Originally Posted by

independent

PW

Sorry for the delay on the post,

Now it is my turn to apologize to you for my tardiness, and I wasn't ill either (unless you count occasionally being inebriated  )

)

Originally Posted by

independent

You don't actually believe that giving $5 Trillion to NASA will return an equal benefit as giving $5 Trillion to Goldman Sachs? Well, neither do I!

Eek, just about any private institution other than financials, generally, and GS, specifically, and I might have given some recognition to your point. Even if you allow for some innovations in the financials (e.g. securitization), i don't think its been worth it. I would much rather have preferred that $5T going into the gov't (perhaps not most into NASA, but some) than going into CDSs, CDOs and huge bonuses for these greedy bastards.

Now if you had mentioned firms pushing e-cars or feasible e-generation, I would be much more willing to accept your point. However, there is one big reason why I would still not - we are 4T, not 1T. I believe that the full utilization of available investment funds does not come until the 1T. The 4T is for setting the foundation - target research but much more importantly setting up the desperate straits to make the political, social, cultural, and economic leaps that will allow for tech innovation to be applied and distributed - soaking up all those dollars and leading to a real and sustainable increase in the markets.

Those dollars in the fading 3T led to asset inflation with increasingly bigger bubbles developing and being popped. Using those dollars now will just ‘reflate’ the next bubble and make the burst even worst. Those dollars need, and can be, soaked up now by taxation and govt investment in infrastructure until the time is rip for huge private investment in real production based on real demand. I think e-cars alone could do this, but I don't think even if the tech was perfected that this is the time for that to happen. I say we're 5-7 years away from it taking off for real.

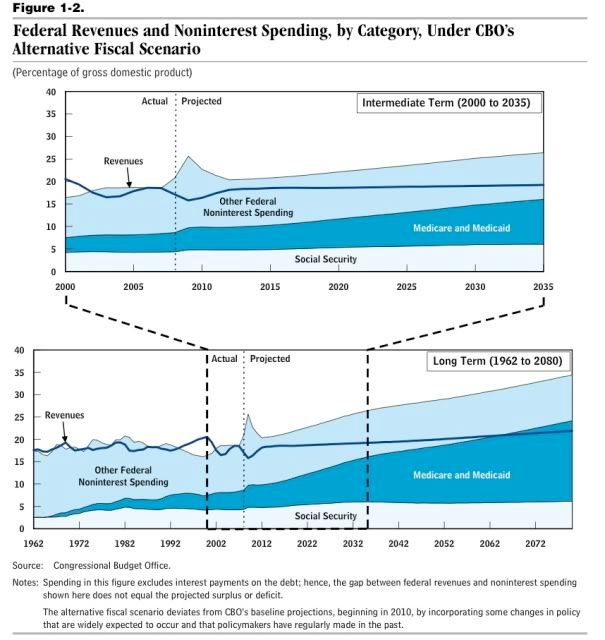

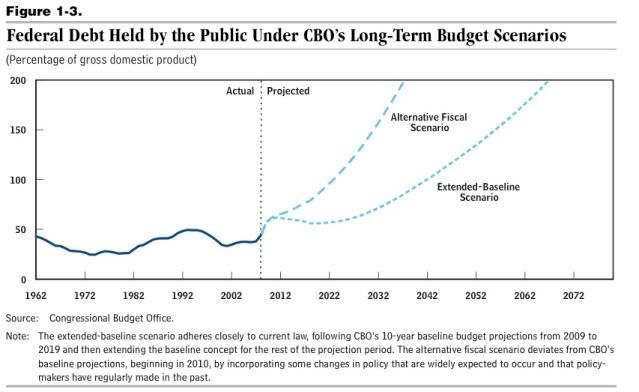

In the meantime, we need to deal with this -

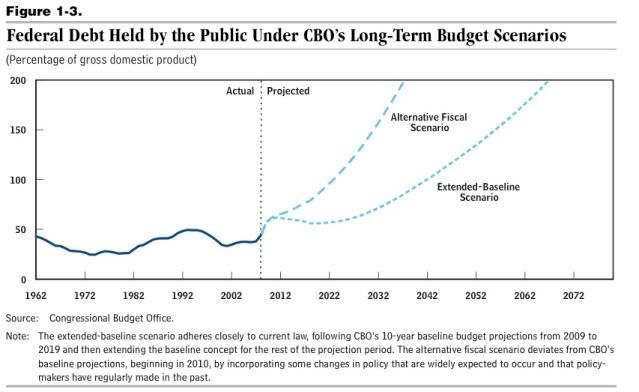

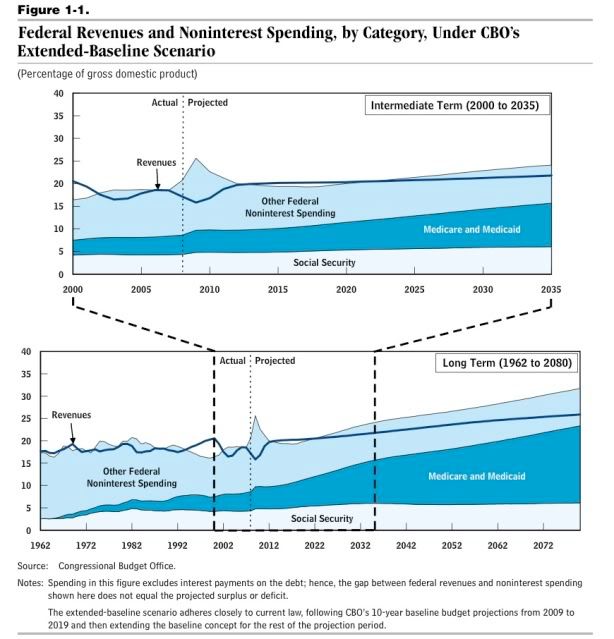

Now the denominator here (GDP) is based on linear thinking without regard to cycles, let alone the S&H Turnings. My belief is that the tech-driven 1T will begin to drive both these curves down in the late 20-teens, keeping the A-F Scenario under 100%. which would still be staggering to our economy, and the E-B scenario below 25%, which would be historically very good for our economy. While health care (i.e., physician compensation) and fixing the AMT plays some significant minor roles, the real difference between these two scenarios is whether you let the Bush tax cuts sunset or not.

Let those tax cuts sunset and you have set the stage for a successful tech-driven 1T. Don't let them sunset, and it won't matter if we get the tech, we be 4T for much longer than anyone anticipated, and likely become a 3rd-world country.

I have faith we will make the right choice.

Last edited by playwrite; 06-29-2009 at 04:51 PM.

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

)

)