Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

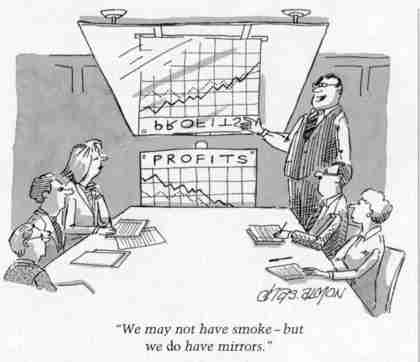

Politicians try to fool all of the people all of the time.

This morning's key headlines from GenerationalDynamics.com.

|

On this April Fool's day, our theme is smoke and mirrors. Everyone's talking about a peace plan for Syria, even though no one except the stupidest politician could possibly believe that it's serious. And the Europeans have been fabricating a new bailout fund, trying to stop Spain from going the way of Greece. Add that to the usual crap that we hear out of Washington, on Wall Street, and in other world centers, and you have a truly demoralizing situation. April Fool!

The AP story says, "The [Syrian] Foreign Ministry statement raised serious doubts about whether Annan's plan to end the conflict will even get off the ground." Duh. The statement that led to this startling conclusion is that Syria's Bashar al-Assad regime will not pull tanks and troops from towns and cities engulfed by unrest before life returns to normal there.

"[The military is in populated areas] in a state of self defense and protecting civilians. The Syrian army is not happy to be present in residential areas. Once peace and security prevail in these areas, the army will not stay nor wait for Kofi Annan to leave. This is a Syrian matter. ...The battle to bring down the state in Syria has already ended and the battle of reinforcing stability has started."

The regime of president Bashar al-Assad won't stop slaughtering civilians until the opposition gives up, and the opposition won't give up until al-Assad steps down. Russia and Iran are supplying weapons and support to Assad, while Iraq and China are indirectly supporting him. Saudi Arabia and Qatar would like to arm the opposition in order to force al-Assad to step down. AP

Angel Gurria, the secretary general of the Organization for Economic Co-operation and Development (OECD) called on the Europeans to come with 1 trillion for a bailout fund. He said,

"When dealing with markets you must overshoot expectations. "The mother of all firewalls should be in place, strong enough, broad enough, deep enough, tall enough, just BIG."

Spurred on by the OECD demand to create the "mother of all firewalls," the euro finance ministers met on Friday and supposedly increased the euro bailout fund to 800 billion, but several analysts are pointing out that it's the usual political scam.

We are always amazed how news organisations dutifully report the line peddled by eurozone officials that they are about to double the ceiling of the firewall, when it fact they are not -- not even close. The story this morning [Friday] is about a tentative agreement at today's Ecofin in Copenhagen, which includes several elements -- the ESM size, the funds committed by the EFSF, the non-committed funds, and a gradual built-in of ESM capital. The key point is that one cannot add the ESM's total of 500bn, plus the existing programmes and commitments of 200bn, plus the EFSF unused capacity of 240bn together. The agreement now subject to negotiation earmarks the 240bn as an emergency slush fund for one year only, and whose release would require unanimity. Once again, Angela Merkel gets it exactly like she wants to -- the ESM runs at 500bn, plus the existing programmes. Not a penny more. And once the programmes expire, we are back to 500bn.Furthermore, the ESM is not going to be active at 500bn right away -- so the 240bn scam at most hides the year one shortfall. From July 2012 to June 2013, the total capacity -- including the slush fund -- will be 640bn, in year two it will be 600bn, in year three 700bn, and then it will gradually fall back towards 500bn, as the existing loans are paid back. In other words, the capacity of the rescue fund will initially oscillate above, and later converge to 500bn. The agreement essentially means that the eurozone has rejected an effective increase in the ESM. That would be our headline on the story -- not 'Eurozone doubles size of ESM.'"

"Accounting Devices and Fiscal Illusions," a staff discussion note by Timothy C. Irwin of the International Monetary Fund (IMF), provides a list of the accounting devices that governments use to lie about finances. The paper gives a list of these fraudulent accounting devices, along with dozens of examples of governments that have been using these devices. Here are some excerpts:

"A TAXONOMY OF ACCOUNTING DEVICESThe essence of an accounting device is to improve headline fiscal indicators without actually improving public finances, or without improving them to the extent suggested by the headline indicators. A device aimed at the deficit reduces this years deficit, but increases future deficits by an amount that largely or wholly offsets the initial improvement. To do this, it must either increase reported revenue or decrease reported spending in the year (or years) of interest. And, in return, it either decreases reported revenue or increases reported spending in future years. ...

The first accounting device, hidden borrowing, increases reported revenue now but increases reported spending later. In Europe, governments are able to reduce their headline deficits by taking over pensions schemes of private companies or public enterprises. The obligations to make future pension payments do not count as liabilities, so when governments take over the pensions in return for compensating payments, the compensating payments count as revenue.4 The government of Portugal used this device to reduce its reported deficit in both 2010 and 2011, as well as in earlier years. But it is not alone. ...

The second accounting device, disinvestment, increases reported revenue now and reduces reported revenue in the future. Under some cash-accounting standards, the proceeds of privatization are revenues that reduce the deficit. But if the sale deprives the government of future dividends its true fiscal benefit may be much smaller than its reported effect. ...

The third accounting device, deferred spending, reduces reported spending now, but increases it later. In the United States, the government has met predominantly cash-based targets for the deficit by postponing a military payday by a single day ... and by deferring Medicare payments that would have been made in the last week of the year. ...

The fourth accounting device, foregone investment, reduces reported spending now but reduces reported revenue later. When governments want new infrastructure to be built, they sometimes use concessions, a kind of public-private partnership in which the private company undertakes an investment under a long-term contract with the government, but receives its revenue from users. For example, since the early 1990s, much investment in public infrastructure in Chile has come from concessions for airports, toll roads, and other projects; total investment has amounted to some $7 billion or 4 percent of current GDP. These arrangements reduce the measured deficit in the years in which investment takes place, but increase it later, compared with what would have happened if the government had group method, which takes account of future as well as past and present employees, is equivalent to 44 percent of GDP (Government of France, 2011, p. 167). 11 financed the investment and then collected the tolls itself. (The Chilean government has also granted minimum-revenue guarantees to many of the concessionaires.) ...

A common way to reduce the reported deficit and debt in the short term is to have spending undertaken by a public entity that is not counted as part of the government for reporting purposes. Often the spending involves an investment, but one whose future profitability is doubtful. If the investment is unsuccessful, its cost may show up later either in the receipt of smaller dividends from the entity (foregone investment) or in the need to grant it greater subsidies (deferred spending). ...

As governments come under greater pressure to cut both costs and spending, more and more responsibility is being pushed down to the sub-sovereign level, to quasi-government bodies, municipalities and regional governments. Government-owned entities and their debt are being deconsolidated."

Back in 2004, someone online asked me, "How can you ever be proven wrong? You're predicting a financial crisis, and if it doesn't happen, then you just say it hasn't happened yet." My response at that time was, "Public debt has been increasing exponentially. If it ever starts leveling off and falling, then you can tell me I'm wrong."

What all these accounting devices have in common is that they increase public debt. All we hear from politicians and analysts is that the fault is with the markets, and if we create the "The mother of all firewalls," then the markets will be "convinced," and we can all go back to a real estate bubble and a credit bubble, to support the current stock market bubble. The Law of Mean Reversion says that they're wrong, as I've described in detail many times. International Monetary Fund (PDF)

(Comments: For reader comments, questions and discussion,

see the 1-Apr-12 World View -- Smoke and mirrors in the Syrian peace plan and the 'Mother of all Firewalls'

thread of the Generational Dynamics forum. Comments may be

posted anonymously.)

(1-Apr-2012)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004