****

**** Economy falters, surprising economists, while stock market bubble explodes

****

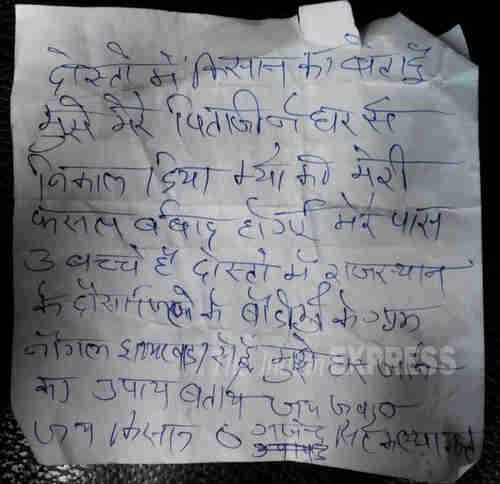

S&P 500 Price/Earnings ratio at astronomically high 20.98 on May 1 (WSJ)

S&P 500 Price/Earnings ratio at astronomically high 20.98 on May 1 (WSJ)

Analysts were shocked on when data released on Wednesday showed that

the Gross Domestic Product (GDP) in the first quarter grew sharply

less than they had expected -- 0.2%, rather than the predicted 1%,

after rising 2.2% in the last quarter of last year.

As usual, the mainstream economists called it just a blip, nothing to

be concerned about, but if they really believed that then they

wouldn't have been shocked. The problem is that this has been going

on for years, since the 2007 credit crunch. Every time the GDP goes

up a bit, as it did in Q4, mainstream economists pull out their

macroeconomic models from the 70s, 80s, and 90s, and announce that the

economy is finally on an upsurge, and that the "Great Recession" is

finally ending. So the shock is not that they got it wrong this time,

but that they got it wrong time after time after time since 2007.

Long-time readers will recall that I used to repeatedly mock and make

fun of mainstream economists. Each quarter I would post the consensus

forecasts for growth in that quarter, and then the actual growth

figures when they came out. It was a major farce.

I always like to point out that mainstream economists didn't foresee

and still can't explain the tech bubble at the end of the 1990s, or

why it occurred at that time and not during the PC explosion of the

1980s. They didn't foresee and can't explain the Nasdaq crash in

2000, didn't foresee and can't explain the real estate and credit

bubbles of the mid-2000s, didn't foresee and can't explain the credit

crunch that began in 2007, didn't foresee and can't explain the global

financial crisis, and have gotten wrong almost every forecast since

then.

The reason that the tech bubble occurred in the late 1990s is because

that's exactly the time when the risk-averse survivors of the 1929

crash and Great Depression all disappeared (retired or died), leaving

behind the younger generations with no personal knowledge of the

dangers of debt. Generational theory can explain almost everything

that's occurred in the last 15 years, but mainstream economists never

think of this because they have a brain malfunction that keeps them

from understanding even the simplest and most obvious generational

explanation of anything. At any rate, if they want to get their

forecasts right, then they have to dig out the macroeconomic models

from the 1930s, and throw away the models from the 70s-90s, which are

irrelevant today.

According to Friday's

Wall Street Journal, the S&P 500 Price/Earnings index (stock

valuations index) on Friday morning (May 1) was astronomically high,

just below 21. This is far above the historical average of 14.

Furthermore, it was 18 just a year ago, indicating that the stock

market bubble is getting so large it's close to exploding.

Generational Dynamics predicts that a panic will occur, and that the

P/E ratio will fall to the 5-6 range or lower, which is where it was

as recently as 1982, resulting in a Dow Jones Industrial Average of

3000 or lower.

So we have a continuation of their bizarre situation where the economy

is getting weaker (or, at least, not getting stronger), which causes

the Fed to pursue policies that pour billions of dollars into the

banking system, which finds its way into the stock market bubble and

into the pockets of the "top 1%." If you want to know why there are

no jobs in Baltimore and elsewhere, this is where you should be

looking.

Bloomberg

****

**** Financial firm analyst told to shut up about over-valued assets

****

ZeroHedge on Saturday posted an analysis of an economic indicator, the

rejection of credit applications. This is a crucial indicator of how

the economy is doing, since if businesses are suddenly unable to get

credit, then it could lead to a severe recession, just like the credit

crunch of 2007.

What I found most interesting about the article was a portion of the

comments section. The writer submitted a report to a top manager at a

large financial firm, and in response he was essentially told to lie:

<QUOTE>"=== Sat, 05/02/2015 - 14:01 | 6053912 Haus-Targaryen

On an aside -- I had to do a report on a couple asset classes in

the States over the past few months. I submitted it to my boss in

the States on Wednesday of last week. I laid out essentially and

irrefutably why the asset classes are horribly over-valued, most

of the barometers used to measure their value are horribly

bastardized, and why we should avoid them like the plague.

My boss sent me an email Thursday in the US around noon EST --

where he said he did not appreciate me injecting my opinions into

the report and I should try again without a biased approach. As

an example, he said I should take out the labor force

participation rate as it is a biased barometer and should use

Federal Unemployment numbers exclusively. He said I should quit

comparing the CPI to various food, energy, education and medical

care price indexes, as it presents an unfair picture of the USD's

purchasing power of these assets and should focus on the CPI

instead. He said the Baltic dry index is irrelevant and our

clients care more about equity performances, and I should take out

the BDI.

Essentially he wants to lie through my teeth to these people. I

don't know what to do, except know for a fact that, given this guy

is one of the top 5 at a firm literally everyone on here knows --

and he is considered to be a genius in his field -- we are all

beyond f--ked.

=== Sat, 05/02/2015 - 14:11 | 6053919 SWCroaker

Haus, my suggestion: get over it, learn to lie. Just don't ever

start believing your own lies.

Surviving in a f'ed up situation sometimes puts the positive

aspect of retaining your head above those accrued from a moral

fight against the system. Look in history to the example of

Sophie Scholl, who (in my armchair quarterback opinion) gave her

life in protest, and thereby removed herself from the scene for

what could have been 70 years of highly successful subversion and

rebellion.

Spitting into the wind isn't all that noble in the end.

=== Sat, 05/02/2015 - 14:23 | 6053941 Haus-Targaryen

This is essentially what I am doing.

"Yeup, MBS are a great and safe buy. Seriously. It's different

this time."

I am documenting this via emails to myself. Noting what egregious

bulls--t it is, and how I am being forced to do this and by who.

No one will hang this around my neck when this whole thing burns

to the ground again.

But I guess I gotta keep doing this kinda crap until I can start

making some decisions around here -- assuming we survive the next

"correction" -- which I am not sure of.

=== Sat, 05/02/2015 - 14:28 | 6053950 Skateboarder

Hang in there Haus, and give 'em what they want - you don't need

to feel bad. It's all lies in the end anyway. Stay true in your

heart, and live for the remaining righteous things in life. In the

days of manufactured existence, righteousness is you producing

'unmanufactured' output. Always important to remember that job =/=

work. Your work is what defines your contribution and connection

to the universe, and it can be entirely within your head.

=== Sat, 05/02/2015 - 14:13 | 6053925 DontGive

Is this a joke? If not, my 2cents:

Keep the original report. Record/note anything he says about it.

=== Sat, 05/02/2015 - 14:26 | 6053944 Haus-Targaryen

Not a joke. 100% serious. You and I were sharing a brain wave

length on that one. See my response above.

=== Sat, 05/02/2015 - 14:34 | 6053956 GRDguy

Haus-Targaryen: Yu'all in good company.

"The men the American people admire most extravagantly are the

greatest liars; the men [and women] they detest most violently are

those who try to tell them the truth." H.L. Mencken (1880 – 1956)

=== Sat, 05/02/2015 - 14:34 | 6053962 corporatewhore

whistleblowers and corporate truth sayers aren't held in high

regard in the corporate world. Save your ammo just to protect

yourself.

=== Sat, 05/02/2015 - 14:28 | 6053949 Haus-Targaryen

Yeah I know. With good enough documentation, I'll be

okay."<END QUOTE>

This kind of stuff was practically unthinkable prior to the rise of

Generation-X in the 2000s, as I wrote in my 2008 article,

"The nihilism and self-destructiveness of Generation X."

As readers know, I've frequently quoted "experts" on CNBC claiming

that stocks are undervalued, even though stock valuations (the P/E

ratio) is astronomically high. It's gotten so common that those guys

really have no idea any more whether they're lying or telling the

truth.

In the above comments, Haus-Targaryen writes, "Yeah I know. With good

enough documentation, I'll be okay." This is very naďve. The

comments make it very clear that Gen-Xers do not value the truth, and

I know from painful experience and the experience of many others that

if you can document the truth, then the Gen-Xers will really screw

you. This guy had better keep his mouth shut and do what he's told,

or he's going to be spending his days writing a blog.

ZeroHedge

KEYS: Generational Dynamics, Syria, Bashar al-Assad, Idlib, Yarmouk,

Fawaz Gerges, Jabhat al-Nusra, al-Nusra Front, Kata’ib Ahrar al-Sham,

Islamic State / of Iraq and Syria/Sham/the Levant, IS, ISIS, ISIL, Daesh,

Turkey, Saudi Arabia, Qatar, Free Syrian Army, Jisr al-Shegour,

Salman bin Abdulaziz al Saud, Iran,

price/earnings ratio, stock valuations, ZeroHedge

Permanent web link to this article

Receive daily World View columns by e-mail