- Join Date

- Jul 2001

- Location

- California

- Posts

- 12,392

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

Just a small correction here. That tax cut was not following the same reasoning. The higher taxes that preceded it were intended to be temporary and a way to partially pay the cost of our involvement in World War I. It was never expected that they would stay high forever.

The Laffer Curve is actually a modern silliness. Legislators in those days would never have thought in terms of cutting taxes to raise revenues. You raise taxes to get more revenue, and you cut them when you don't need as much revenue (as when the war is over, for example) -- common sense. Laffer's argument was a way to advocate cutting taxes when common sense says that's a dumb idea.

Laffer's reasoning is valid provided we have numbers to plug in. The problem as you pointed out is establishing exactly where the sweet spot lies. This is complicated by the fact that tax revenues are always a moving target, so we can't simply do a before-and-after comparison to say that a tax cut did or did not increase revenues (although that's what advocates like to do, and probably what JPT will do if we give him enough rope). Pick any two years that don't include a recession between them, and tax revenues will be higher in the later year than they are in the earlier one. That's the case whether we raise taxes, lower them, or leave them the same (unless the tax cut is truly drastic). Thus, the fact that revenues were higher in absolute amounts after a tax cut shows nothing at all. What would need to be shown, ideally, is that revenues were higher, not than they were, but than they would have been absent the tax cut -- and of course that's not possible.

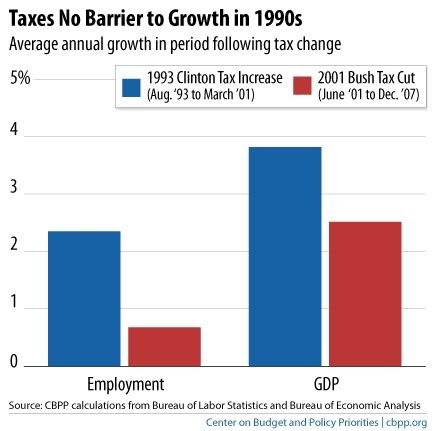

We can perhaps approximate it by looking at the deficit. This is also imperfect, because levels of spending also factor into the deficit, but unless there is some dramatic increase in overall spending relative to GDP accompanying the tax cut, an increase in the deficit should show that the tax cut lowered revenues, while a closing of the deficit shows the opposite. By that measure, the Reagan tax cut certain did decrease revenues from where they would have been without it. The Clinton tax increase, on the other hand, certainly increased revenues. The Bush tax cut is more ambiguous, since under Bush spending was also increased dramatically. However, logically, given the general territory of taxes at the time, if Reagan's cuts lowered revenues (which they did), and if Clinton's increases raised revenues (which they did), then Bush's cuts lowered revenues, and his simultaneous spending binge only made a problem worse that would have existed even without that.

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

The really interesting fact about tax rates and revenue is that the amount of revenue going into government has been remarkably stable over time, regardless of the tax rates. Which is about as much proof of the basic concept behind the Laffer Curve as you could ask for.

Clearly, tax rates do not remotely have a direct relationship to the amount of revenue the government takes in.

Last edited by JustPassingThrough; 05-18-2011 at 01:31 AM.

I don't know where you found that one. It does not match data I found with a simple Google search:

http://www.usgovernmentrevenue.com/d...ent%20of%20GDP

One interesting thing one can see in this chart is that revenue to GDP is not just a function of taxes. The dramatic uptic in the late 2000s shows the Great Recession. Revenues in absolute amount sharply dropped, but revenue as a percent of GDP increased because GDP dropped more. That's in spite of the Obama tax cuts.

In any case, your graph shows revenues holding steady at about 20% of GDP for decades, when in reality they've been well above 30% since the 1970s and trending upward (although at present they're low as a recession-fighting measure).

Last edited by Brian Rush; 05-18-2011 at 01:45 AM.

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

The graph I posted shows federal revenue vs. the top marginal federal income tax rate. The one you linked shows all tax revenue, including state and local. If you click through the options, you will see that the increase in the % of GDP for the total is due almost solely to a steady increase at the state level. If you look only at the federal data, you get the graph in my post above.

To see the situation we are now in, compare Federal Revenue as a % of GDP vs. Federal Spending as a % of GDP.

It's bad.

Last edited by JustPassingThrough; 05-18-2011 at 07:39 AM.

Brian, your chart shows the exact opposite of what you said. I noticed this myself blogging a few weeks ago. Revenues have drastically fallen as a percent of GDP since the recession, and I have seen no explanation why. Apparently the recovery has been in untaxed income and/or profits. This is an important question for some one to address.

David Kaiser '47

My blog: History Unfolding

My book: The Road to Dallas: The Assassination of John F. Kennedy

It's not silliness in and of itself. What is silliness is to claim that one knows where the "peak" of the curve is (or that we're to the "right" of the peak on the graph). I think it's intuitive that both a 0% and 100% tax rate produce essentially no revenue and that in between, you produce various levels of tax revenue. That would seem to indicate that there *is* a peak somewhere, a point at which lower taxes produce lower revenues *and* higher taxes produce lower revenue. Back in "the day" you mention, the tax code was used not so much for revenue maximization per se, but to encourage/discourage certain economic activities -- hence a 70% tax rate that was easy to avoid.

I think supply-siders abuse the concept by always claiming we're on the "high tax" side of the curve regardless of the situation and regardless of tax rates, but that doesn't invalidate the general concept.

When the Reagan Administration (Art Laffer was an advisor) cut income tax rates, they also removed a lot of the deductions and loopholes. The difference, as you accurately stated, between the post-New Deal tax code and the post-Reagan tax code is mainly that the former embodied the "progressive" goal of concentrating power in Washington and micro-managing the economy from the top down, while the latter sought to reduce the government role and turn the decision-making back into the private economy. The overall amount of revenue to the federal government was not dramatically reduced.

I can assure you that with the arguable exception of professional athletes, the people who get the highest incomes aren't the people who work hardest. Good work habits? Sure, but that's not the difference between A-Rod and some fellow trying at age 30, someone basically washed up, to try to return to the major leagues while playing AA ball.

What we are doing here, to be completely honest, isn't the most productive of activities. Most of us are here because of our egos. There are other hobbies and pastimes. But all in all, hard labor good for keeping a job (and laziness is not good for job security) that does good for most of us is hardly enough for the Good Life.

Are you about to argue that oilfield roustabouts and coal miners are lazy in contrast to oil and coal executives? That milking cows, herding sheep, slaughtering livestock, cutting lumber, working metals, pulling in nets as a commercial fisherman, 'finishing' cement, or handling luggage or merchandise is easy work? I can say this in a clear conscience: if it weren't for people who do the hard, dangerous, demanding work that feeds you, puts fuel in your household furnace and motor vehicle, gets the lumber for your house, makes available the wool for your sweater or the cotton for your underwear, makes your appliances possible, and allows you to get something that you simply 'pay for', then maybe you would be hungry, cold, immobile, and bored.

The connection between toil and pay has typically been one of the weakest correlations in historical reality. Owners and managers have almost always sought to ensure that the reward for real work close to the production and distribution of necessities is as low as possible -- so that they can grab as much of the bounty as they can. Most of the reward for ownership has typically related to inheritance of great fortunes, if not to outright crime and corruption. Most of the reward for management has gone to those who can treat workers most harshly. I could easily make the case that the best way to become a corporate executive these days is to show a kiss-up, kick-down personality who knows how to treat subordinates harshly.

Another piece of suggested reading:

http://www.gutenberg.org/etext/203

No, Harriet Beecher Stowe was a Christian -- not a Marxist -- and it shows.

Corporate America long made a deal with American workers -- that in return for low taxes they would get more consumer goodies (with cash incomes) but fewer services from the Government than their counterparts in western Europe. Now American workers seem to be told by executives that they can simply suffer for the greed of owners and managers, go into debt to keep up appearances, work harder and longer for less -- while getting vague promises of pie in the sky when they die if they happen to accept the fundamentalist Christianity that makes people tolerate subordinate, repressed, insecure, and impoverished lives in This World.More to the point, you could raise the taxes of everyone making over $250,000 a year to 100%, and it still would not close the budget gaps we now have thanks to Obama and the Democrats. The dirty little secret of European socialism that the fanciful American left has ignored is that their system is built upon massively regressive VAT taxes and spiderwebs of regulation that lock people into a permanent class status in exchange for the welfare state hammock. They also do not operate in a federal system like the U.S. -- another fact that the American left ignores in its quest to make the U.S. federal government look like the national governments of Europe. They seem to forget that the state governments even exist, with individual systems of taxes and regulations of their own.

Again, have you even started reading Keynes' General Theory?The above does not help dispel your appearance of economic illiteracy. The Laffer Curve illustrates the relationship between taxes and government revenue. Supply-side economics, on the other hand, was in large part a response to the myopia of Keynesianism, and the crippling sclerosis it had introduced into the U.S. economy by the 1970s.

Wrong, wrong, wrong! Everyone can create a 'supply' of feces, and nobody wants it. In fact, most of us go to considerable lengths to get rid of it. That is the extreme, to be sure, but only the creation of desirable goods and services can create demand. I can scribble artworks as profusely as Picasso did, and I could never sell them. I can create great quantities of prose -- but I am not J. R. Rowling. Quality matters greatly if a market exists to reward those who well serve customers and give tiny rewards to those who those who offer substandard results. Need I remind you that Commie economies were prime examples of supply-side economics at work? I can scribble artworks as profusely as Picasso did, and I could never sell them. I can create great quantities of prose -- but I am not J. R. Rowling. They went to great lengths to create gigantic quantities of whatever the central planners considered essential to prosperity. Of course, they rejected any concept of consumer demand that can discipline a market so that it doesn't create gluts of low-grade steel and shortages of consumer goods.Keynesians focus solely on demand, which is only half of the economic equation. They think that you can tax and regulate the supply side of the economy into oblivion and still have a healthy economy by constantly pumping in "stimulus" on the demand side. There are some basic things that happen as a result of reducing the burden of taxes and regulation on the supply side. It's easier and cheaper to bring new products to market, the economy is more flexible in response to change, and prices fall. It does not rest on the assumption that demand is insatiable. It rests on the (accurate) assessment that supply creates its own demand. Not necessarily in a 1:1 ratio, but there is no doubt, for example, that the introduction of new goods and services, and the reduction in prices for existing goods and services, increases the demand for those goods and services, and ultimately raises standards of living at all levels of society.

By the way -- Keynes even has a solution for inflation -- which is to raise taxes and cut spending so that people no longer have the means with which to bid up prices for a stagnant supply of goodies.

The greatest evil is not now done in those sordid "dens of crime" (or) even in concentration camps and labour camps. In those we see its final result. But it is conceived and ordered... in clean, carpeted, warmed and well-lighted offices, by (those) who do not need to raise their voices. Hence, naturally enough, my symbol for Hell is something like the bureaucracy of a police state or the office of a thoroughly nasty business concern."

― C.S. Lewis, The Screwtape Letters

No. America and especially its political leadership did not respond as if the 9/11 attacks were a Crisis. Take a look at the generational constellations of 1921 and 2001:

In 1921 I would consider the Gilded to have been acting enough like a Civic generation to be considered one -- at least among their elite. The Roaring Twenties1921 2001

Generation Type Age of youngest members Generation Type Age of youngest members

Gilded C* 77 GI C 75

Progressive A 61 Silent A 57

Missionary I 38 Boom I 40

Lost R 20 Thirteenth R 20

GI C being born Millennial C being born

were just starting, and America had just elected a weak, decidedly-conservative President (Warren G. Harding) who acceded to Big Business at every possible chance and gave reform no chance. There was a mini-downturn in the economy that was over quickly. Popular culture was unusually mindless. Glitz was extremely fashionable. Sound familiar?

If anyone had first impressions that 9/11 was the start of the Crisis of 2020 because more Americans were killed on 9/11 than on the day of the Pearl Harbor Attack , then consider that America responded in a way utterly inconsistent with a Crisis Era. Think of how Dubya responded to 9/11 just as FDR did -- telling Americans to prepare for great sacrifices of their living standards, make it do or do without, raise taxes, put an end to all speculative activity, sacrifice lucrative careers to become soldiers and sailors, plant a Victory Garden, find work in a defense plant, turn civilian production into military production, reduce the speed limit to 35, starting rationing if anyone didn't get the message...

Whoops! That was FDR, and not Dubya!

I know of only one film or TV star or professional athlete who sacrificed a lucrative career to be a soldier -- Pat Tillman, who made the ultimate sacrifice. The mass low culture remained as depraved and cynical as ever. A speculative boom ensued based on shady lending and "Don't be left out" rhetoric. The Double-Zero Decade began to look much like the 1920s; not until America had a 1929-style crash did America begin to act as if in Crisis Mode.

The greatest evil is not now done in those sordid "dens of crime" (or) even in concentration camps and labour camps. In those we see its final result. But it is conceived and ordered... in clean, carpeted, warmed and well-lighted offices, by (those) who do not need to raise their voices. Hence, naturally enough, my symbol for Hell is something like the bureaucracy of a police state or the office of a thoroughly nasty business concern."

― C.S. Lewis, The Screwtape Letters

Keynesianism has a perception problem -- the perception is that it advocates deficit spending as far as the eye can see, when in reality the "pump priming" deficit spending in weak economic times is only one part of it. One also needs to pay *down* the debt (or at very least, reduce it as a percentage of GDP) during strong economic times to make that feasible. And that's political poison; who will advocate for spending cuts and government layoffs when the economy is really strong and the public coffers are flush with cash? Hence, given political sensibilities, I think Keynesianism could never be fully implemented.

Apparently your definition of "real work" is physical labor, and anyone who just "pushes papers around" in an air-conditioned office is not doing "real work". I suppose that had some validity in the days of feudalism. We do not live in those days, despite your apparent inability to accept it. I am prepared to say, without hesitation, that executives of manufacturing companies work harder than those working on the assembly lines. Without a doubt. And people who have college degrees worked harder in school than those who do not.

You seem unable to reconcile yourself to the fact that the jobs with the highest pay are the jobs where the fewest people possess the skill and knowledge to do that job. A job that can be done by anyone who is able-bodied is never going to be highly paid.

pbrower2a said "Wrong, wrong, wrong! Everyone can create a 'supply' of feces, and nobody wants it. In fact, most of us go to considerable lengths to get rid of it."

No, there's a market even for that, if you're a gardener. Albuquerque's water department is selling high-quality compost from the waste water system at something like $20/bag. It's not organic- i.e. there may still be stuff in it you don't want on your rosemary bush - but there's a market for it.

How to spot a shill, by John Michael Greer: "What you watch for is (a) a brand new commenter who (b) has nothing to say about the topic under discussion but (c) trots out a smoothly written opinion piece that (d) hits all the standard talking points currently being used by a specific political or corporate interest, while (e) avoiding any other points anyone else has made on that subject."

"If the shoe fits..." The Grey Badger.

I think PW hit that nail pretty hard. Is there a Laffer Peak? Yes. Is it calculable? Most likely not. Is it stable? No. This year's optimum may be above or below next years, and the optimum in one part of the US is not necessarily the optimum everywhere.

So it's an intellectual exercise with no practical application. Exit right to Funway.

Marx: Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.

Lennon: You either get tired fighting for peace, or you die.

Marx: Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.

Lennon: You either get tired fighting for peace, or you die.

I guess it depends on where your eyes draw the line for 2008-9. It looks to me like we have a surge in revenue/GDP in the early part of the recession and then a drop afterward, and then a move back upward.

However, as far as the recovery being one mainly of profits rather than earned income, I completely agree. And yes, that's something to address. We are moving towards a world where the labor of American citizens becomes superfluous, not needed to produce goods and services, between outsourcing to cheap foreign labor and computer automation. None of the old solutions will work to address the imbalances that result, since all were based on the idea of full employment being needed.

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

The "real wealth" is made by starting your own business and growing it into something huge, like Bill Gates and Larry Ellison did. "Skimmed" is a phony word, when you consider that the person at the top is the one knows what needs to be done, and instructs the employees in how to do it. If the employees knew what to do themselves, they would be running their own business (as they often will branch out and do). Your devaluation of people who are more successful than you are is rooted in envy, not fact.

All you're doing is presenting a moral argument that the skimmer deserves to do the skimming. The fact that he's skimming from the labor of others remains a fact, regardless of how you feel about that personally. Profit is in a different existential category from pay for work, no matter how much the work is paid, and so the comparison between someone who works with hands and muscles and someone who pushes paper around a desk is not pertinent.

I could in fact argue with your moral position. Bill Gates didn't make money from Microsoft because he knew what needed to be done and instructed the employees to do it. He made money from Microsoft because he owned the business. If he had sat back and let someone else do the job that he did as CEO, he'd have still owned Microsoft and still made money from it. (Come to think of it, now that he's retired, that's exactly what he does.) If the hired CEO had done a better job, he might even have made more money for being a lazy slob than he did for working at the business.

And by the way -- once again, it has nothing to do with me. "More successful than me" is one hundred percent irrelevant. If you were right, I would not be making a distinction between those who make their money in profit, and those who are paid high salaries for their work, such as sports stars or movie stars, who also make more money than I do. I've seen before that conservatives seem to have a problem understanding anyone who cares about society in general, since they don't. Perhaps everything is personal and selfish for you. It's not for me. And it's also telling that when you don't have a good answer for something, you always seem to fall back on personal insults, which of course this is -- unwarranted, untrue, and frankly contemptible. You should be ashamed.

Last edited by Brian Rush; 05-18-2011 at 03:16 PM.

"And what rough beast, its hour come round at last, slouches toward Bethlehem to be born?"

My blog: https://brianrushwriter.wordpress.com/

The Order Master (volume one of Refuge), a science fantasy. Amazon link: http://www.amazon.com/dp/B00GZZWEAS

Smashwords link: https://www.smashwords.com/books/view/382903

Without the real work in the form of heavy physical labor, there is no food, coal, ore, steel, lumber, or clothing -- and nothing gets moved from where it is to where it is needed. I can assure you that I have spent more time pushing papers than I have doing the hard, physical work, but I also know very well where paper comes from and that without the essential contributions of those who do the heavy labor there are no white-collar salaries to be paid or profits to be made or anything to be enjoyed with the profits. The free enterprise system has made possible the rich earnings of the likes of Ernest Hemingway and Irving Berlin -- but Hemingway always needed a desk at some point and Berlin always needed a piano... and both needed paper.

As Brian Rush puts it, all profit and interest from investment, and all executive compensation are indeed skimming from the profitability of industrial toil and consumer spending. Is that skimming necessary? Sure. How much of that skimming is necessary? That is a question of morals more than of economics. The only profit-makers who do hard physical work for their living are small-business owners whose pay comes only in the nominal category of profit.

I'm not going to pretend that someone who types 100 wpm deserves no more as a typist than someone who types 20 wpm. If you can only type 20 wpm you need to find some other career. I'm not going to deny that someone with the talent to do something other sweep floors shouldn't jump at the opportunity to do something better (unless there is the mitigating circumstance that sweeping floors allows one to get specialized learning to do something incredibly lucrative, like law). s But I find much wrong with people getting rewarded richly for doing nasty things to people. Executives are paid as they are now, much differently than they used to be, for treating others badly. The great moral hazard is that when people get rewarded for doing terrible things to people, we get horrible things done to us. We don't need more socialism; we need more humanism. Socialism without humanism -- as in Stalin's Soviet Union -- is as vile as honest-to-Satan fascism.You seem unable to reconcile yourself to the fact that the jobs with the highest pay are the jobs where the fewest people possess the skill and knowledge to do that job. A job that can be done by anyone who is able-bodied is never going to be highly paid.

The greatest evil is not now done in those sordid "dens of crime" (or) even in concentration camps and labour camps. In those we see its final result. But it is conceived and ordered... in clean, carpeted, warmed and well-lighted offices, by (those) who do not need to raise their voices. Hence, naturally enough, my symbol for Hell is something like the bureaucracy of a police state or the office of a thoroughly nasty business concern."

― C.S. Lewis, The Screwtape Letters

Most small-business owners never get rich, and many go broke. For years, most of the small-scale capitalists were farmers -- and most of them did very hard work for meager rewards. Some of the biggest rewards in recent years came from hustles of "High Finance" that have since failed -- often with some people cashing out early.

By the way -- what do you think of the Mafia? It is very profitable -- at prostitution, gambling rip-offs, loan-sharking, labor racketeering, drug smuggling and manufacture, human trafficking, and outright robbery.

The greatest evil is not now done in those sordid "dens of crime" (or) even in concentration camps and labour camps. In those we see its final result. But it is conceived and ordered... in clean, carpeted, warmed and well-lighted offices, by (those) who do not need to raise their voices. Hence, naturally enough, my symbol for Hell is something like the bureaucracy of a police state or the office of a thoroughly nasty business concern."

― C.S. Lewis, The Screwtape Letters

There is not much here to hang on to - it's conjecture built on a pile of conjecture - i.e. a lot of bullshirt.

Please give me an example of someone paying an effective tax rate of 60%+ - hell, you can add in federal/state/local and payroll taxes and go ahead and roll in any sales, property or gizmo tax they may have paid on their mansion or yacht for the numerator and just use their income in the denominator - BUT, I want an effective tax rate. Put your taxes where your mouth is, my friend.

I'd like to take your Atlas shrug supermen and shirt kick'em back into their gulch - overpaid CEOs and hedge fund managers sure aren't the ones who actually come up with new technologies and products, they just know how to work the system with connections that have been in place long before either of us walked the earth - and there is a shirtload of folks clamoring to take their place if the current crop wants to go off and pout in some gulch. If you think that they will do that voluntarily under any circumstances, your still living an adolescent fairy tale.

Regarding the standard of living, not everyone is enjoying what's been accomplished in the last 30 years - not by a long shot. Maybe you need to get out more and meet some people a whole hell of a lot less lucky than yourself. And by your way of thinking, there would never be any progress - let's all stop at the point where people learned to start a fire, whoo-hoo!

And as far as standard of living and Europe, you need to travel a bit and get that myopic viewpoint a much needed workout. Or, at least look at some comparative measures across nations to see how poorly the US does - particularly when you take out of the equation the top 5% of income households across those countries and look at what typical people have - in a word, we suck.

I'll give you the assumption of "supply makes its own demand" (I think it fruitless to attempt an open-minded discussion of the possibility that assumption may increasingly be proven false), but point out that it is only of utility IF there is investment in increased production. When current capacity exceeds projected demand, nobody with any sanity is going to invest in increasing capacity. If you knew anything, you would know that this is at the basis of Keynes and why the government must be the entity to increase demand when you are in that trap.

Again, without the availability of productive investments, that freed-up cash from tax cuts is going to wind its way into the kind of trash that caused the 2008 (as well as 1928) financial meltdown. Yes, the Fed create a low-interest, highly liquid environment, but somebody had to put up real money to make it go (e.g. sure it's great to have a 2% 30-year fixed mortgage, but you still have to pay with hard money back to somebody that invested hard money into the loan to begin with). And sure, a lot of the hard money came from savers in China and elsewhere, but a whole hell of a lot of it came from people who would have otherwise paid it as taxes.

You seem to have pieces of the puzzle, but only the pieces that draw little bitty pictures that please your right wing viewpoint.

Oh by the way -

"The Devil enters the prompter's box and the play is ready to start" - R. Service

“It’s not tax money. The banks have accounts with the Fed … so, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money.” - B.Bernanke

"Keep your filthy hands off my guns while I decide what you can & can't do with your uterus" - Sarah Silverman

If you meet a magic pony on the road, kill it. - Playwrite

The greatest evil is not now done in those sordid "dens of crime" (or) even in concentration camps and labour camps. In those we see its final result. But it is conceived and ordered... in clean, carpeted, warmed and well-lighted offices, by (those) who do not need to raise their voices. Hence, naturally enough, my symbol for Hell is something like the bureaucracy of a police state or the office of a thoroughly nasty business concern."

― C.S. Lewis, The Screwtape Letters

http://en.wikipedia.org/wiki/Government_of_France[QUOTE=JustPassingThrough;372010]http://www.nytimes.com/2011/04/13/bu...rzp4E5r2qcXZhQMore to the point, you could raise the taxes of everyone making over $250,000 a year to 100%, and it still would not close the budget gaps we now have thanks to Obama and the Democrats. The dirty little secret of European socialism that the fanciful American left has ignored is that their system is built upon massively regressive VAT taxes and spiderwebs of regulation that lock people into a permanent class status in exchange for the welfare state hammock. They also do not operate in a federal system like the U.S. -- another fact that the American left ignores in its quest to make the U.S. federal government look like the national governments of Europe. They seem to forget that the state governments even exist, with individual systems of taxes and regulations of their own.

Eliminating the Bush tax cuts for everyone would actually close 75 percent of the budget deficit over the next five years. Winding down our military committments in Afghanistan and Iraq, as we are planning to do, would eliminate the rest.

I think that it is important to remember that there are components to the budget deficit that are both short term and long term. The short term budget deficit is caused by the Bush tax cuts of 2001, the wars in Iraq and Afghanistan, and the recession (which caused revenues to fall unexpectedly). Simply "doing nothing", as the article suggests, would essentially close this deficit because it would involve ending the tax cuts and continuing the process of ending our committments in the middle east. Hopefully an improving econonomy would help as well.

The long term deficit is driven by increasing medical costs, which effect medicare, and the retirment of the baby boomers, which effects social security. As a result, either cuts to those programs, measures to reduce medical costs, or additional taxes to raise revenue to fund those programs are the only option to solve the long term deficit problem that they pose.

For what it is worth, here is a link to an interactive graphic that shows different options for raising revenue and cutting spending and how they would contribute to shrinking the deficit.

http://www.nytimes.com/interactive/2...s-graphic.html

Here is a link to my plan, which is 87 percent tax increases and 13 percent spending cuts.

http://www.nytimes.com/interactive/2...s-graphic.html

That might seem extreme left wing to people, but I think it actually is in line with most people's preferences as to how to close the deficit.

If people are simply asked whether they want spending cuts or tax increases to close the deficit, without reference to what is acutally causing the deficit or options for closing it - they say they prefer spending cuts. If they are presented the option of either raising taxes or cutting medicare and social securtiy, however, then they say that they prefer taxes to be raised. Since medicare and social security are the drivers of the long term deficit, either cutting them or raising taxes to pay for them are the only possible options for closing the deficit. Such a measure of taxation would still be low by historical standars, and low in comparison to many advanced countries.

The publics' preferences with reguard to policies for closing the defict, as well the reality of the measures neccessary to actually accomplish the task, have implications for the 2012 elections....

I should also point out that you are incorrect about the nature of the the government of the countries in Europe. Germany and France, for example, two major European countries, both have a system of government that, similar to ours, contains multiple layers of government, from the municipal, to the state (proviancial), to the national level, each which can and does tax its citizens in order to fund both its own functioning and the services that it provides.

http://en.wikipedia.org/wiki/Government_of_France

http://en.wikipedia.org/wiki/French_tax_law

http://en.wikipedia.org/wiki/States_of_Germany

http://en.wikipedia.org/wiki/Taxation_in_Germany

That is not what "Keynesians" think. Keynesians think that governments should spend and take on debt during recessions, then accumlate surpluses during good times. That is a "quick and dirty" summary of their views. A more technical summation might be that they theorize that recessions are caused by a change in preferences by individuals from investments such as conusmer products, new businesses, and stocks, to such items as cash, bonds, and commodities due to a percieved increase in risk. Keysians view this a highly irration mass behavior with devestating consequences to the economy, so they adocate that the government spend money in order to replace the lost economic activity (the demand), which increases employment as well as increasing the quantity of goods and services that the economy produces. The hope is that the new economic activity restores the confidence of the players in the economy enough that they begin changing their investment behavior.The above does not help dispel your appearance of economic illiteracy. The Laffer Curve illustrates the relationship between taxes and government revenue. Supply-side economics, on the other hand, was in large part a response to the myopia of Keynesianism, and the crippling sclerosis it had introduced into the U.S. economy by the 1970s.

Keynesians focus solely on demand, which is only half of the economic equation. They think that you can tax and regulate the supply side of the economy into oblivion and still have a healthy economy by constantly pumping in "stimulus" on the demand side.

Actually, what I wrote above probably isn't completely correct either. The difficulty lies in trying to encapsulate an entire thread of economic though an anlysis into a single bullet point. In reality what people now refer to as "Keynsian" encapuslates an entire area of economic thought and models of analysis. Many of the individuals grouped under the term would be very suprised to find themselves together, considering how they disagree with each other.

The comparitive performance of the American and European economies of the past thirty years renders this contention nonsense. If you *just* looked at the late nintees, when the U.S. was experiencing the tech bubble, you would have a point. That was when talk of "Eurosclerios" reached its peak. The eightees, early 90s, 00's, and the present all paint a different picture. Right now most European countries have lower unemployment, greater social mobility, and greater business formation, especially small business, then the U.S.There are some basic things that happen as a result of reducing the burden of taxes and regulation on the supply side. It's easier and cheaper to bring new products to market, the economy is more flexible in response to change, and prices fall. It does not rest on the assumption that demand is insatiable. It rests on the (accurate) assessment that supply creates its own demand. Not necessarily in a 1:1 ratio, but there is no doubt, for example, that the introduction of new goods and services, and the reduction in prices for existing goods and services, increases the demand for those goods and services, and ultimately raises standards of living at all levels of society.

To pretend that the last 30 years were not characterized by a dramatic increase in the standard of living for all Americans, to the point where even people in the "lower class" possess cell phones and high definition TVs, is to perpetuate a bald-faced politically motivated lie, nothing more, nothing less.

The United States benefitted from the tech boom (most of whose biggest players were founded in the 60's and 70's), and the resulting introduction of new products and technologies. Currently the tech industry, while still strong in the U.S., is now global. There are tech players in all across the developed world from Europe to Asia. Right now the U.S. is in danger of falling behind because of its poor broadband infastructure.

More broadly, the average American, along with pretty much everyone else in the world, benefitted from the introduction of new consumer goods like cell phones and computers, as well as technological advances like automation and computer design which made the production of consumer goods both cheaper and more effective. Where automation was not used, trade laws which allowed companies to pick the country with the lowest labor costs and laxest environmental laws lowered the cost of producing cosumer goods, which further increased the amount of "stuff" that people could buy. Similarly, relaxations of trade restrictions, new technologies that allowd companies to manage their supply chains better, and (until recently), lower fuel costs allowed a widening of the global food trade, which increased the quality of food avaiable.

I have a suspicion, though, that the quality of food that the average American eats declined, as rising costs and lack of availability of non processed foods in certain areas caused signifigant portions of our population to switch to less healthy foods than their parents ate. That brings me to the dark side of all of this ....

The increased use of automation and changes in our trade laws decimated what used to the cornerstone of the American middle class - manufacturing employment. That, along with a concurrent effort by the goverment to weaken and smash the power of unions, caused the wages of most Americans to either stagnate or drop. While the wage of the average American stagnated, the price of certain neccessities that could not be automated or outsourced, such as a college education (which increasingly came to seem to many Americans as the only route to the middle class left), healthcare, and housing rose until it was out of reach for many. As a result, we now have a perverse economy where what most would think of as luxeries are cheap, while what we would think of a neccessities are expensive. Developed countries with a strong welfare state were able to mitigate *some* the harmful effects of globalization, while allowing their citizens to enjoy some of the benefits. The United States was not so lucky.

The Federal reserve needed to keep interest rates low or the economy would have crashed even sooner, possibly as early as 1998 when the Asian financial crisis hit. What happened was we switched from an economy with a broad middle class, whose economic interests were largely represented by labor unions, to a bi-model economy where capital flowed only to those in certain sectors. In the earlier economy inividuals earning a high wage were largely able to pay for neccessities like health care and housing. Under the "new" economy, only individuals with certain in-demand skills (like technology in the late 90's), or in fields currently experiencing a bubble (like real -estate in the mid 00's) were able to raise their wages enought to keep up with rising costs in health care and housing. The de-regulation of banking, while refelective of the declining of influence of labor unions and other interests groups representing the middle class at the expense of narrower corperate interests, was also an attempt to solve the above problem. If individuals could no longer earn a wage neccessary to afford a house, for example, the solution was to make it easier for them to obtain the neccessary credit buy one. Hence the relaxtion of financial regulations in the name of "increasing liquidiy", and "financial innovation". When such solutions proved impossible, the entire house of cards came down.As for the recent downturn, it has nothing to do with any of the above, despite the left's desperate efforts to conflate the two. The asset bubbles of the .com bust and subsequent housing bust were made possible by the monetary policy of the Federal Reserve. Interest rates were kept too low for long. The catastrophic nature of the housing bubble was specifically the result of moral hazard introduced into the market by government policy. Too easy credit and loans where no one is ultimately liable (except, as we have found out, the taxpayer) have nothing to do with low income tax rates or supply-side economics.

.The Crisis started on 9/11/2001. At the latest

I felt a change in mood around 2006, but I'm pretty sure that 2008, when the stock market crased, was the start of the crisis in the U.S.. I would compare the involvement of the United States in the Middle East with its involvement of the European Wars of the first half of the 20th century. Then, as now, it is a process that spans decades, and turnings.

The above chart is highly misleading. Not only does it use graphic design to minimize the changes in the proporation of the economy the government collects as revenue (when you are dealing with an economy that is around 14 trillion dollars such seemingly "small"changes amount to billions of dollars, but it omits the ways in which the U.S. shifted tax policy so that a proportionally greater burden fell on the middle class (hikes in payroll taxes, cuts in capital gains taxes ect.).

Here is a graphical illustration of what I mean.

http://www.datapointed.net/2011/03/r...xes-1913-2011/

Even granting that the graph shows what you say it does, that changes in U.S. tax rates have no effect on the amount of revenue collected, it does not explain why the other countries, with higher taxes, are able to collect a larger portion of their GDP in taxes.

http://en.wikipedia.org/wiki/List_of...centage_of_GDP

Last edited by btl2283; 05-18-2011 at 07:02 PM.