[S]o far, the current world oil crunch doesn't look at all like the crises of 1973 or 1979. That's why it's so scary.

The oil crises of the 1970's began with big supply disruptions: the Arab oil embargo after the 1973 Israeli-Arab war and the 1979 Iranian revolution. This time, despite the chaos in Iraq, nothing comparable has happened ? yet. Nonetheless, because of rising demand that is led by soaring Chinese consumption, the world oil market is already stretched tight as a drum, and crude oil prices are $12 a barrel higher than they were a year ago. What if something really does go wrong?

Let me put it a bit differently: the last time oil prices were this high, on the eve of the 1991 gulf war, there was a lot of spare capacity in the world, so there was room to cope with a major supply disruption if it happened. This time there isn't.

The International Energy Agency estimates the world's spare oil production capacity at about 2.5 million barrels per day, almost all of it in the Persian Gulf region. It also predicts that global oil demand in 2004 will be, on average, 2 million barrels per day higher than in 2003. Now imagine what will happen if there are more successful insurgent attacks on Iraqi pipelines, or, perish the thought, instability in Saudi Arabia. In fact, even without a supply disruption, it's hard to see where the oil will come from to meet the growing demand.

But wait: basic economics says that markets deal handily with excesses of demand over supply. Prices rise, producers have an incentive to produce more while consumers have an incentive to consume less, and the market comes back into balance. Won't that happen with oil?

Yes, it will. The question is how long it will take, and how high prices will go in the meantime.

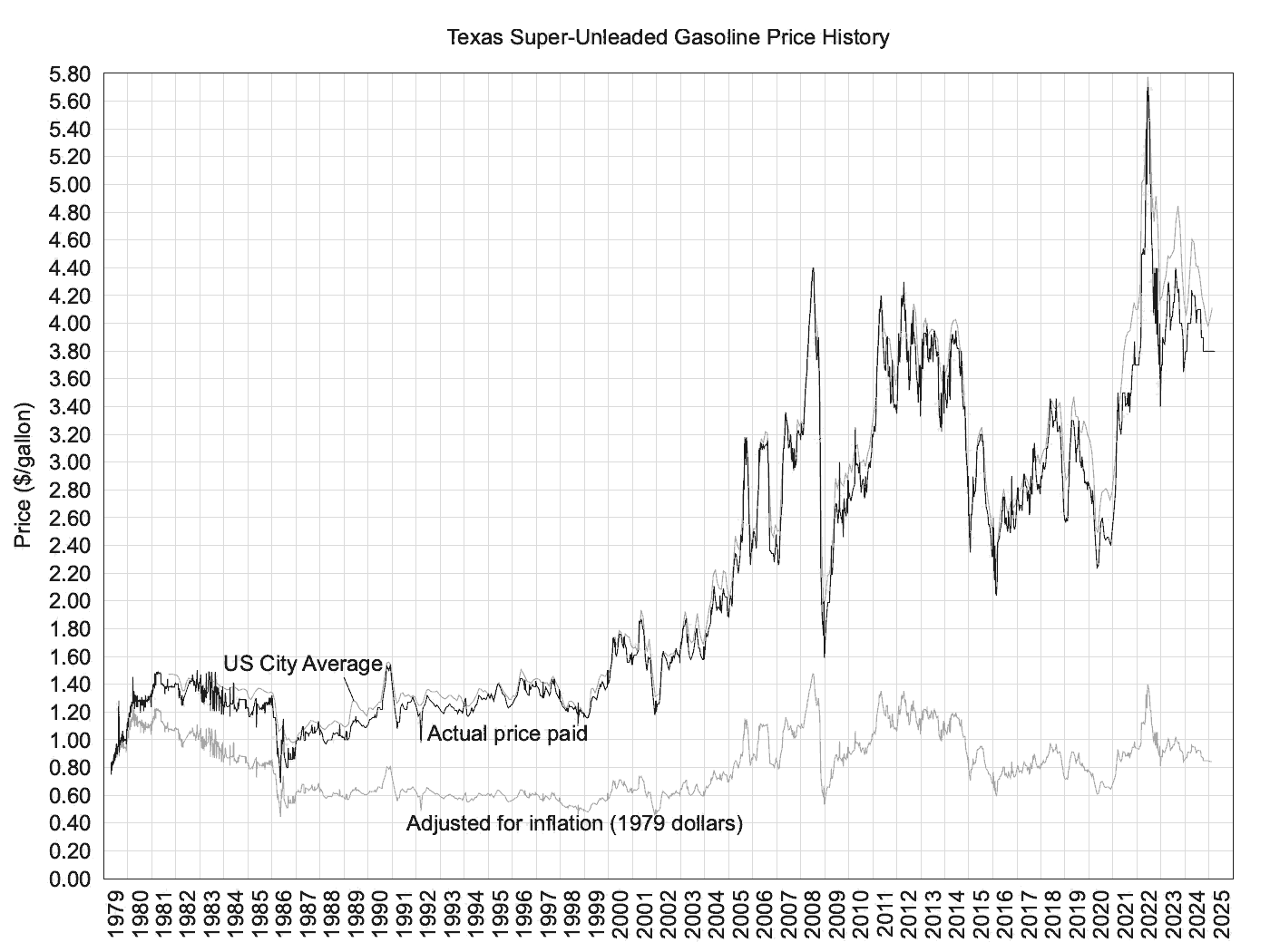

To see the problem, think about gasoline. Sustained high gasoline prices lead to more fuel-efficient cars: by 1990 the average American vehicle got 40 percent more miles per gallon than in 1973. But replacing old cars with new takes years. In their initial response to a shortfall in the gasoline supply, people must save gas by driving less, something they do only in the face of very, very high prices. So very, very high prices are what we'll get.

Increasing production capacity takes even longer than replacing old cars. Also, major new discoveries of oil have become increasingly rare (although in my last column on the subject, I forgot about two large fields in Kazakhstan, one discovered in 1979, the second in 2000).

Petroleum engineers continue to squeeze more oil out of known fields, but a repeat of the post-1973 experience, in which there was a big increase in non-OPEC production, seems unlikely.

So oil prices will stay high, and may go higher even in the absence of more bad news from the Middle East. And with more bad news, we'll be looking at a real crisis ? one that could do a lot of economic damage. Each $10 per barrel increase in crude prices is like a $70 billion tax increase on American consumers, levied through inflation. The spurt in producer prices last month was a taste of what will happen if prices stay high. By the way, after the 1979 Iranian revolution world prices went to about $60 per barrel in today's prices.

Could an oil shock actually lead to 1970's-style stagflation ? a combination of inflation and rising unemployment? Well, there are several comfort factors, reasons we're less vulnerable now than a generation ago. Despite the rise of the S.U.V., the U.S. consumes only about half as much oil per dollar of real G.D.P. as it did in 1973. Also, in the 1970's the economy was already primed for inflation: given the prevalence of cost-of-living adjustments in labor contracts and the experience of past inflation, oil price increases rapidly fed into a wage-price spiral. That's less likely to happen today.

Still, if there is a major supply disruption, the world will have to get by with less oil, and the only way that can happen in the short run is if there is a world economic slowdown.

An oil-driven recession does not look at all far-fetched.

It is, all in all, an awkward time to be pursuing a foreign policy that promises a radical transformation of the Middle East ? let alone to be botching the job so completely.