries all saying the same thing: That the amount of money in the world has been contracting sharply in the last few months.

There have been three closely related stories in the past week:

|

He told a financial conference on Tuesday: "The U.S. is not out of the woods. I think the financial crisis is at the halfway point, perhaps. I would even go further to say 'the worst is to come'. ... We're not just going to see mid-sized banks go under in the next few months, we're going to see a whopper, we're going to see a big one, one of the big investment banks or big banks. ... We have to see more consolidation in the financial sector before this is over. ... Probably Fannie Mae and Freddie Mac -- despite what U.S. Treasury Secretary Hank Paulson said -- these giant mortgage guarantee agencies are not going to exist in their present form in a few years."

These three news stories are all related to the same thing: That the global financial system is in a deflationary spiral, and there is less money in the world each day than there was the day before. One web site reader put it this way: "Seems like deflation is right around the corner despite persistent hysteria about inflation among the general population."

The spectre of deflation forces a historic change in economic theory:

Economists are shocked that the fight against inflation is over....

(8-Nov-2008)

What's coming next: Understanding the deflationary spiral:

Why are the dollar and the yen getting stronger, while the euro is getting weaker?...

(27-Oct-2008)

Roubini: The situation is "sheer panic," as hundreds of hedge funds are going bust:

Policy makers may need to close markets for one or two weeks....

(24-Oct-2008)

There's never before been a day like this on Wall Street.:

Possible exception: One of the days just before or after the 1929 crash....

(11-Oct-2008)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Government promises to buy bad debt to end the credit crisis:

Stock markets stage huge comeback as giddy investors pile in....

(19-Sep-2008)

Another stunning and historic bailout: Fannie Mae and Freddie Mac:

Giddy investors are popping the champagne corks....

(9-Sep-2008)

Long-term negative market trends asserting themselves strongly:

Stock and commodities prices plummet as worldwide foreclosures and recessions worsen....

(5-Sep-2008)

Money supply contracts dramatically, as credit markets continue to seize up.:

Former IMF chief: Worst of global financial crisis is yet to come....

(24-Aug-2008)

As commodities plummet worldwide, the meaning is unclear.:

We speculate on some possibilities....

(11-Aug-2008)

Alan Greenspan calls this a "once in a century" liquidity crisis.:

Says that the "big surprise" is the "impressive" American economy...

(3-Aug-2008)

More questions from readers on finance and investing:

Anxious readers wonder what's going on, what to do next....

(18-Jul-2008)

Pundits and analysts are baffled by the market's performance:

They have some interesting fantasies, as well....

(10-Jul-2008)

Questions from readers on finance and investing:

On fraud, the FDIC, China, and other subjects....

(23-Jun-2008)

Royal Bank of Scotland issues global stock crash alert:

"A very nasty period is soon to be upon us - be prepared,"...

(18-Jun-2008)

A clearer explanation of credit default swaps.:

How credit default swaps (CDSs) present a systemic risk to the global financial system...

(4-Jun-2008)

WSJ's page one story on Bernanke's Princeton "Bubble Laboratory" is almost incoherent:

So is Thursday's speech on bubbles by Fed Governor Frederic S. Mishkin....

(18-May-2008)

Brilliant Nobel Prize winners in Economics blame credit bubble on "the news":

Meanwhile, the deflationary spiral is in progress, but hyperinflation is not....

(27-Apr-08)

Investment bank UBS is now "writing down" clients' auction rate securities:

From individual investors to tech firms, people are losing their money....

(29-Mar-08)

Both consumer and commercial credit is disappearing as deflationary spiral accelerates:

Wall Street markets plummet 3% on Tuesday, as service sector contracts sharply....

(6-Feb-08)

Will hyper-inflation make the dollar worthless (like the Weimar republic)?:

I've gotten this question several times this week from web site readers,...

(21-Dec-07)

Questions and answers about the "credit crunch":

What's going on, and what you can do about it....

(6-Dec-07)

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Japan's real estate crash may finally end after 16 years:

To see where America is going, look what happened in Japan....

(20-Feb-07)

This week's financial data points to trend back toward deflation.:

Several inflationary indicators are down for June...

(17-Jul-04)

| ||

For those who wish to understand this better, please refer to the accompanying list of "related articles." A good place to start is "Understanding deflation: Why there's less money in the world today than a month ago."

The collapse of M3 since February is one of the most dramatic pieces of evidence yet of the deflationary spiral.

There's also plenty of anecdotal evidence about the worsening credit squeeze. I recently spoke to an accountant who told me that American Express has frozen the long-time accounts of three of her clients. American Express is cutting off credit to its own customers.

M3 has become somewhat controversial, since the Federal Reserve announced in 2005 that it was discontinuing the computation and reporting of M3. This has led to a number of conspiracy theories that the Fed was hiding information from the public for dire reasons, even though several private firms are now making their own M3 computations available to the public. See http://shadowstats.com for a current chart.

I look at the M3 question a little differently than most.

When I was studying economics in the 1970s, I learned that M1, M2 and M3 meant the following:

M2 = M1 + assets invested for the short term. These assets include money-market accounts and money-market mutual funds.

M3 = M2 + big deposits. Big deposits include institutional money-market funds and agreements among banks."

These definitions made sense in the 1970s when I was studying them, as did concepts like the velocity of money. But when you're in a credit bubble, as has been the case since 2002, they make no sense at all.

For example, money in money market funds is counted in M2 and M3. What about money in other kinds of funds that are "just as good" as money market funds -- like funds backed by auction rate securities or CDOs? What about funds backed by credit default swaps (CDSs) or other credit derivatives?

Back in the 70s, when I was learning this stuff, there were clear boundaries between different kinds of money. There were few credit cards around, and most credit was clearly defined.

Today, there's no way in practice to distinguish between money and credit. Money "created" by credit can be spent in exactly the same way as printed money. If a bank has money provided by the Fed's discount window, and another bank has money provided by depositors, then it's money either way, and can be loaned to borrowers to spend.

Money created by the alchemy of CDOs or credit derivatives is still money. You can't buy groceries with a CDO security, but you can use the security as collateral for a loan of money that you can use to buy groceries. And with $700 trillion in credit derivatives in the world, there's no longer any real meaning to M3.

And so I don't view the Fed's discontinuance of publishing M3 figures as a major international conspiracy to fool the public. I view it as acquiescing to the obvious -- that M3 has no real meaning in a credit bubble. Once the credit bubble has dissipated over the next few years, then measuring M3 will make sense again, and the Fed will probably start doing it again.

A web site reader asks the following about the recent news about the collapse of M3:

If I could reliably predict the "next thing to happen," I wouldn't tell you guys -- I'd just use the information to become millionaire.

The best list of "next things to happen" was provided by Nouriel Roubini's "12 steps to financial disaster" in the current financial crisis. I summarized Roubini's 12 steps in an article last April. However, Roubini doesn't always get it right. He didn't get the housing bubble until 2006, even though it was obvious (and was discussed on this web site) in 2004. By 2005, Alan Greenspan was mentioning it, but Roubini and other mainstream economists ignored it.

This web site uses generational theory to make predictions based on long-term trends. I was telling people in 2002 that we would be entering a new 1930s-style Great Depression, and at that time I didn't know what a "collateralized debt obligation" or an "auction rate security" was. All I knew was that the stock market was overpriced by a factor of over 200%, and that generational theory showed we were overdue for a major stock market crisis.

(For an explanation of why the stock market is overpriced, see "How to compute the 'real value' of the stock market." For an explanation of why the credit bubble didn't create massive inflation, see the discussion of the "crusty old bureacracy theory" in "Greenspan to increase interest aggressively.")

What we're seeing today is that the the world financial system is now careening toward the fulfillment of the predictions made in 2002. This had to happen. It could not be either caused nor prevented by Alan Greenspan, George Bush, or anyone else. It was caused by a lethal combination of incompetent Boomers and nihilistic Gen-Xers: The Gen-Xers created the financial instruments necessary for the fraudulent activities leading to the credit bubble, and Boomers who were supposed to be managing the Gen-Xers instead encouraged the fraudulent activities so that they could all make money.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(24-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The government is completely rudderless as suicide bombers shock the country.

(My computer went down this week, leaving me way behind on a lot of stuff -- both articles and e-mail. I hope to catch up in the next few days.)

The fantasy among Pakistani people has been and continues to be that all of Pakistan's troubles were caused by President Pervez Musharraf's relationship with the United States in fighting the war against the Taliban in Afghanistan. And so, the fantasy continued, as soon as Musharraf was gone from the Presidency, Pakistan's troubles would disappear. It would be change you can believe in, no matter who replaced Musharraf.

Unfortunately, the Taliban aren't cooperating.

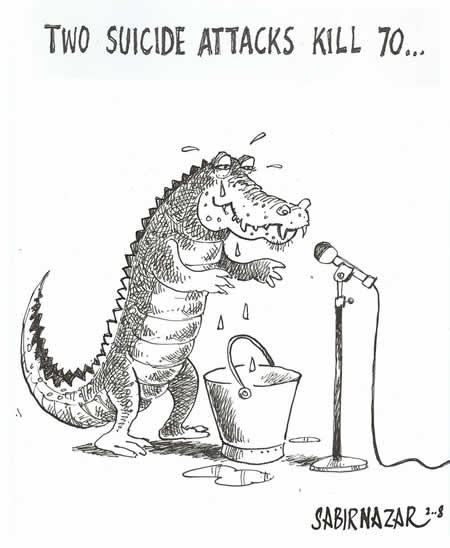

|

There have been several major terrorist attacks in Pakistan since Monday. The latest occurred on Thursday, in the town of Wah, just outside of Islamabad, Pakistan's capital. Two suicide bombers simultaneously attacked two separate entrances of a large manufacturer of munitions at shift change time. 70 people were killed.

Earlier in the week, on Tuesday, a suicide bomber in the Swat Valley in NorthWest Frontier Province (NWFP) killed 59 people in a hospital emergency room, in an attack on Shiites. (The Taliban are Sunni extremists, allied with al-Qaeda.)

At the end of the week, on Saturday, four people were killed in two suicide bombings, again in the Swat valley.

The Taliban have claimed responsibility for these attacks, saying that it's in retaliation for the Pakistan army's military campaign against the Taliban in the tribal regions.

According to BBC reporter Owen Bennett-Jones, the entire country is in denial about what's going on. He describes a period of increasing danger to the entire country, including new terrorist bombings, but the people don't talk about it, the politicians don't talk about it, and the media don't talk about it. The coalition government, having control of the Parliament, and now having driven Musharraf out of office, don't want to deal with the violence at all. According to Bennett-Jones, the coalition government is simply telling the army to do what it wants. The army is coming back and complaining that the politicians have to do their part by educating the public about what's going on.

In fact, political opinion in Pakistan appears to be split on the Taliban/al-Qaeda question. Some groups, including both the protesting lawyers and many Urdu-language newspapers, are openly supporting al-Qaeda and the Taliban against the Pakistani government.

In fact, the reinstatement of the country's Supreme Court justice, who was suspended by Musharraf early last year, remains a major source of political haggling in the coalition government in Parliament.

So, with Parliament haggling over political trivia while the NWFT burns with suicide bombings and warfare, I'm always reminded at times like this of how when the Muslims were approaching the center of Constantinople for the final conquest of the Byzantine Empire in 1453, the people of the Senate were having a lengthy political debate about whether angels were male or female.

At any rate, the Parliamentary coalition appears to be falling apart. The victory of Musharraf's opposition in February caused a great deal of euphoria, as it was believed that the new government would negotiate with the Taliban and al-Qaeda and bring an end to the violence. Instead, violence has been steadily increasing. Then it was hoped that the resignation of Musharraf would end the violence, but the events of the last week seemed to have dashed those hopes.

The two coalition leaders are:

Zardari and Sharif hate each other, but they've been united in their mutual hatred for Musharraf. But now that they've brought down Musharraf, their differences have become more important, and this is hindering their ability to name a candidate to replace Musharraf as President.

As leader of the PPP, the party with the largest representation in the government, Zardari is the logical choice. However, Sharif doesn't want to give Zardari the full level of power that Musharraf had, and wants Zardari to accept the presidency with less power. A long-time correspondent of mine from Pakistan put it as follows:

However, late Saturday, the news is that Zardari is agreeing to run for President, although the details of the agreement with Sharif are not yet known.

It may be that the events of the last week have brought Pakistan close to a full regeneracy.

Recall that, in generational theory, the "regeneracy" is an event or series of event that end the political bickering and unify the country behind the leader. In a country where there are fault lines between different ethnic or religious groups, the regeneracy solidifies the unity of each of the groups. It's called the "regeneracy" because civic unity is "regenerated" for the first time since the end of the previous crisis war.

(For information about the term "regeneracy," see "Basics of Generational Dynamics.")

Among the Pakistani people, February's euphoria has now been shattered, and more and more people are beginning to understand that their country and their way of life is coming under attack. This switch from euphoria to anxiety or panic among masses of people tends to make people take extreme positions, and that can lead to a regeneracy.

In fact, this does appear to be happening, according to an editorial in the Lahore-based Daily Times:

|

Two suicide bombers blew themselves up outside Pakistan’s main army munitions factory at Wah on Thursday, killing 70 workers in “the deadliest attack on a military installation in the country’s history”. The Tehreek-e Taliban Pakistan (TTP) owned the attack, its leader Maulvi Umar saying, “Our bombers carried out today’s attack. It is in reaction to military operations in Swat and Bajaur. Similar attacks will be carried out in other cities of Pakistan including Lahore, Islamabad and Rawalpindi”.

Prime Minister Yousaf Raza Gilani’s reaction was that Pakistan had to “take the war on terror to extremists’ doorsteps because it cannot be won on the defensive”. Mr Rehman Malik, adviser to the prime minister on security, said, “Some foreign hands might be involved in terror activities in DI Khan, Kurram Agency and Swat”. On the other hand, the leader of Jama’at-e Islami, Qazi Hussain Ahmad, asked the government to “pull out troops” from the Tribal Areas and bring “relief” to the displaced persons of Bajaur, Kurram and Waziristan.

Many Urdu newspapers have begun to reverse the incidence of mobilisation in the Tribal Areas. Instead of saying that troops have been sent to the Tribal Areas in response to terrorism, they editorialise that suicide-bombing trouble in the big cities has started after the troops were sent into the Tribal Areas. Thereafter, some have squarely placed the blame on the policy of following the “American diktat” in a negation of Pakistan’s sovereignty. Most TV anchors on Thursday night followed the same cue. On Thursday too, protesting lawyers in Lahore were seen holding placards bearing pro-Al Qaeda slogans for the first time since their protests for an “independent judiciary” began.

Clearly, the Pakistani mind is changing under pressure from the Al Qaeda strategy of suicide bombing. In the same week, Al Qaeda struck. ...

The Pakistani mind is turning pro-Al Qaeda in the same measure as it is turning against the government in Pakistan. The fundamental reason is the inability of the state to protect its citizens and assert its writ on its territory. Past military strategies have caused the state power to decline in relation to those that it allowed to wage jihad. Unless the state fights back with all the means at its disposal and defeats the terrorists, it will be seriously endangered. And the final shock will come, not from Al Qaeda, but from the economy which is slowly giving up the function of sustaining Pakistan’s population."

Thus, from the point of view of Generational Dynamics, we could be seeing a major shift of public opinion in Pakistan. This could be the reason why Zardari suddenly agreed to run for the Presidency, but it also could mean that violent fault lines are close to some kind of explosion.

Meanwhile, in the India-controlled portion of Kashmir, tens of thousands of Muslims in a new generation of young Kashmiris are now demonstrating violently against the Indian government, demanding independence from India. As of today, these growing demonstrations are India's problem. But with events moving so quickly, something could happen at any time to make them Pakistan's problem.

There's a tough contest going on these days between Pakistan and the

Caucasus over which is the most dangerous region in the world.

Today, with things in Georgia seeming to be settling down for the

time being, Pakistan is once again the winner.

(23-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Second quarter earnings were disastrous.

As regular readers know, I post the table of S&P 500 average corporate earnings estimates, based on figures from CNBC Earnings Central supplied by Thomson Reuters.

Here's the final table for second quarter earnings:

Date 2Q Earnings growth estimate as of that date ------- ------------------------------------------- Jan 1: +4.7% Feb 6: +3.5% Apr 1: -2.0% Start of quarter Jun 6: -7.3% Jun 13: -8.1% Jun 20: -9.0% Jun 27: -11.3% End of quarter Jul 3: -12.4% Jul 8: -13.0% Jul 11: -14.7% Jul 18: -17.1% Jul 25: -17.9% Aug 1: -20.4% Aug 8: -22.1% Aug 15: -22.0%

You can see that, as the second quarter earnings season ends, and actual earnings are available, earnings are 22% lower than they were last year. We should start to have third quarter earnings estimates next week.

A fall in earnings estimates means an increase of price/earnings ratios estimates. Here's the Friday's version of the graphic that appears on the bottom of the home page of this web site:

|

As you can see, P/E ratios (also called "valuations") have returned to really astronomical heights.

We're now "celebrating" the one-year anniversary of the worldwide global credit crisis.

As a measure of that celebration, here's an interesting graph from a blog at the Federal Reserve Bank of Atlanta:

|

LIBOR is the London InterBank Offered rate. It represents the interest rates that banks charge one another for 30 or 90 day loans.

The OIS is the Overnight Index Swap rate, and it represents the interest rates that banks charge each other for overnight loans.

The difference (or "spread") between LIBOR and OIS measures the willingness of banks to loan money to one another for more than overnight. If I don't trust you, then I might still risk loaning you money overnight, but for any longer period I'd charge a much higher interest rate. The size of that interest rate is a measure of my distrust.

Prior to August, 2007, the Libor-OIS spread was pretty much flat at 6 basis points (or a 0.06% interest rate difference). With the credit crunch, the spread skyrocketed, reaching 110 basis points (1.10% interest rate difference) on December 4. Now it's still much higher than historical rates, meaning that the credit crunch is far from over.

That shouldn't be surprising, because continually have to write down more and more worthless assets. According to one analysis:

The writedowns and credit losses at more than 100 of the world's biggest banks and securities firms rose after UBS AG reported second-quarter earnings [on August 12], which included $6 billion of charges on subprime-related assets."

The following table shows the asset writedowns and credit losses as well as the capital raised in response. All numbers are in billions of U.S. dollars. Check out your favorite bank:

Firm Writedown & Loss Capital Raised

Citigroup 55.1 49.1

Merrill Lynch 51.8 29.9

UBS 44.2 28.3

HSBC 27.4 3.9

Wachovia 22.5 11

Bank of America 21.2 20.7

IKB Deutsche 15.3 12.6

Royal Bank of Scotland 14.9 24.3

Washington Mutual 14.8 12.1

Morgan Stanley 14.4 5.6

JPMorgan Chase 14.3 7.9

Deutsche Bank 10.8 3.2

Credit Suisse 10.5 2.7

Wells Fargo 10 4.1

Barclays 9.1 18.6

Lehman Brothers 8.2 13.9

Credit Agricole 8 8.8

Fortis 7.4 7.2

HBOS 7.1 7.6

Societe Generale 6.8 9.8

Bayerische Landesbank 6.4 -

Canadian Imperial (CIBC) 6.3 2.8

Mizuho Financial Group 5.9 -

ING Groep 5.8 4.8

National City 5.4 8.9

Lloyds TSB 5 4.9

IndyMac 4.9 -

WestLB 4.7 7.5

Dresdner 4.1 -

BNP Paribas 4 -

LB Baden-Wuerttemberg 3.8 -

Goldman Sachs 3.8 0.6

E*Trade 3.6 2.4

Nomura Holdings 3.3 1.1

Natixis 3.3 6.7

Bear Stearns 3.2 -

HSH Nordbank 2.8 1.9

Landesbank Sachsen 2.6 -

UniCredit 2.6 -

Commerzbank 2.4 -

ABN Amro 2.3 -

DZ Bank 2 -

Bank of China 2 -

Fifth Third 1.9 2.6

Rabobank 1.7 -

Bank Hapoalim 1.7 2.4

Mitsubishi UFJ 1.6 1.5

Royal Bank of Canada 1.5 -

Marshall & Ilsley 1.4 -

Alliance & Leicester 1.4 -

U.S. Bancorp 1.3 -

Dexia 1.2 -

Caisse d'Epargne 1.2 -

Keycorp 1.2 1.7

Sovereign Bancorp 1 1.9

Hypo Real Estate 1 -

Gulf International 1 1

Sumitomo Mitsui 0.9 4.9

Sumitomo Trust 0.7 1

DBS Group 0.2 1.1

Other European banks 7.2 2.3

Other Asian banks 4.6 7.8

Other U.S. banks 2.9 1.9

Other Canadian banks 1.8 -

____ ____

TOTAL 501.1 352.9

As one online correspondent wrote, "I would compare the current economy to a house of cards. Cards are being yanked out from the bottom-it won't be much longer before the whole thing collapses."

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(19-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Russian language blogs provide a complex and threatening picture.

I'm grateful to a web site reader for sending me the following message, that I received just as I was finishing up my article, "The gathering storm in the Caucasus":

Whoever joins this union is accepted. Others, especially financially and politically dependent on US and EU, will be crippled by sanctions (energy supply infractions). All these new pro-western. pro-liberal elites in the former USSR and Eastern Europe are considered the main targets of Russian foreign policies. With a serious economic crisis unfolding, the West going to be less prone to back these small countries with funding.

First, Slovakia, Bulgaria, Serbia and Hungary will take different approach. Others will follow or fall (Estonia and Latvia, but not Lithuania). The Kurds, probably, will gain independence in North Iraq, but not US-oriented. Israel will sign multiple peace agreements, giving away [Golan Heights] and providing for Palestinians better territorial conditions.

Important part: Given the relations with Azerbaijan and Central Asia - all Muslim and turkish-like nations. Most unexpected outcome - Much wider spread of moderate, Sunni Islam all over Russia with support from Orthodox church and government structures. Some politics see this as only choice to stop dying off Russian population in Northern Russia."

This message provides a picture of a very complex Russian plan to counter U.S. influence in Russia's backyard, and to punish East European "élites" for siding with Europe and the U.S.

According to this message, based on postings by knowledgeable Russians, Turkey, Russia and Iran form an anti-West alliance and use their control of gas and oil supplies to gain hegemony over Western allies.

There are a couple of very interesting things that particularly are worthy of more research. First, we've frequently discussed radical "Islamist" Sunni Islam -- al-Qaeda, the Taliban, Muslim Brotherhood, Jemaah Islamiah in Indonesia, GSPC (Salafist Group for Preaching and Combat in Northern Africa), and so forth.

However, Turkey and some central Asian countries are also Sunni Muslim, but not allied with the al-Qaeda groups. According to the message, these groups will ally with Russian Orthodox community.

The message closes by referring to what many see as a huge Russian problem today: The negative growth of the Russian population.

What's missing from this analysis is the same thing that's missing from Western analyses: The recognition of a coming world war. Everyone is assuming that things will continue to evolve in the same manner as before. Regular readers of this web site know that that isn't going to happen.

The three nations forming this new alliance -- Turkey, Russia and Iran

-- are all countries that I would expect would be allied with the West

against China, Pakistan, Bangladesh, and others in the coming Clash

of Civilizations world war. The exact nature and timing of these

alliances of course cannot be predicted, since they depend on chaotic

events that can't be predicted. But if this message is correct, then

it illuminates an important scenario that the world will be following

in the coming months.

(18-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Pakistan looks into the abyss.

A week after being threatened with impeachment, Pakistan's President Pervez Musharraf appears to be close to resignation.

According a front-page article in Pakistan's prestigious Daily Times, "The deal is done." Musharraf will be permitted to flee to a foreign country.

Who will replace Musharraf? It will certainly be someone younger, someone without anything close to the same negotiating skills required to achieve peace with India. A younger President will have to prove that he can stand up other foreign leaders, and he'll be far more confrontational.

I heard one Pakistani official on the BBC get asked how any new president would handle the violence going on in Pakistan's tribal regions. His answer: "The fighting will stop by itself, since it's Musharraf's presence that's causing the fighting."

Thus we see the crazy level of fantasy that many Pakistanis are exhibiting as they go forward to get rid of the one person who had held the country together for 8 years, and maintained peace with India. That remark about the fighting stopping by itself is a very familiar sounding kind of statement to me. In America, it would be a nihilistic Gen-Xer with contempt for any accomplishment by anyone older, and a willingness to destroy all such things. As I've said many times, this nihilism and destruction backfires and turns into self-destruction.

|

Pakistan seems well on the way to similar self-destruction. I've heard nothing from the politicians who might replace Musharraf that gives me anything remotely close to the feeling that these people have a clue what's going on. Pakistan has enormous problems -- huge economic problems, conflict in the tribal areas, and conflict in Kashmir -- and the new President will be clueless about how to handle them.

Fighting in the Bajaur between the Pakistan army facing Taliban and al-Qaeda forces has gotten so bad that 135,000 residents have fled to other regions.

Fighting has also been escalating in Kashmir and Jammu provinces, mainly in the Indian-administered region, as there are massive protests by both Muslim and Hindu residents.

A new Pakistan president will have to deal with all of these problems, and the chances are that a younger, clueless President will be extremely confrontational and will over-react.

We now have two regions that are becoming increasingly dangerous and

unstable -- Pakistan and the Caucasus. From the point of view of

Generational Dynamics, a new world war will affect both of these

regions. It only remains to be seen where it will start.

(15-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Some technical issues about generational theory and the Caucasus.

I make no attempt to give every detail of every battle. Also, at the time I wrote that article, there was no confirmation of any of Russia's claims. Even today, the Russian claims of Georgian "ethnic cleansing" have not been confirmed. However, for that particular article, the most relevant fact is that the Russians are ACCUSING the Georgians of "ethnic cleansing," and I did mention that, because that perception is highly relevant to the article.

Well, we'll have to see how the investigations proceed. But I'm not so sure that "the truth will prevail." As I'm always pointing out on this web site, certain perceptions will prevail, but they may or may not have anything to do with the truth.

This is an interesting point, but things are a lot more complicated than that.

Georgia has been lobbying to become a member of the European Union and/or NATO. It's widely believed that if Georgia had become a member, then Russia would never have invaded Georgia, since that would have forced a military response from Europe.

Therefore, goes the reasoning, let's admit Georgia to the EU or Nato, to prevent a future conflict.

The problem with that reasoning is that it would probably backfire. Depending on which side you favor, Georgian President Mikhael Saakashvili either "stands up to the Russians" or "purposely provokes the Russians." However, Saakashvili's actions are restrained because he's a small, lone country. But if he could count on the backing of EU or Nato, then he would be free to take far more provocative actions. Sooner or later, he would do something so provocative that the Russians would respond militarily anyway, and then there would be a much larger war.

Remember that World War I began because of interlocking treaties. Germany had no intention of going to war with France, but they were forced to do so because of a treaty with Austria. If Georgia were part of Nato, then a small war would spread to a big war very quickly.

The relative populations and power of the combatants does not determine how long a war will last, or how savage and bloody it will be. What matters most is whether or not it turns into a generational Crisis war.

The 1960-70s American war with Vietnam was won by the North Vietnamese, who had a smaller population than America, because it was a Crisis war for the Vietnamese, but an Awakening era war for the Americans. The Americans crippled themselves politically, as often happens during an Awakening era war, while the Crisis era Vietnamese fought savagely and ruthlessly.

Russia's 1990s war with the Chechens (people of Chechnya) was not a Crisis war, because Chechnya was in a generational Unraveling era. Chechnya's last crisis war was Stalin's massive relocation of Chechens to Kazakhstan and Siberia, starting in 1944.

I don't want to go too deeply in the weeds here, because this is a highly technical subject within generational theory, but in simplest terms: Russia is a huge country, with many ethnic populations, and it's possible for such a large country to have separate generational timelines for the different populations. For the Russians and the Georgians, the last Crisis war was the 1917 Bolshevik Revolution and the subsequent series of civil wars in the 1920s. But for the Chechens, the last Crisis war was Stalin's savage relocation of the Chechens after WW II. So, in the 1990s, Chechnya was in a generational Unraveling era, and so the Chechen war didn't spiral into a crisis war. But a war today between Georgians and Russians is much more likely to do so, because both countries are deep into generational Crisis eras.

(For information about generational Awakening and Crisis eras, see "Basics of Generational Dynamics.")

I assume that you're referring to my previous statements that in the coming Clash of Civilizations world war, Russia will be allied with America and the West. That is still true, irrespective of any Georgian-Russian conflict, should it occur.

Russia's crisis wars have ALWAYS been with the Asians -- the Mongols, the Turks, the Muslims. One of the most interesting findings of generational theory is that Russia has had three major wars with Europeans, but they were all non-crisis wars. They were the Great Northern War, 1700-1720, when Sweden invaded Russia; the Napoleonic wars, when France invaded Russia in 1812; and World War II, when Germany invaded Russia. All three of those wars were non-crisis wars for the Russians, but occurred during major crisis wars for the Europeans (the War of the Spanish Succession, the Napoleonic Wars, and World War II, respectively). And Russia won all three of those wars in pretty much the same way: Let the invading enemy go deep into Russia, where the frigid Russian defeated the invaders.

Bringing this back to today, it's possible that Europe and America

will support Georgia in a civil war against Russia, but when

difficult choices have to be made in the Clash of Civilizations world

war, Russia and the West will side with India and Japan against China

and Pakistan.

(15-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

It's still not known what Russia's final objectives are, though there's no doubt in my mind.

Theoretically, Russia and Georgia have agreed to a cease-fire in the Russian invasion of Georgia, but Russia apparently isn't honoring it.

Russian soldiers are effectively splitting the country in two, by blocking critical points in major highways. Russian bombers continue to attack Georgian cities, and Russian troops are looting and setting homes ablaze.

There's a lot of public debate about what are the intentions of Russia and of Russian Prime Minister Vladimir Putin in Georgia.

But there's little doubt about it in my mind: Putin's intention is to lay the groundwork for a complete takeover of Georgia in the near future. All other stated intentions are pure subterfuge.

Yukos nationalization may set the pattern for Russia in 2005:

There was more high comedy last week, as the Kremlin completed the nationalization...

(29-Dec-04)

Now we know - Baikal is a neighborhood liquor store:

High comedy continued on Monday, as Russian officials stonewalled...

(20-Dec-04)

After a week of high comedy, who the heck is Baikal?:

Baikal Finance Group, an unknown company with unknown backers, is the new owner of Yukos'...

(19-Dec-04)

Ukraine headed for a confrontation with Putin :

Ukraine is headed for trouble as it moves to reverse the 20-Nov Presidential election.

(28-Nov-2004)

Yukos still very close to bankruptcy as oil tops $47 per barrel:

The U.S. State Department is expressing concern about the fate of Yukos....

(18-Aug-04)

Kremlin backs down and hires Dresdner to evaluate Yukos subsidiary:

Russia's ping-pong nationalization of Yukos appears to have ponged back in the direction of sanity,...

(13-Aug-04)

Yukos is now fit only for vultures, as rumors of insider trading fly:

Concerns about Russian and Iraqi oil output are spiking international oil prices to new highs,...

(10-Aug-04)

Incredible! The Kremlin has frozen Yukos' assets again, sending international oil prices to yet another record high:

Putin's herky-jerky policy may signal a serious split in Kremlin leadership....

(5-Aug-04)

Kremlin appears to be backing down on nationalizing Yukos:

Russia's Justice Ministry gave Yukos more time to pay its back taxes,...

(2-Aug-04)

Yukos freeze order rescinded after worldwide oil prices soar to all time high.:

The Kremlin's ham-handed treatment of Yukos brings memories of its Communist days,...

(29-Jul-04)

Kremlin orders Yukos to stop selling oil.:

Oil prices spiking today to $42 per barrel as the worst possible scenario unfolds in Russia....

(28-Jul-04)

Yukos: Bankruptcy is near:

The Kremlin is stonewalling Yukos and preparing to nationalize its major asset...

(22-Jul-04)

I wish we knew more about Putin's plans for Yukos:

The gathering crisis for Russia's oil giant Yukos threatens both Russia's economic stability and world oil prices....

(6-Jul-04)

| ||

Why am I so certain? Because I've been watching Putin for several years now, particular during the 2004 takeover of oil giant Yukos.

In 2003, Yukos a privately owned Russian energy provider that supplied 11.4% of all the oil in the whole world. But then Yukos CEO Mikhail Khodorkovsky indicated that he was going to challenge Putin politically -- the biggest mistake of his life. Khodorkovsky was jailed on trumped-up political charges, and he's in jail to this day.

By the end of the year, Yukos had been dismantled and nationalized by means of the vilest series of steps imaginable.

It was in July, 2004, when I wrote "I wish we knew more about Putin's plans for Yukos," where I expressed my confusion about what Putin was doing.

By the end of the year, it was obvious that Putin had lied about his intentions, and that he was willing to use any means available to him to get what he wants, while still retaining personal deniability.

My conclusion was, and is, that Putin considers himself to be the new Nicolai Lenin (Vladimir Ilyich Ulyanov), the father of the 1917 Bolshevik Revolution. I've previously quoted this 1922 memo to the Politburo on the destruction of the Russian Orthodox Church in order to harvest the Church's wealth:

By the end of 2004, it was obvious that Putin was much more politically subtle than Lenin, but just as ruthless.

Like Lenin, Putin has a secret police available to kill or jail political enemies. Like Lenin, Putin is willing to use extortion and fraud and violent force to take anything he wants.

It's also clear that the new President, Dmitry Medvedev, is simply Putin's puppet. Putin is the one in charge.

There's something else. The Bolshevik Revolution was followed by an extremely savage civil war, with mass executions and many atrocities. And a major component of that civil war pitted Georgians against Russians.

Thus, one thing that has become apparent in the last few days is that we're seeing the beginning of the re-fighting of the Russian-Georgian crisis war of the 1920s.

It's always been 100% certain that a new crisis war would begin in the Caucasus. In the past, when I've talked about a major new genocidal war in the Caucasus, I assumed that it would be along the Orthodox / Muslim fault line, and would grow out of the existing conflict in Chechnya and Dagestan. That conflict may revive, but the epiphany I've had in the last week is that the major battle will be between Georgians and Russians.

In the 1920s, Lenin died of a stroke in 1924, and in the subsequent wars, Joseph Stalin -- a Georgian -- became the supreme dictator of the Soviet Union, and remained so until his death in 1953. He committed savage purges directed at Russians and Ukrainians, causing tens of millions of deaths by execution and starvation.

When Putin accuses modern Georgians of "genocide" and "ethnic cleansing," he may in fact be thinking of Joseph Stalin's genocide of his political enemies in the 1920s and 1930s.

There is nothing that can stop this re-fighting of the war between Georgians and Russians. There are only two important questions.

The first question is: How far will the West and the United States get pulled into this war? America's involvement has already begun, as indicated by a Wednesday afternoon statement by President Bush, that included the following:

The second major question is whether the war between the Georgians

and the Russians will be the war that launches World War III -- the

Clash of Civilizations world war.

(14-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

I'm raising the "Conflict Risk Index" for the Caucasus from 2 (medium risk) to 3 (high risk).

This kind of thing was standard operating procedure for the Soviets after World War II.

World War II was particularly brutal for Soviets. Although it was a generational non-crisis war for Russia (the previous crisis war was the Bolshevik Revolution and the massive civil war of the 1920s), it was a particularly brutal war, as Hitler's Germans attempted to eradicate everyone in European Russia.

The "lessons learned" for the Soviets were to repress, quickly and brutally, any neighboring country that might pose a threat. As Ukraine and Georgia move towards joining the EU and Nato, some of Russia's worst nightmares are being realized.

Now Russia is evidently applying these "lessons learned" to Georgia.

|

The following has happened:

Late on Monday afternoon, President Bush made the following televised statement:

I am deeply concerned by reports that Russian troops have moved beyond the zone of conflict, attacked the Georgian town of Gori, and are threatening the Georgia's -- Georgia's capital of Tbilisi. There's evidence that Russian forces may soon begin bombing the civilian airport in the capital city.

If these reports are accurate, these Russian actions would represent a dramatic and brutal escalation of the conflict in Georgia. And these actions would be inconsistent with assurances we have received from Russia that its objectives were limited to restoring the status quo in South Ossetia that existed before fighting began on August the 6th.

It now appears that an effort may be underway to depose Russia's* duly elected government. Russia has invaded a sovereign neighboring state and threatens a democratic government elected by its people. Such an action is unacceptable in the 21st century.

The Georgian government has accepted the elements of a peace agreement that the Russian government previously said it would be willing to accept: an immediate cease-fire, the withdrawal of forces from the zone of conflict, a return to the military status quo as of August 6th, and a commitment to refrain from using force. There are representatives of the European Union and the Organization for Security and Cooperation in Europe currently in Moscow seeking Russia's agreement to this peace plan.

Russia's government must respect Georgia's territorial integrity and sovereignty. The Russian government must reverse the course it appears to be on, and accept this peace agreement as a first step toward resolving this conflict.

Russia's actions this week have raised serious questions about its intentions in Georgia and the region. These actions have substantially damaged Russia's standing in the world. And these actions jeopardize Russians' relations -- Russia's relations with the United States and Europe. It is time for Russia to be true to its word and to act to end this crisis."

This is definitely a return to "Cold War rhetoric," strongly condemning the Russians. But no military threats are made.

However, he does threaten to damage Russia's standing in the world which, I'm sure, will leave Vladimir Putin quivering in his boots.

A Generational Dynamics analysis of a war cannot be complete without examining the war from both sides. Even when two sides fight in a war, it's often a completely different war to them. This is similar to a married couple arguing about sex, when he's really arguing about money and she's really arguing about his mother.

The Russian view of the conflicting is breathtaking, as you'll see from this video that presents the Russian view of the conflict, accusing the Georgians of committing ethnic cleansing:

I will only quote one portion of the 6:55 minute video.

At the 5 minute point in the video, they play a sound byte from Georgian President Mikhael Saakashvili:

And now, here's the incredible and amazing response from Russian military analyst Evgeny Khruschchev:

And it was Stalin and his KGB chief [Lavrenti] Beria, these two Georgians, who mutilated all nations of the USSR, including Russians, Georgians, and everybody else.

So I think that those who helped him [Saakashvili] to prepare this speech, his speechwriters, were really just trip over.

The second important point, about Afghanistan. Please, give me a BREAK! Myself as a Soviet Afghan war veteran, it was Brzezinski junior, it was his brilliant information campaign to draw Soviet Union into Afghanistan in Soviet times. And now, in effect, the current Georgian president, he reminds me, [it was that person] who managed to draw the Soviet Union into that conflict, which was totally an internal affair, and he converted the Afghan civil war into the biggest cold war battle, or proxy war between the Soviet Union and the USSR [he probably meant "the US"]. And I hope that those who run Saakashvili that they also remember that he got his law degree in the United States, and I hope he will not wind up as a ?? himself."

In other words, the Russians played no part in the Budapest and Prague invasions, because Stalin was a Georgian!

In fact, Khruschchev actually sees the current invasion of Georgia as getting even for Stalin's atrocities committed against the Russians!

And the Afghan war? Well, that's the fault of "Brzezinski junior," who conducted a disinformation campaign to suck the Soviets into the Afghan war. Who's Brzezinski junior? I'm honestly not sure, but I believe it has to be Zbigniew Brzezinski, who was President Jimmy Carter's national security adviser at the time of the Soviet invasion of Afghanistan. However, Brzezinski has children, and perhaps Khruschchev was referring to one of them.

So the Soviet invasion of Afghanistan wasn't the Russian's fault either! It was the Americans' fault!! Amazing!!

At the time of the Budapest and Prague invasions, America and Western Europe were in generational Recovery and Awakening eras. The countries of Eastern Europe and the Caucasus, including Russia, had all had crisis wars in the 1920-1945 period, so they were in Awakening or Unraveling eras. In any case, from the point of view of Generational Dynamics, it was very unlikely that any of those invasions could have led to a wider war.

But that's not true today. All of these countries are now in a generational Crisis era. Russian President Dmitry Medvedev and Georgian President Mikhael Saakashvili are both young men, with little fear of the consequences of their actions. Thus, the danger of the current situation spiraling out of control into a larger war is much higher today than it was at the time of the previous invasions we discussed.

| Conflict risk level for next 6-12 months as of: 6-Nov-2007 | ||||

|---|---|---|---|---|

| W. Europe | 1 | Arab Israeli | 3 | |

| Russia Caucasus | 2 | Kashmir | 3 | |

| China | 2 | North Korea | 2 | |

| Financial | 3 | Bird flu | 3 | |

| ||||

The last time that I changed the Conflict Risk Graphic was last year in November. I raised the Kashmir risk level from 2 (medium risk) to 3 (high risk). I did this because the Pervez Musharraf government in Pakistan was becoming increasingly unstable, and the risk of all out war between Pakistan and India within six months had gotten considerably greater. The epicenter of such a war would be the disputed regions of Kashmir and Jammu.

(Incidentally, I don't have time to write a complete article about it, but the violence is Kashmir between Hindus and Sunni Muslims is still getting much, much worse, following the article that I wrote last week on the subject.)

It's now time to recognize that the Caucasus region is becoming similarly unstable, thanks to the events of the last week.

Quite honestly, when the 2004 Beslan school massacre occurred, I was surprised that it didn't lead to wider violence. Since it didn't, I kept the conflict risk level at 2 (medium risk).

| Conflict risk level for next 6-12 months as of: 11-Aug-2008 | ||||

|---|---|---|---|---|

| W. Europe | 1 | Arab Israeli | 3 | |

| Russia Caucasus | 3 | Kashmir | 3 | |

| China | 2 | North Korea | 2 | |

| Financial | 3 | Swine/Bird flu | 3 | |

| ||||

But that's now in the past. As long as Russia is crushing a small neighbor during a generational Crisis era, and another small neighbor, Ukraine, is similarly threatened, anything can happen.

I am therefore going to raise the "Conflict Risk Level" for the Caucasus from 2 (medium risk of war within 6 months) to 3 (high risk of war within six months). The new graphic is as shown on the right.

From the point of view of Generational Dynamics, the Caucasus

mountain region, which controls many valuable land routes connecting

the Caspian Sea to the Black Sea, has been the battlefield for many

crisis wars between the Orthodox Christian and Muslim civilizations,

and between different ethnic groups of the same or different religions

for many centuries. A new genocidal crisis war in the Caucasus is

coming with absolute certainty.

(12-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Russia's overreaction may lead to wider war.

Georgia evidently capitulated in South Ossetia, withdrawing its troops after four days of fighting.

|

However, Russian soldiers and tanks continue to pour into South Ossetia. Russian bombers continued to attack military targets throughout Georgia, including an airport south of the capital, Tblisi.

The city of Tskhinvali, the capital of South Ossetia, is being described as a humanitarian disaster, with a shortage of food and water, and thousands of bodies littering the streets. Each side blames the other, and accuses the other of genocide and ethnic cleansing.

Russia appears to be taking total control of South Ossetia. It is not known whether Russia will claim that South Ossetia is now Russian territory.

Russia also is moving tanks and soldiers into another secessionist Georgia province, Abkhazia. It is not known whether Russia will also claim that Abkhazia is now Russian territory.

Russia has blockaded Georgia's Black Sea ports by moving its Black Sea fleet into Georgia's ports. The Russian fleet is normally stationed in Sevastopol, which is in the Crimea, which is part of Ukraine.

As Georgia seems to be pretty much militarily defeated, and western nations are refusing Georgia's request for military support, it seems unlikely right now that the war will spread into a major regional war.

However, Ukraine is taking Georgia's side in the fight, which is not unexpected since leaders of both countries have said they wish to join the European Union and NATO.

On Sunday, Ukraine warned Russia that it might bar Russian navy ships from returning to their base in Sevastopol, because of their deployment to Georgia's coast. Right now, this seems to be the only significant possibility of a lead to a wider conflict.

However, it's really probably up to Russia right now, as Russia is continuing to expand the war.

From the point of view of Generational Dynamics, the Caucasus

mountain region, which controls many valuable land routes connecting

the Caspian Sea to the Black Sea, has been the battlefield for many

crisis wars between the Orthodox Christian and Muslim civilizations,

and between different ethnic groups of the same or different religions

for many centuries. A new genocidal crisis war in the Caucasus is

coming with absolute certainty.

(11-Aug-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

We speculate on some possibilities.

|

Commodities -- oil, soybeans, gold, corn, etc. -- are suddenly falling sharply in price. The dollar is significantly strengthened in one day. And stocks surge on Wall Street.

The conventional view is that commodities were in a speculator-induced bubble, and that now the bubble is ending. Prices will return to "normal" in an orderly fashion, and many of the problems caused by the commodities bubble will sort themselves out fairly quickly.

That may well be what's happening, but let's speculate on something far different.

From the point of view of Generational Dynamics, what I watch for are major shifts in public opinion, since these usually indicate an important new generational viewpoint.

That's exactly what's going on, according to The Telegraph's Ambrose Evans-Pritchard:

The psychology of global markets has shifted hugely over recent days as it becomes clear that Europe, Australasia and parts of Asia are sliding into recession.

The US dollar has launched its best rally in half a decade, reflecting a recognition that half the world is in even worse shape than the US. In fact, America is the only G7 country to eke out modest growth this summer.

The US dollar index - currencies watched closely by traders - smashed through resistance yesterday in the biggest one-day move since the long dollar slide began seven years ago.

"This was highly significant. Perceptions have changed," said Ian Stannard, currency strategist at BNP Paribas. ...

Commodities tumbled as hedge funds and financial investors struggled to untangle themselves from crowded positions on the futures markets. Brent crude fell $4 to under $114 a barrel, down over 20pc since peaking in early July. The Baltic Dry Index has now fallen every day for over three weeks, dropping 30pc on fears that ship demand is fizzling out.

Copper fell to a six-month low on reports of rising inventories in China and Europe. Lead, nickel and tin all dived in frantic trading on the London Metal Exchange.

"We see a deep global recession," said Albert Edwards, chief strategist at Société Générale.

"Growth prospects in the Eurozone, Japan and the UK have deteriorated. Most now accept that recession has already begun in all three," he said. Mr Edwards predicted a "collapse" in emerging markets next. "You ain't seen nothing yet," he said."

This article goes to the heart of the global financial system today.

I've written many times on the subject of deflation -- how the country is in a deflationary spiral, and there's no danger whatsoever of "hyperinflation," as many people fear.

Those who have worried about hyperinflation in the US often overlook the important fact that, as bad off as the American economy is, it's actually much better off than many foreign economies.

The huge international credit bubble has been almost entirely an American dollar bubble. That's because the $750 trillion in credit derivatives that have been created in the past few years have all been denominated in dollars. As the bubble leaks, it reduces the amount of money (in dollars) in the world, which actually makes the dollar more valuable. Thus, the American dollar is in a deflationary spiral around the world.

But that's not true, for example, of the euro. The volume of credit derivatives denominated in euros is tiny compared to those in dollars. Any inflationary tendency in US dollars is overwhelmed by the deflationary spiral in US dollars, but an inflationary tendency in euros would not be similarly deflated.

The sudden spike in the international value of the dollar currency is, according to the article quoted above, not something based on the American economy, but on something based on the other economies -- that they're deteriorating quickly, more quickly than the American economy.

Thus, investors are pulling money out of non-dollar-denominated assets. Thus, we've seen substantial plunges in stock market indexes, particularly in Asia. Even China's Shanghai Stock Market, which had finally seemed stable in the last month after falling 50%, has now resumed its plunge in the last week.

Commodities prices are also denominated in dollars, and so the rapid strengthening of the dollar last week means that commodity prices are going to fall in price relative to the strengthened dollar.

This would seem to be good news -- and it is for any business that purchases copper or oil as raw material. It's also good news if it means that food prices will moderate. It also seems to be good news for Wall Street -- money invested in foreign markets is now being redirected into American stocks.

But it may be very bad news for numerous Asian economies. With stock markets crashing, the fall in commodities prices may be caused by financial crises in these countries -- not just recessions, as Evans-Pritchard suggests, but full-fledged stock market crashes.

The speculation, then, is that the sudden strengthening of the dollar, combined with a fall in commodities prices, is the sign of an imminent global financial crisis. Presumably, we'll know within a week or two which of the two views (mainstream or speculative) is in play.

As regular readers know, I post the table of S&P 500 average corporate earnings estimates, based on figures from CNBC Earnings Central supplied by Thomson Reuters.

Here's the latest table for second quarter earnings:

Date 2Q Earnings growth estimate as of that date ------- ------------------------------------------- Jan 1: +4.7% Feb 6: +3.5% Apr 1: -2.0% Start of quarter Jun 6: -7.3% Jun 13: -8.1% Jun 20: -9.0% Jun 27: -11.3% End of quarter Jul 3: -12.4% Jul 8: -13.0% Jul 11: -14.7% Jul 18: -17.1% Jul 25: -17.9% Aug 1: -20.4% Aug 8: -22.1%

As you can see, second quarter earnings estimates have fallen by another 8%, which means that price/earnings ratios will rise by 8%.

I don't know where the P/E ratio index will end up this week, but stock prices surging and earnings plunging, it should be quite dramatic.

I wrote on August 3 that New York's attorney general Andrew Cuomo was bringing fraud charges against several banks over auction rate securities.

(For a discussion of the hare-brained auction rate securities scheme, see "Investment bank UBS is now 'writing down' clients' auction rate securities.")

It didn't take long to get a response. Swiss bank UBS AG, Citigroup and Merrill Lynch have all agreed to repurchase the near-worthless auction rate securities from retail customers, charities and small and mid-size businesses, and to pay substantial fines.

What's interesting about this is how quickly these financial institutions caved in to the accusations, agreeing to settle very quickly. Why were they willing to settle very quickly?

Obviously it's because they knew they would be found guilty, but there's more to it, according to some pundit conversations I heard on CNBC last week. It seems that the brokers in each of these financial institutions were pressuring their bosses to settle, because the brokers themselves were afraid of being individual prosecuted, for having lied to their customers.

Two months ago we had "'Operation Malicious Mortgage' indicts 406 people including Bear Stearns execs." Now we have more a few more banks.

Last year in September, I made a list of people who are currently being blamed, or soon will be blamed, and who will be the subject of investigations, civil lawsuits and possible prosecution. Let's take another look at that list, and update it a little:

We can now see that the deception and fraud were ubiquitous, occurred in every financial, real estate and government organization, from top-level management to bottom-level salesmen. Furthermore, it occurred throughout the world.

What I really think is hilarious is that everyone I hear on tv is now blaming the current situation on Alan Greenspan, because the Fed lowered interest rates to near-zero in 2002-2003.