I think the problem is more that they have too many candidates. Palin, Bachman, and Trump, if the last two decide to run, all appeal to basically the same kind of people, so they will likely split the vote. I don't know a lot about Hermain Cain, but from what I've seen he identifies himself with the tea party

http://www.youtube.com/watch?v=MOFB-2yJzCY, so I would guess that he will be chasing those voters as well. Contrast that with the "establishment" Republicans, who basically only have Romney and Pawlenty, and it becomes apparent that simply by virtue of their being less candidates to split the vote that someone from the establishment will probably win. Right now that someone appears to be Romney, as Pawlenty seems to be having trouble rising in the polls. It is still a long way till the Republican primary thought, so a lot could change. Someone like Chris Christie entering the race could change things.

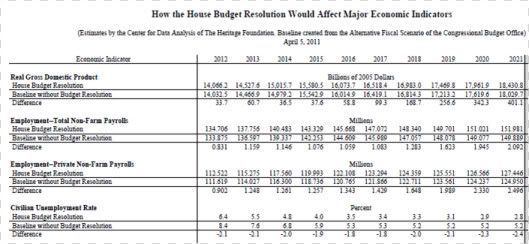

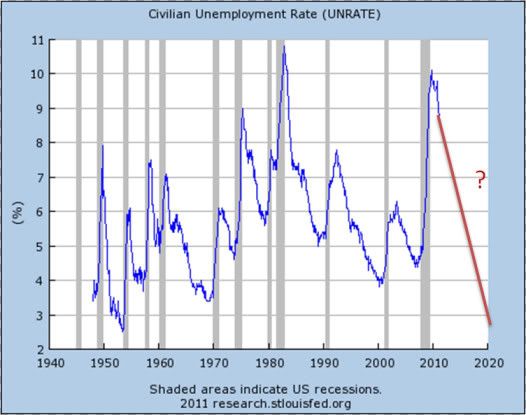

Honestly, going by the advice that the Obama administration is getting from its economic advisers and its base, I don't think that they view the deficit as being the pressing concern that the Washington establishment or the Republicans do. In that, I agree with them. Right now we are facing persistently high unemployment and, judging by the week economic data already posted in this thread, the prospect of another recession. We need the government and increase the amount of debt that it holds in order to, among other things, help to relieve the private sectors' debt burden which continues to drag on the economy. Cutting government spending by balancing the budget will only make things worse, as it did in America in 1937 or as it is currently doing in the UK and the rest of Europe.

http://www.guardian.co.uk/business/2...h-weakest-2009

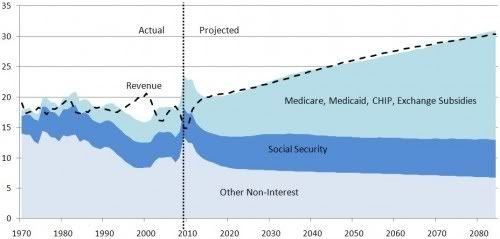

That being said, it would be inaccurate to say that the Obama administration is doing nothing, or has done nothing, to address the largest driver of the long term deficit, the increases in medicare costs. The Affordable Care Act, whatever its faults, does contain several reforms aimed at making medicare more efficient that reduce the long term deficit.

http://www.americanprogress.org/issu...e_numbers.html

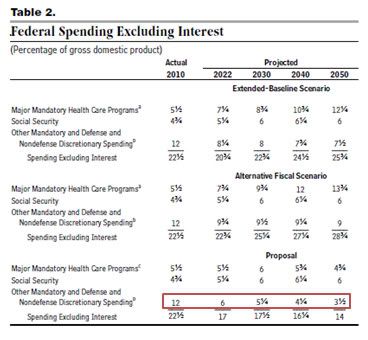

In the short term, the deficit will largely take care of itself if we draw down our overseas military commitments like we plan to and let the bush tax cuts expire. In the long term, the deficit is driven by Social Security and Medicare, but the measures required to fully fund those programs are not radical, and need not involve dismantling them. It is indeed possible to fully fund those programs through taxation. Here is a link to a NYT interactive graphic that demonstrates different ways to balance the budget. I managed to get it balanced through raising taxes and enacting measures designed to make medicare more efficient.

http://www.nytimes.com/interactive/2...s-graphic.html

That doesn't mean raising taxes to fund medicare is the best option, just that it is possible. It is worth keeping in mind that all of the current discussion around the deficit assumes a linear increase in health care costs and that no further reforms are enacted in the health care system in general or medicare specifically in order to lower costs.

It is also worth keeping in mind that, as of yet, we are nowhere near the level of public debt that would necessitate a default, and there is absolutely no evidence that a crisis in investor confidence which would necessitate a government default is going to occur.

http://research.stlouisfed.org/fred2/graph/?s[1][id]=DGS10

That shouldn't be surprising as the government of Japan manages to carry a debt load twice our own and, even after a devastating earthquake and nuclear accident, is still able to borrow money at very cheap rates.

http://en.wikipedia.org/wiki/Debt-to-GDP_ratio

All of this doesn't mean I think that we should never act to close the deficit or pay off the national debt. I just means that I don't think that it is anywhere near the top of our concerns as a country.

Methinks the ultimate sell out is the privatization of Medicare, just in time for us. Remember Bush's attempt to privatize Social Security? Yup. Let Wall $treet manage our collective retirement nest eggs, (right before the Dot-Bomb crash. ) Dumb move...

Methinks the ultimate sell out is the privatization of Medicare, just in time for us. Remember Bush's attempt to privatize Social Security? Yup. Let Wall $treet manage our collective retirement nest eggs, (right before the Dot-Bomb crash. ) Dumb move...