*** 11-Mar-15 World View -- Europe, America, China economies all continue in deflationary spiral

This morning's key headlines from

GenerationalDynamics.com

- Iran elects hardliner to head Assembly of Experts

- Greece's deflationary spiral continues with consumer prices down 2.2%

- European Central Bank tries desperate measure to fight deflation

****

**** Iran elects hardliner to head Assembly of Experts

****

84 year old Ayatollah Mohammad Yazdi

84 year old Ayatollah Mohammad Yazdi

Ayatollah Mohammad Yazdi, born 1931, was elected on Tuesday to be

chairman of Iran's Assembly of Experts, a clerical body that will

choose Iran's next Supreme Leader, when the 76-year-old current

Supreme Leader Ayatollah Seyed Ali Khamenei dies.

The election was a surprise, because Yazdi is considered to be an

extreme hardliner, and it's assumed that if Khamenei dies, then he'll

be replaced by another hardliner.

Last week,

I described significant possible policy changes in Iran

that his death could trigger due to

generational differences between the survivors of the 1979 Great

Islamic Revolution and the generations that grew up after the

revolution. Those policy changes can only take place if a

representative of the views of the younger generation is chosen as the

next Supreme Leader. It doesn't matter how old the selectee is. It

only matters whether he holds the hardline views of the Great

Revolution survivors or the views of the generations that grew up

after the war.

AEI Iran Tracker and

BBC

****

**** Greece's deflationary spiral continues with consumer prices down 2.2%

****

Greece's consumer prices fell 2.2% in February, compared with a year

earlier. On a monthly basis, prices fell 0.6% compared with January.

Housing prices led the plunge, falling 7.1%. The only product

categories to show a rise were food, up 0.9%, and alcohol and tobacco

goods, where prices rose 2.0%.

In the eurozone as a whole, consumer prices fell 0.3% in February,

after falling 0.6% in January. In the US, the CPI fell 0.7% in

January. In China, the economy is not yet deflationary, but the

inflation rate is much lower than Beijing's target. In other words,

much of the world is spiraling into deflation.

As long-time readers know, Generational Dynamics has been predicting a

deflationary spiral for years, despite the insistence by almost every

mainstream economist that, because of near-zero interest rates and

quantitative easing, the economy would become inflationary or even

hyperinflationary. It's worth taking a moment to review what's going

on here, in case any mainstream economist is reading and wants to

learn something (which, based on experience, is very unlikely).

In the 70s, 80s and 90s, the Fed could reasonably control inflation by

setting appropriate interest rates. Generally speaking, lowering

interest rates means that people can borrow more, and they use the

money to buy things or to hire employees. This creates a demand for

things and employees, which, by the law of supply and demand, means

that prices and wages should go up, causing inflation. Quantitative

easing, where the Fed "prints money" and pours it into the banking

system, should create even more inflation. That's why mainstream

economists keep talking about inflation.

I always like to make fun of the fact that mainstream economists

cannot explain the tech bubble of the late 1990s -- why it occurred at

all, and why it occurred then, instead of a decade earlier during the

PC technology explosion, or a decade later. The answer is that the

1990s is exactly the time when the risk-averse survivors of the Great

Depression all disappeared -- retired or died -- all at the same time,

leaving behind younger generations having no clue what could go wrong

with the economist. Mainstream economists are from these younger

generations with no clue.

Mainstream economists (including those in the so-called "Austrian

school") think that inflation is determined by the amount of money in

circulation as set by monetary policy -- interest rates and

quantitative easing. And you can find thousands of articles in the

past decade explaining why continued low interest rates would cause

inflation.

But anyone who's taken Economics 1.01 knows that inflation is caused

by two factors: the amount of money in circulation times the velocity

of money. You can google "velocity of money" for a full explanation,

but it represents how frequently money is actually used to buy things

or pay wages. The velocity of money has been plummeting in the last

decade, meaning that all that money that the Fed has been spewing out

in the form of low interest rates and quantitative easing has just

been sitting in bank accounts, and not used for purchases and wages.

Actually, it's been used by hedge funds and already-wealthy investors

to invest in the stock market, pushing up the Wall Street stock

bubble. With the velocity of money plummeting, inflation has been

plummeting as well, defying the mainstream economists.

The size of the money supply is set by monetary policy, but it turns

out that the velocity of money is set by generational changes. In a

generational crisis era, like the 1930s and today, once a crisis

occurs, like the 1929 crash or the 2008 housing crash, people's moods

change dramatically. They pinch pennies, for fear of a new financial

crisis, and they refuse to buy things, causing the velocity of money

to plunge. After the 1929 crash, the mood didn't begin to lift until

the 1950s. In Japan, there was a stock market crash in 1990, and

Japan remains in a deflationary spiral to this day, 25 years later.

So this generational mood is very deep and long-lasting.

So when you hear a financial "expert" on TV say that such and such and

change in policy will encourage people to spend more money next year,

you can be sure you're listening to a clueless mainstream economist.

This deflationary spiral is going to continue and deepen for a long

time, and will trigger a new stock market crash.

Bloomberg and

Market Watch and

Dow Jones

****

**** European Central Bank tries desperate measure to fight deflation

****

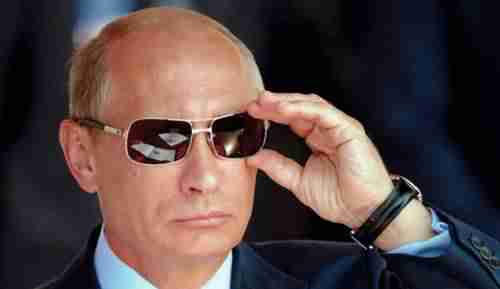

S&P 500 Price/Earnings ratio at astronomically high 20.50 on March 6 (WSJ)

S&P 500 Price/Earnings ratio at astronomically high 20.50 on March 6 (WSJ)

The European Central Bank (ECB) is taking desperate measures to end

deflation by starting a massive quantitative easing program. On

Monday, the ECB "printed" three billion euros and used them to

purchase bonds issued by individual eurozone nations.

This huge purchase of bonds caused the prices of these bonds to up (by

the law of supply and demand). In the case of bonds, when the price

goes up, the corresponding bond yield (interest rate) goes down. So

the result of the ECB's actions on Monday was to push many bond yields

into negative territory. This means, in effect, that the ECB is

lending money to individual governments, and paying those governments

to take the money. I wish I could get that deal.

The second effect of the of the ECB's actions was to drive the value

of the euro down relative to the dollar. Or, to put it another way,

to strengthen the dollar relative to the euro.

This highlights another mistake that mainstream economists make when

they're talking about inflation. There are two completely separate

ways of looking at inflation: the internal inflation, as measured by

consumer prices, and the international inflation, as measured by the

value of the currency against other currencies. In this case, the

euro is in a deflationary spiral internally, but it's losing value

internationally. So it appears that the euro is going in two opposite

directions at the same time, one of the many dysfunctions in today's

global finance.

All this bad news in Europe affected Wall Street stocks on Tuesday,

with a 333 point plunge in the Dow Jones Industrial Average.

According to Friday's

Wall Street Journal, the S&P 500 Price/Earnings index (stock

valuations index) on Friday morning (March 6) was astronomically high

at 20.50. This is far above the historical average of 14, indicating

that the stock market is in a huge bubble that could burst at any

time. Generational Dynamics predicts that the P/E ratio will fall to

the 5-6 range or lower, which is where it was as recently as 1982,

resulting in a Dow Jones Industrial Average of 3000 or lower.

Tuesday's stock market plunge has probably already pushed the P/E

ratio down to the 18-19 range.

Telegraph (London) and

Reuters and

Bloomberg

KEYS: Generational Dynamics, Iran, Ayatollah Mohammad Yazdi,

Assembly of Experts, Ayatollah Seyed Ali Khamenei,

eurozone, consumer price index, European Central Bank

Permanent web link to this article

Receive daily World View columns by e-mail