Optimal Tax Rates for Generating Economic Growth According to Barro-Sahasakul Tax Data

This piece is a bit more wonky than what I normally post.

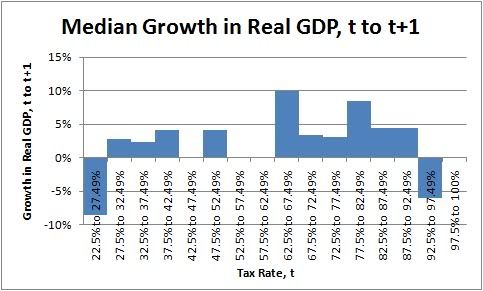

I recently re-read "Macroeconomic Effects from Government Purchases and Taxes" by Barro & Redlick. I was struck by how different the conclusions they make about taxes are from what you get if you simply make a bar chart of the top marginal rate at any given time versus the growth rate over the next year.

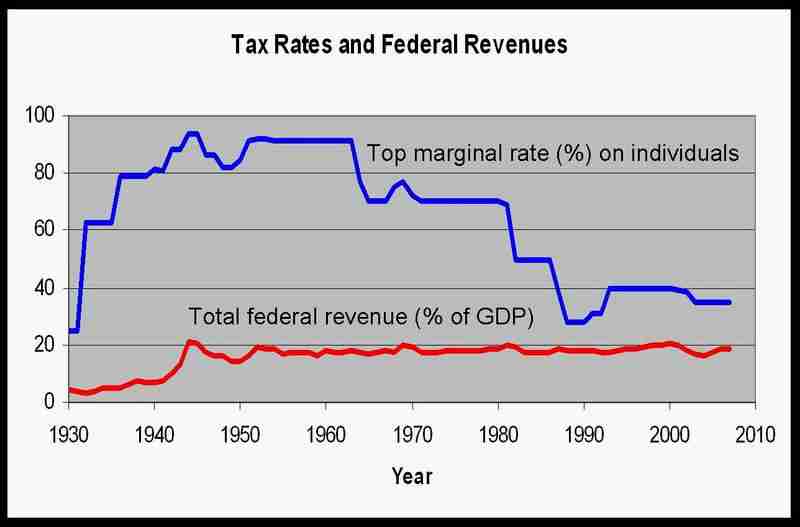

Now, obviously, Barro & Redlick take a completely different approach... but at the bottom of everything is the data set they use (see Table 1 of the above referenced paper and this explanation of the "Barro-Sahasakul" data set). To cut to the chase, they use estimates of the average marginal tax rates paid by taxpayers rather than the top marginal rate that I used in the bar chart referenced above. Their overall marginal rate is made up of not just federal tax rates, but also social security tax rates, and even estimates of the state tax rates. It should be noted the Barro is an average rate, and since the average includes non-filers (who pay zero), the Barro rate is often well below the top marginal rate. The top Barro rate is 41.8% which occurred in 1981 (compared to top marginal rates of 90%+ from 1951 and through 1963). The Barro rate is also not correlated with the top marginal income tax rate (correlation going back to 1929 is -30%).

A lot of work clearly went into producing this overall marginal rate (I'm going to call it the "Barro tax rate" for simplicity). But does it explain economic growth rates any better than the top marginal rate?

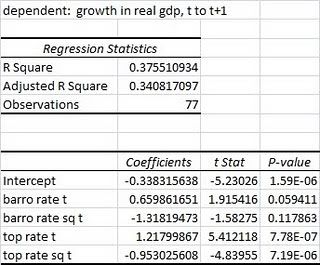

I ran a quick and dirty regression...

Growth in real GDP from t to t+1 = f(Barro Tax Rate, Barro Tax Rate Squared, Top Marginal Income Tax Rate, Top Marginal Income Tax Rate Squared)

Data ran back to 1929, the first year for which real GDP was computed by the BEA. Top marginal rates came from the IRS Statistics of Income Table 23. And the Barro Tax Rate came from Table 1 of the Barro & Redlick paper. Since Barro rates are computed only through 2005, that's when the analysis stops.

Results were as follows:

Note... the errors got big during leading up to WW2, but I don't think that invalidates this quick and dirty look.)

Here's what I get out of this:

1. There is definitely a quadratic relationship between tax rates in one period and real economic growth the next.

2. If you're going to pick either the Barro rate or the top marginal income tax rate, go with the latter. Its clearly better at explaining economic growth rates.

3. There may be something to be said about using the Barro rate and the top marginal income tax rate together. They do explain different things.

If you compute the "optimal tax rate" - the rate that maximizes economic growth implied by the regression - you get a Barro rate of 25% and a top marginal income tax rate of 64%. The optimal Barro rate was last seen in 1966, when the top marginal rate was 70% and the bottom rate was 14%. I'm guessing from this, and from looking at the Barro rate series, that this would imply that if you want to maximize growth, the top rate should be raised to about 64% and the tax burden on folks at the lower end of the income scale should be lowered. I'm not sure Barro would be pleased with these results.

I may return to this, but my next post should be the next in the series on GDP growth and the S&P 500.

As always, if you want my spreadsheet, drop me a line with the name of this post. I'm at my first name (mike), my last name (kimel - with only one m) at gmail.com. BTW... this spreadsheet contains a lot more wonky goodness!

Thanks to Sandi Saunders for getting me started wading through this particular pile of weeds.