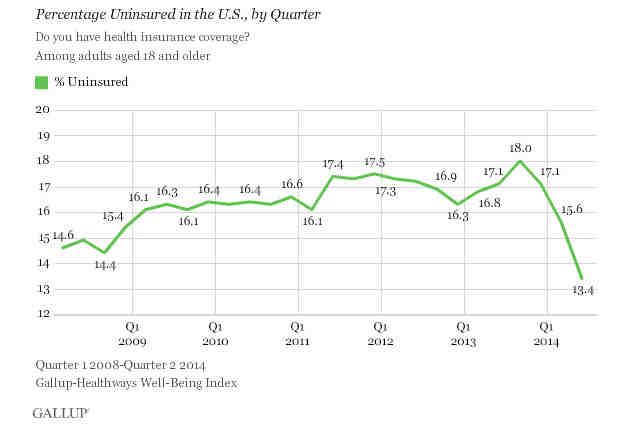

State health insurance marketplaces that offered consumers very few health plan choices in 2014 are starting to add more insurers — slowly, in most cases. But this is a sign that insurers are feeling confident about the second year of the Affordable Care Act's coverage expansion.

The development is important for a few reasons. For one, recent research suggests that more competition in the exchanges could help temper premium increases. Other new analysis shows that exchange plans, on average, are cheaper than individual plans offered outside the insurance marketplaces. And given the narrow networks in exchange plans,

more insurers could mean better access to providers.

In New Hampshire, the exchange's only insurer last year had excluded 10 of 26 hospitals in the state from its network, meaning the exchange's customers were limited in their choice of care providers.

In 2015, though, New Hampshire will have five insurers selling individual and family health plans on the exchange, state officials announced this week. That also includes the expansion of two non-profit, co-op plans that received start-up funding from the Affordable Care Act.

Then there's

West Virginia, a poorer state and one of the least healthy in the country — not exactly an attractive market for insurers.

Just one insurer sold 2014 exchange plans, but

a second insurer from Kentucky, another co-op,

will join in 2015. Kentucky Health Cooperative, which signed up 75 percent of the approximately 82,000 people who selected private plans in Kentucky's exchange, will sell plans statewide in West Virginia next year.

The

two insurers selling individual plans on Maine's exchange will be joined by a third in 2015, the state announced this week. The two insurers selling in 2014 have proposed average rate increases of .1 percent and 3.1 percent, well below what's been offered in other states so far.

Although

Washington state had one of the more successful individual exchanges this year, it never fully launched an insurance marketplace for small businesses —

just one insurer sold health plans in a couple of counties in 2014. At least one insurer,

Moda Health, has applied to sell statewide on the small business exchange in 2015, according to Washington state's insurance department.

The plan offerings could obviously be more robust in these marketplaces, and they may continue to grow in the coming years. For now, though, this seems to be a positive sign for the health-care law.