*** 1-Feb-14 World View -- Syria 'peace talks' end in recriminations and accusations

This morning's key headlines from GenerationalDynamics.com

- Syria 'peace talks' end in recriminations and accusations

- Eurozone continues spiral into deflation, with 12% unemployment

- Three bankers commit suicide in one week

****

**** Syria 'peace talks' end in recriminations and accusations

****

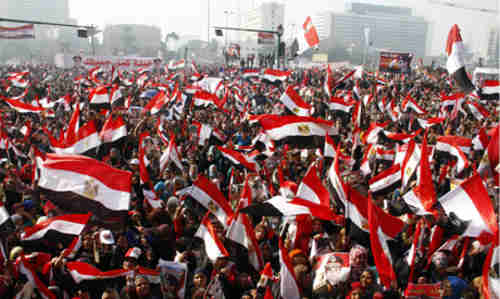

Supporters of Syria's president Bashar al-Assad demonstrate in Geneva on Friday (Reuters)

The so-called "Geneva II" Syria peace conference in the Swiss town of

Montreux ended on Friday with no agreement on peace, no agreement on

humanitarian aid, and no commitment to another meeting. According to

UN envoy Lakhdar Brahimi, who was conference leader:

<QUOTE>"Progress is very slow indeed, but the sides have

engaged in an acceptable manner. This is a modest beginning on

which we can build.

The gaps between the sides remain wide; there is no use pretending

otherwise. Nevertheless, during our discussions, I observed a

little bit of common ground – perhaps more than the two sides

realize or recognize.

Things have gone so far down that they are not going to get out of

the ditch overnight."<END QUOTE>

The Friends of Syria, a Western alliance that backs al-Assad's foes,

said, ""The regime is responsible for the lack of real progress in the

first round of negotiations. It must not further obstruct substantial

negotiations and it must engage constructively in the second round of

negotiations." The U.S. State Department said that the Syrian

government "continues to play games."

Syria's deputy prime minister, Walid al-Moallem, gave two reasons for

the failure of the conference:

<QUOTE>"[One reason was] the non-seriousness and non-ripeness

of the other side and its threat of blowing up the meetings many

times and stubbornness on one issue as if we come here for one

hour to hand them over everything and return and this indicates

the illusions they live.

The second reason was the US flagrant interference in the talks

and the tense atmosphere through which the US wanted to cover

Geneva meeting by its actual appearance and its flagrant

intervention in the meeting affairs were also reasons that made

the talks don’t lead to tangible outcomes."<END QUOTE>

Brahimi says that a new meeting is scheduled to begin on February

10, but the Syrian delegation denies that it's agreed to attend.

Debka's subscriber-only newsletter (sent to me by a subscriber) says

that its intelligence sources are telling quite a different story.

Debka, which sometimes gets things wrong, claims that the meeting in

Montreux was just for show for the media, and that the real

negotiations are going on at a meeting in Bern, with representatives

from the U.S., Russia, Syria, and Syrian opposition representatives.

The Mideast Arab countries, Saudi Arabia, Qatar, Oman and the UAE,

were not invited. I found no confirmation of this story anywhere, so

make of it what you will, Dear Reader. Daily Star (Lebanon)/AFP and Syria Online (Damascus) and Debka

****

**** Eurozone continues spiral into deflation, with 12% unemployment

****

As we wrote several weeks ago ( "9-Jan-14 World View -- Eurozone plummets into deflation"

), the eurozone inflation rate has been falling

steadily for over a year, raising very real concerns that the eurozone

is headed into deflation. The statistics for January are out, and the

eurozone CPI was just 0.7%, substantially lower than the 0.9%

predicted by expert economists. This raises more alarm bells over

deflation, which is often the precursor to a major economic

depression. As long-time readers know, Generational Dynamics predicts

that we're headed for a deflationary spiral and a major global

economic crisis, the worst of which is far from over. CNBC

****

**** Three bankers commit suicide in one week

****

It's hard to know what to make of this, but three bankers

have committed suicide in the last week:

- Gabriel Magee, 39-year-old VP of JP Morgan's technology

department, jumped to his death from the roof ot the bank's European

headquarters in London.

- William Broeksmit, a 58-year-old former senior executive at

Deutsche Bank AG, was found dead in his home, also in London, after an

apparent suicide.

- Mike Dueker, the 50-year-old chief economist at Russell

Investments in Washington state, jumped over a fence and fell down a

50-foot embankment, in an apparent suicide.

It's well known that suicides occur most often around the Christmas

holiday season, so it's possible that the timing of these three

suicides was coincidental. But it's also true that a number of

bankers and investors jumped to their deaths during the Great

Depression, usually from hotel rooms, and that the overall suicide

rate today has surged even higher than during the Great Depression

(usually because of unemployment). A financial crisis sends many

people to financial ruin, but more than that, a financial crisis

exposes a lot of crime, particularly embezzlement.

John Kenneth Galbraith described what happened during the Great

Depression in his 1954 book, The Great Crash - 1929, as

follows:

<QUOTE>"In many ways the effect of the crash on embezzlement

was more significant than on suicide. To the economist

embezzlement is the most interesting of crimes. Alone among the

various forms of larceny it has a time parameter. Weeks, months,

or years may elapse between the commission of the crime and its

discovery. (This is a period, incidentally, when the embezzler has

his gain and the man who has been embezzled, oddly enough, feels

no loss. There is a net increase in psychic wealth.) At any given

time there exists an inventory of undiscovered embezzlement in --

or more precisely not in -- the country's businesses and

banks. This inventory -- it should perhaps be called the bezzle --

amounts at any moment to many millions of dollars. It also varies

in size with the business cycle. In good times people are

relaxed, trusting, and money is plentiful. But even though money

is plentiful, there are always many people who need more. Under

these circumstances the rate of embezzlement grows, the rate of

discovery falls off, and the bezzle increases rapidly. In

depression all is reversed. Money is watched with a narrow,

suspicious eye. The man who handles it is assumed to be dishonest

until he proves himself otherwise. Audits are penetrating and

meticulous. Commercial morality is enormously improved. The

bezzle shrinks.

The stock market boom and the ensuing crash caused a traumatic

exaggeration of these normal relationships. To the normal needs

for money, for home, family and dissipation, was added, during the

boom, the new and overwhelming requirement for funds to play the

market or to meet margin calls. Money was exceptionally

plentiful. People were also exceptionally trusting. A bank

president who was himself trusting Kreuger, Hopson, and Insull was

obviously unlikely to suspect his lifelong friend the cashier. In

the late twenties the bezzle grew apace.

Just as the boom accelerated the rate of growth, so the crash

enormously advanced the rate of discovery. Within a few days,

something close to universal trust turned into something akin to

universal suspicion. Audits were ordered. Strained or

preoccupied behavior was noticed. Most important, the collapse

in stock values made irredeemable the position of the employee who

had embezzled to play the market. He now confessed.

After the first week or so of the crash, reports of defaulting

employees were a daily occurrence. They were far more common

than the suicides. On some days comparatively brief accounts

occupied a column or more in the Times. The amounts were

large and small, and they were reported from far and wide. ...

Each week during the autumn more such unfortunates were reveled

in their misery. Most of them were small men who had taken a

flier in the market and then become more deeply involved. Later

they had more impressive companions. It was the crash, and the

subsequent ruthless contraction of values which, in the end,

exposed the speculation by Kreuger, Hopson, and Insull with the

money of other people. Should the American economy ever achieve

permanent full employment and prosperity, firms should look well

to their auditors. One of the uses of depression is the exposure

of what auditors fail to find. Bagehot once observed: "Every great

crisis reveals the excessive speculations of many houses which no

one before suspected." [pp. 132-35]<END QUOTE>

We have to remember that today there's a tremendous undercurrent of

what we might call "unreported crime" going on. Thousands of bankers

purposely created and sold trillions of dollars in fraudulent

synthetic securities backed by faulty subprime mortgages, and not a

single person has gone to jail for these crimes. If there's an

increase in suicide rates among bankers, then it's possible that some

kind of Karmic retribution is taking place. We'll have to wait and

see what's going on. Bloomberg and Business Insider and Global Research (May 2013)

KEYS: Generational Dynamics, Syria, Bashar al-Assad, Lakhdar Brahimi,

Friends of Syria, Walid al-Moallem,

eurozone, deflation,

Gabriel Magee, William Broeksmit, Mike Dueker,

John Kenneth Galbraith

Permanent web link to this article

Receive daily World View columns by e-mail