- Join Date

- Apr 2007

- Posts

- 1,097

Last edited by SVE-KRD; 06-16-2009 at 11:54 AM.

It's funny 'cause Krugman has been consistently wrong for several years.Originally Posted by Paul Krugman

"Qu'est-ce que c'est que cela, la loi ? On peut donc être dehors. Je ne comprends pas. Quant à moi, suis-je dans la loi ? suis-je hors la loi ? Je n'en sais rien. Mourir de faim, est-ce être dans la loi ?" -- Tellmarch

"Человек не может снять с себя ответственности за свои поступки." - L. Tolstoy

"[it] is no doubt obvious, the cult of the experts is both self-serving, for those who propound it, and fraudulent." - Noam Chomsky

Here is a pretty good chronology of excerpts that make it fairly clear the meaning of Krugman's opinion piece -

http://www.slate.com/discuss/forums/thread/1827592.aspx

Essentially, you have a neighbor across the street from a house with its porch on fire. The neighbor tells you that regardless of what you or he say or do, the homeowner is going to pour a liquid on that fire. The liquid just happens to be gasoline. The homeowner comes out, pours the liquid on, the fire explodes and your whole neighborhood is now on fire. You now complain to the neighbor for prescribing the gasoline to the homeonwer and you want the neighbor to stay out of rebuilding the neighborhood because of his lack of predictive capabilities!

For me, it is a little hard to see how someone could conclude prescription from that article's description, but given the forecasting nature of the article, I'm willing to give some benefit of the doubt. However, within the context of what else Krugman has written, it is either from ignorance of Krugman’s works or it is intentional meandrous crap given in an attempt to discredit him. As evident with a simple Google search for the article, the speed with which this article has been resurrected and passed around the wingnut networks makes clear what is going on.. For example -

http://www.dailypaul.com/node/96518

http://futurejacked.blogspot.com/200...-commence.html

http://globaleconomicanalysis.blogsp...-all-over.html

One gets the sense of the convenience to the wingnuts of not being able to discern prescription from description.

Krugman's sin, of course, is, now that we nearly went over the deflation cliff, prescribing Keynes! So, for that, he must be targeted!

What's funny (eventually) is Krugman uncanny ability to outlast the sniping of the lessor lights - as evident (and pretty funny) here -

http://mjperry.blogspot.com/2008/01/...recession.html

http://www.frontpagemag.com/readArti...px?ARTID=14742

http://www.punditreview.com/2007/11/...-broken-clock/

http://www.randomjottings.net/archives/000704.html

Be sure to check the dates of the critiques of these 'bright lights.' I think there’s a good chance of this latest misdirection winding up on the same pile of worthless doggey-poo.

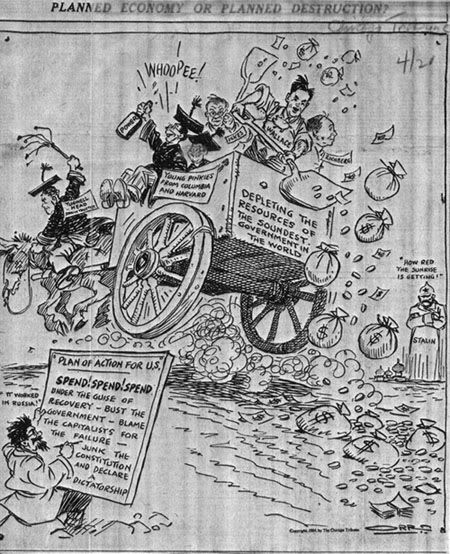

Notihing new under the sun -

Last edited by playwrite; 06-16-2009 at 04:53 PM.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

There's plenty of rational reason to hold that belief as long as you properly view capital goods as non-homogenous. During a boom, some of the capital goods created can only be applied to specific goods production for a high level of demand. When that demand fails to materialize, the resources spent creating those capital goods are revealed to have been wasted and those capital goods can no longer support the jobs created to operate and maintain them.

It is true that some overproduced capital goods will be re-tooled to create different goods and some will be sold off and produce at a lower price with workers at a lower wage level, but it is indisputable that a significant amount of boom period investment will never be useful and must be liquidated.

Now, you may object that the purpose of stimulus is to get demand back up again, but there are many ways in which that can fail. For example, let's say you created capital goods to manufacture flip-open phones at a high level of demand, assuming that even with introduction of touch-screen phones that demand would still go up for the foreseeable future. However, with the economy faltering, consumer psychology has shifted and now people will wait longer to replace old phones making them much more likely to go straight to the ever cheaper touch-screen style.* The result is that the level of demand you anticipated did not materialize and furthermore, never will. Those capital goods must be re-tooled or scrapped and to the extent that re-tooling is impossible or too expensive, that means lost money and therefore lost jobs.

Only by oversimplifying capital goods as some kind homogenous stuff-producing goo, can economists make the assumption that stimulus will work. In fact, the greater the boom, the more likely the resource misallocations were too acute to prevent lost jobs.

* This example is purely for illustrative purposes. I have no idea if the cell phone market actually operates on these assumptions and incentives.

I'm really confused by this comment. Krugman's point is clear. He advocated inflating our way out of the early 2000s recession and doubted whether the Fed was doing enough to make that happen. He was in no way skeptical of the intent of the Fed policy, just whether or not they would be successful.

To refute this interpretation, one would have to provide evidence of Krugman advocating against monetary stimulus at that time. You won't find it. Krugman has argued (per Keynes) that at some point monetary stimulus reaches diminishing returns and fiscal stimulus is needed. So, the real reason he was skeptical back then is not because he opposed monetary stimulus but because he wanted to add fiscal stimulus on top of that. Krugman made similar arguments backing Obama's fiscal stimulus as well (and criticizing it as too small).

One concludes that Krugman will always view government stimulus as too small. Perhaps this would change if Krugman himself had the power to decide how much stimulus to pursue. I suspect not, though. Rather, any policy failures would merely cause him to damn himself for his own timidity.

Yes, but it is also an extreme oversimplification that this is a simple mass-balance equation with supply's overreaching demand being resolved by simply turning off the spigot for a few 'econ-time minutes.' A lot of unaccounted extranalities there ranging from lost job skills to tent cities to food riots.

The real powderkeg, however, is deflationary behavior were expectations of declining prices firmly takes hold throughout society, making the current savings binge barely an afterthought.

Some of us have had experience with an inflationary spiral, and have grown up with how much of a bugaboo that is , how it most be avoided, and how anyone suggesting something inflationary must be an idiot, a kook or a threat. But I doubt any of us have had experience with a deflationary spiral, at least as adults. The former spiral is a piece of cake compared to the latter one.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

That is never the cause of an economic downturn, though. It's the cause of a failure, or less drastically overproduction, of a specific line of product.

Demand consists of two parts, desire to buy plus ability to buy. If we are treating capital goods as non-homogenous, i.e. dealing with specific products, then the deisre to buy portion of demand becomes important; that's why the Edsel failed, for example. But it's never why the economy nosedives. That's not a failure of specific products, it's a failure of consumer demand across the board. And for that, desire to buy is unimportant, only ability to buy matters. (Say rather: overproduction of items people don't want is canceled by underproduction of items people do want, and so is not an overall factor.) A recession is not caused by overproduction. It's caused by failure to share the wealth broadly. While there is such a thing as overproduction of a particular item, there is no such thing as generalized overproduction, and therefore no such thing as a required level of wealth destruction before the economy can expand again.

We can see empirical validation of this theory by looking at the severity and duration of economic downturns during the 1950s and 1960s, compared to the ones bewteen the Civil War and the Great Depression. In the earlier period, wealth was more poorly distributed (by design) than in the later period, and we also see much more severe recessions. Since we have returned to the pro-capital/anti-labor policies under the presidents from Reagan through Bush 43, recessions have again increased in severity. The very fact that they have varied in this pattern calls the idea of a required level of wealth destruction into question. Why was this supposely required level of destruction so much less during the postwar decades than before or after?

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

Here is the 'offending language,' but going one sentence further -

Now one could be predisposed to reading that when Krugman says "needs," he is cajoling. But then, why would that have been necessary when Krugman tconcludes that Greenspan "thinks he can pull that off"??? Obviously, Krugman is describing the situation as it was, there is no evidence that he is telling Greenspan to do something --Greenspan is already dong it.To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

Judging by Mr. Greenspan's remarkably cheerful recent testimony, he still thinks he can pull that off.

And Krugman goes on to say -

Krugman is railing against deficit spending and the Bush tax cuts that took us there; not only reversing Clinton's enormous surplus into enormous deficits (this was a 3T Repub ploy to trigger cuts in non-defense spending and it never worked) but providing the cash that resulted in the huge asset inflation across the board from 2002 to 2006 (houses, stocks, commodities).The administration needs a recovery because, with deficits exploding, the only way it can justify that tax cut is by pretending that it was just what the economy needed.

What you are attempting to do is to take today's context (or more acturately, the context between last October up through this April) of Krugman now clearly prescribing more stimulus and trying to paint that as the picture back seven years ago. It's not only unfair, its not true.

Most smart people know its not a good idea to ingest high levels of stimulants, but when a person's heart is failing or stopped, you jam that 00 needle, dripping with epi (i.e. adrenaline), right into that frickin ticker, baby - just ask Uma

http://www.youtube.com/watch?v=JKQ-BpO4Gzo

Oh, I think Rosanna Arquette is playing the role of the liberterian in this scene.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

I didn't address why the downturn occurred, I just pointed out that once one is occurring there is definitely reason to expect a minimum amount of pain that must happen. One could adhere to many of the various business cycle theories and still recognize that a downturn will feature a certain amount of pain before recovery can occur. Specific capital goods must be reallocated or discarded.

Now as for the cause of general downturns . . .

Technically, this is the Austrian conclusion as well -- although most Austrian school types are aesthetically disinclined towards stating it that way. You are correct that it's not just that people adjust their desires that causes a downturn, but that they become incapable of meeting their desires as credit expansion progressively prices them out of the market.

I would describe it as an upward redistribution of wealth that eventually collapses. Stating it as if it were a lack of generosity on the part of the wealthy implicitly confers legitimacy on those concentrations of wealth. That's flawed both ethically and strategically.

It's not overproduction but malproduction -- production that fails to correspond to actual human needs. I'm not sure the distance between our positions is as great as you imply.

Because, as you state, the imbalances were less pronounced, being offset by an effective system of social safety. That the rotten core of state capitalism is once again exposed to view makes me want to strike at the root. Most liberals seem to want to paint over it again.

playwrite ... good post. What you just have to accept is that the libertarians hate Krugman simply because he is not an Austrian who prostrates himself in supplication before the altar of their religion. Its that simple.

You could interpret the column that way. But doing so would require you to ignore all of his other work.

Also, once a war starts, you should support the troops no matter what . . .

There is a strong tendency for an intervention to cause people to ignore the circumstances that caused the crisis. Intervention has saved the patient. Unfortunately, the patient isn't the economy is a whole -- it's the banking establishment in particular.

Sure, if you want to stop your excerpting there (and by stop, I mean full-stop -- that is, take into account absolutely nothing else Krugman ever said before or since), you might be able to strain such a conclusion out. I mean, the rest of the article talks about the need for jacking more money into the economy, and the one negative is a pretty clear statement that whever specific tasks Greenspan's Fed was doing at the time wouldn't get that job done. It's like Krugman was arguing razor blades over scalpels for a bloodletting to treat indigestion. Sure, he wants to use a slightly different tool, but his prescription is nevertheless a proven failure.

Funny how he only 'objected' (if, that is you want to call 'doesn't go far enough' an objection of any real mass) to that one thing at the one time; and how as soon as His Guy got in charge all of a sudden the exact same stuff became the True Path.Krugman is railing against deficit spending and the Bush tax cuts that took us there; not only reversing Clinton's enormous surplus into enormous deficits (this was a 3T Repub ploy to trigger cuts in non-defense spending and it never worked) but providing the cash that resulted in the huge asset inflation across the board from 2002 to 2006 (houses, stocks, commodities).

This is why I used the term blackwhite (unfairly edited by David in his reply post) to describe Krugman's work.What you are attempting to do is to take today's context (or more acturately, the context between last October up through this April) of Krugman now clearly prescribing more stimulus and trying to paint that as the picture back seven years ago. It's not only unfair, its not true.

I speak to you today about the Eastasian enemy; the Eastasian mobs want only your blood and the destruction of everything we hold dear; we must unfailingly strive to the very final gasp of our essence to save our ho-... ... -mes from the menace that is Eurasia. For in this world, Eurasia will not rest until our destruction is complete; their fanaticism and unreasoning hatred for all that we hold dear knows no bound and cannot be reasoned with or controlled. Our enemy is, and always will be until their final destruction - Eurasia!

"Qu'est-ce que c'est que cela, la loi ? On peut donc être dehors. Je ne comprends pas. Quant à moi, suis-je dans la loi ? suis-je hors la loi ? Je n'en sais rien. Mourir de faim, est-ce être dans la loi ?" -- Tellmarch

"Человек не может снять с себя ответственности за свои поступки." - L. Tolstoy

"[it] is no doubt obvious, the cult of the experts is both self-serving, for those who propound it, and fraudulent." - Noam Chomsky

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

Where exactly are you reading that? I tried to find the best case for you from the article, but if you could show where it is more clear that would be informative. When I look up from the "needs excerpt," what stands out is -

On August 2, 2002 do you really think he was taking about government fiscal stimulus, and then endorsing it??? I'm pretty sure most believe he (and Greenspan earlier) were talking about unsupportable investment in assets, i.e., asset inflation. And how would you add gasoline to a private-sector asset-inflation fire? Hmm, a big fat tax cut might do it, hey?This was a prewar-style recession, a morning after brought on by irrational exuberance.

And again, when I look below the "needs excerpt", what stands out for me is

If one is not only "okay" about deficits but actually promotes them, it is a little weird to be describing them as "exploding." And again, what he is railing against is the tax cut.The administration needs a recovery because, with deficits exploding, the only way it can justify that tax cut is by pretending that it was just what the economy needed.

But let's look at another excerpt from some other writing at that time. For example -

http://query.nytimes.com/gst/fullpag...=&pagewanted=9

Hmm, his nightmare consists of stagnant economy, housing bubble burst, deficit spending, hugh government debt and he even adds that his nightmare includes that old deficit spending "crisis" bugaboo of SS for baby boomers. Lions and tigers, oh my!Here's my nightmare: America's recovery from its current slump, whenever it comes, is tentative and short-lived, because the business investment that drove our boom in the 1990's remains stagnant. Eventually the housing bubble bursts and we have another slump; then we have another weak recovery, this time driven by deficit spending, but that, too, fades out. Eventually we look around and realize that it's 2009, and the economy still hasn't fully recovered from the slowdown that began at the end of the previous decade.

And we also realize that while the government's subsequent attempts to sustain the economy, mainly through tax cuts and subsidies to energy companies, have arguably staved off depression -- the unemployment rate has risen, but only to 8 percent -- they have also devastated the environment and left a huge government debt. The fiscal 2010 budget deficit is projected at $800 billion, and nobody has any idea how we will manage in a couple of years, when millions of baby boomers start collecting their Social Security checks.

Now let's put aside not only his predictive capability but his incredible focus on the issue(this article was written about 2 weeks after 9/11). Does this guy come across as someone who, damn the torpedos, damn the deficits, wantonly and indiscrimantly, "will always view government stimulus as too small"?

This really is the fundamental flaw in your thinking. You realy equate Bush's tax cuts and the resulting asset inflation with today's government stimulus efforts to mitigate deflation??? Granted, there is the one commonality of increased government deficit as evident here -

But that is a rather myoptic prespective that just has too many blind spots to address - at least in a single post.

Last edited by playwrite; 06-17-2009 at 10:14 AM.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

What this is about, and why this is the appropriate thread, is nicely laid out here

http://www.slate.com/id/2219769/

Where we hear from the big econ-man himself -The Bond War

Why Paul Krugman and Niall Ferguson are hammering each other about T-Bill interest rates.

And with a little insight from the author that might apply here as well -"But it's hard to escape the sense that the current inflation fear-mongering is partly political, coming largely from economists who had no problem with deficits caused by tax cuts but suddenly became fiscal scolds when the government started spending money to rescue the economy. And their goal seems to be to bully the Obama administration into abandoning those rescue efforts."

Echoes of the last 4T, hey?In evaluating the relative claims of the pessimists and the optimists, you also have to evaluate the messengers. And in this instance, the Fergusonians lack credibility. H.L. Mencken tagged the Puritans as people possessed of the "haunting fear that someone, somewhere, may be happy." Ferguson represents a strain of intellectual Toryism bedeviled by the haunting fear that someone, somewhere may be getting social insurance. (Fellow sufferers include Clive Crook, Andrew Sullivan, and George Will.) Their solution to the problem of large deficits always seems to be to cut entitlements and never to raise taxes.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

Andrew Sullivan is just a right-wing hack who hates social insurance?

Krugman just keeps losing credibility, doesn't he...

'82 iNTp

"Sometimes it is said that man cannot be trusted with the government of himself. Can he, then, be trusted with the government of others? Or have we found angels in the form of kings to govern him? Let history answer this question." -Jefferson

But still, a "Hack" would be lying through the closet doors...

The whole argument is that these are people who don't think for themselves and merely toe the party line for partisan gains. Advancing individual opinions and breaking with the team over principle is about the opposite of what I'd define as a hack.

Anyway, America and her economy have basically become a laughingstock from what I've seen overseas.

I am going to listen to Obama's regulatory proposals here (live now) but spending alone isn't a fix for anything but a nominal metric.

We have serious problems of overspending due to inefficiency. Essential components of life are too expensive because everyone is afraid to ruffle the feathers of large interests (AMA, insurance, lawyers)

Refusal to address inefficiency and insistence on inflating out of ever-more debt will lead us to be the loser in an international scale.

'82 iNTp

"Sometimes it is said that man cannot be trusted with the government of himself. Can he, then, be trusted with the government of others? Or have we found angels in the form of kings to govern him? Let history answer this question." -Jefferson

http://krugman.blogs.nytimes.com/200...ir-of-the-dog/

I don't think Krugman could possibly be more clear about his stance in the above blog post. Regardless of whether his argument is correct or not, Krugman clearly indicates unequivocal support for the re-inflation policy.

Except that last time such policies weren't done in a forceful manner until after the downturn had bottomed out. This time, they're being tried earlier, which means there will be no way for the natural bounce-back from a market bottom to be attributed to "successful" stimulus policy.

If Keynesianism is even remotely correct, the recession should turn around this year or early next as long as stimulus isn't relaxed (a policy choice which strikes me as extremely unlikely). But if, instead, the situation continues to worsen despite all of this stimulus . . . I think economic policy may take a decidedly different turn in this 4T.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

Yes, he does that in this March 2008 blog that is just a few months away from the Oct nearly-going-over-the-cliff moment. But, what I'm looking for is statements earlier, say prior to 2007, that would indicate that he is the one-armed economist that only pulls on the 'more fiscal stimulus' handle that some accuse him of. As opposed to someone who has recognized earlier than most how close we came, and still remain close to, a repeat of the 1930s, and where fiscal stimulus may need to go to unprecedented levels.

I think he is much more nuanced. I think he sees that (a) Bush tax cuts causing not only an incredible swing from enormous fed. surplus to enormous fed deficit but also rekindling unsustainable asset inflation in combination with (b) laizze-faire regulatory oversight of banking 'innovations' as being the prime reasons why we are in the mess that seems to be defining our 4T. I believe he sees and supports countercyclical interest rate regimes by the Fed as normal and appropriate, but much much more was going on in this period that made it highly unlikely for that tool to be ideally and successfully applied, either by Greenspan or whoever was at the helm.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite