Its the difference between the real value of the mortgage papers vs. the perceived value that the Federal Reserve (an actor with no cost constraints) is willing to pay. That difference creates an increase in available funds, acting in effect to lower interest rates.

It's the

financial sector. Once they can convert non-liquid mortgage paper to highly liquid bank reserves, they're armed with more fresh ammo (cash) to invest. Equities? Well, P/E is already fair and anything else would be a bubble. Cash? Expectations point to devaluation. Commodities? Sure, what could possibly go wrong?! "I mean they just kinda go up and down and you can't really explain that, can you scientists!?"

Actually, we can explain the cause as well.

http://www.hks.harvard.edu/fs/jfrankel/CP.htm

High interest rates reduce the demand for storable commodities, or increase the supply, through a variety of channels:

¤ by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock herds culled)

¤ by decreasing firms' desire to carry inventories (think of oil inventories held in tanks)

¤ by encouraging speculators to shift out of spot commodity contracts, and into treasury bills

If we all have to get out and push the truck out of the mud, I want to make sure the idiot in the driver's seat isn't gassing it in reverse...

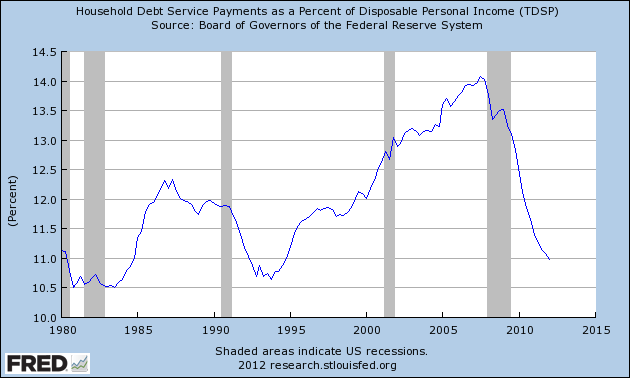

Uh, that just tells me that households aren't able to pay down debt. It's not like the existing debts have cleared, we've just stopped making progress against it and started heading back to the pre-crash peak.

Elections or not, the economy is in for a bumpy ride, and we're not even headed in the right direction yet.